Fund managers around the world have become increasingly bullish this month, according to closely watched positioning and sentiment research, with many expecting an economic revival and increased profits.

The findings of the April edition of the Bank of America Global Fund Manager Survey, which polled 224 asset allocators running a combined $638bn, were the “most bullish” since January 2022.

The survey’s broadest measure of fund manager sentiment, which looks at cash levels, equity allocations and economic growth expectations, jumped to 5.8 this month from 4.6.

Percentile rank of fund manager growth expectations, cash level and equity allocation

Source: Bank of America Global Fund Manager Survey, Apr 2024

Fund managers have turned bullish on macroeconomics for the first time since December 2021, with a net 11% expecting a stronger economy over the next 12 months. This is a massive turnaround from last month, when a net 12% of respondents thought the economy would weaken.

Some 78% of managers believe a global recession is unlikely within the next 12 months, which is the highest level since February 2022.

Bank of America analysts added: “While global growth expectations are picking up rapidly (to the highest since September 21), they are still playing ‘catch up’ with equity prices.”

Exactly how this growth will look is more polarising, however.

While ‘stagflation’ (or below-trend growth, above-trend inflation) is still the consensus view at 60%, it has come down from the 92% peak in September 2022.

Expectations for an ‘economic boom’ of above-trend growth and above-trend inflation have jumped to 24%, surging from 12% last month and 5% in January.

Just 9% expect ‘stagnation’ (below-trend growth, below-trend inflation) and only 6% expect ‘goldilocks’ (above-trend growth, below-trend inflation).

Meanwhile, a net 20% of asset allocators think profits will improve over the coming 12 months, which is the highest in three years.

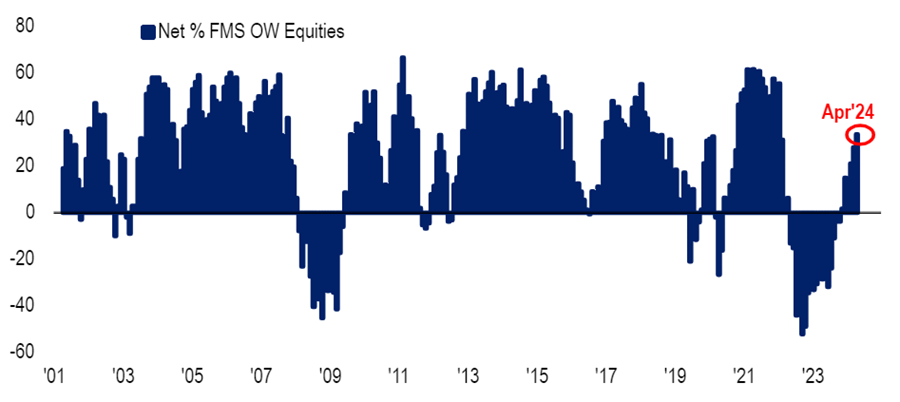

Net % of fund managers overweight equities

Source: Bank of America Global Fund Manager Survey, Apr 2024

Amid this bullish macroeconomic sentiment, fund managers have taken their equity allocation to a 34% overweight, up 6 percentage points on last month and going to the largest overweight since January 2022.

In April, investors are rotating into materials, commodities, energy and industrials while reducing allocations to bonds, cash, staples and emerging markets, the survey found.

Fund managers’ bond allocation has dropped 20 percentage points since the March survey, which is the biggest monthly fall since July 2003. With a net 14% underweight, investors are now the most underweight bonds since November 2022.

The cash allocation fell 14 percentage points month-on-month to a net 9% underweight, which is the biggest underweight since January 2002.

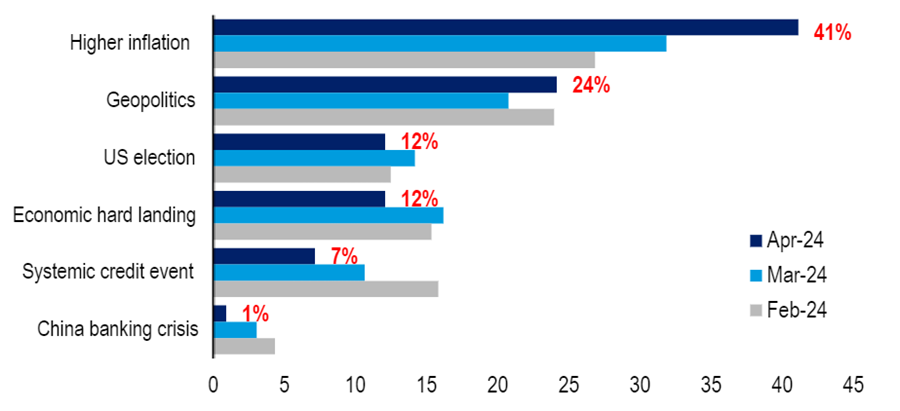

What fund managers consider to be the biggest tail risks

Source: Bank of America Global Fund Manager Survey, Apr 2024

Despite the overall bullish sentiment, there are still some worries keeping managers awake at night.

Some 41% of respondents said higher inflation is currently seen as the largest tail risk, which is higher than the reading last month. Inflation is proving sticker than thought in the US.

Geopolitics is the second tail risk at 24%, reflecting ongoing conflicts in eastern Europe and the Middle East. However, worries around the US election and a hard landing appear to be easing.