A well-designed portfolio should include investments that do well in different contexts – there's nothing scarier than all your funds going up at the same time, because they might also crash simultaneously.

Investors who own the JOHCM Global Opportunities fund haven't had this problem – its diversification and value style have meant it behaved quite differently from the rest of the market, and kept it struggling against its sector and benchmark while other strategies flourished. But this underperformance is a virtue, according to FE fundinfo Alpha Managers Robert Lancastle and Ben Leyland, who find silver linings to their track record.

“There's virtue in underperforming – not necessarily per se, but in doing something different. For the majority of the past year, five years, perhaps even 10, many in our industry have herded towards the same place, so there's a virtue in avoiding the herd,” said Leyland.

Instead, Lancastle noted the pair prefer to "sow seeds" in areas (or fields) that may not be producing any returns at present. "It's fine to have a field full of things that are at the harvest stage, but if everything is aligned to that, you end up with a big brown patch of ground after the harvest," he said.

This boils down to the age-old debate of jam today or jam tomorrow. “We are sacrificing some of our returns trying to sow future seeds. Ultimately, if you're owning things with low momentum in a market that has high or rising momentum, you're going to have quite a big gap in performance."

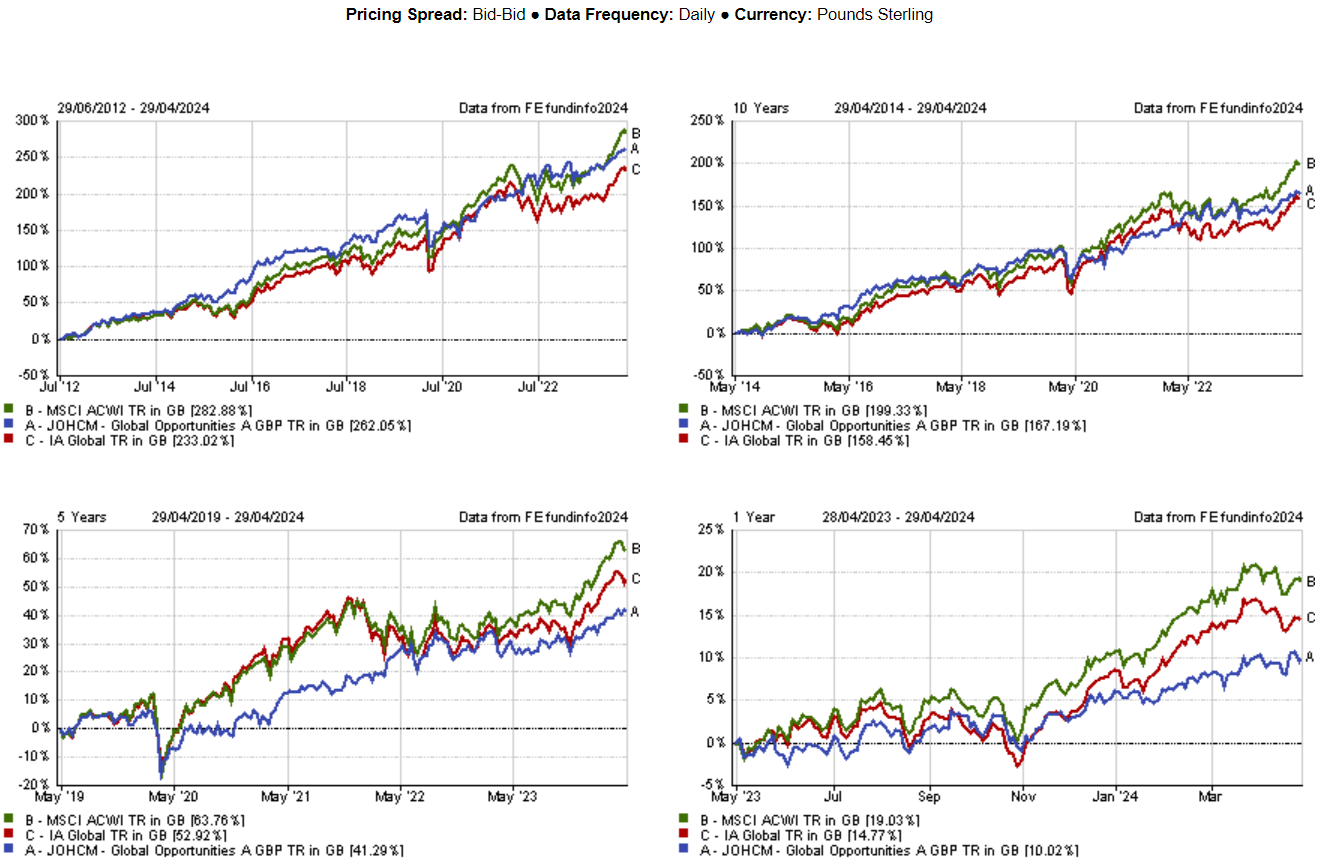

The £624m Global Opportunities fund failed to beat the MSCI All Country World index in the past 10, five and three years and remained in the third quartile of funds in the IA Global sector over 10 years and 12 months.

The strategy fell into the fourth quartile over five years but picked up over three years, when it was second quartile – thus beating the average fund in its sector.

Rayner Spencer Mills Research (RMSR) analysts rated the fund for "having demonstrated the characteristics you would expect given the investment process” and praised the managers for their discipline in applying their investment process through thick and thin.

They particularly appreciated the managers for being willing to hold above-average cash levels to use only when stocks become more attractively valued.

“The strategy is not suited by momentum or out-and-out growth phases in the market but can deliver outperformance in most market conditions and especially when investor focus is on valuation,” they said.

The managers made clear that they don’t like underperforming, but accept underperformance over certain time periods “in the expectation that it is there to diversify and to protect the downside as and when the environment changes”, according to Leyland.

Performance of fund against sector and index over different timeframes

Source: FE Analytics

The team invests in lowly valued quality companies with a high-conviction, benchmark-unconstrained approach. Value investing has been out of fashion in the past decade, with the exception of 2022, when it went through a short-lived revival. But, according to Leyland, 2022 showed that conditions do change, as they are doing again right now.

“We've moved away from a trend phase towards a transition phase. Even within the technology sector, the dynamics are changing and shifting away from software and services towards infrastructure, and elsewhere in the market towards real-world companies,” Leyland said.

“As we go through that process, assuming that what has worked well for the past 10 years is going to work well for the next 10 years would be naïve. That isn't to say that every investor should sell everything that's done well for them and buy everything that's done badly, but they do need to think about portfolio balance and make sure they’re not overexposed in one particular direction.”

Lancastle and Leyland achieve diversification by avoiding “flavour of the month” stocks and sectors.

Healthcare for example has been going sideways or even downwards recently, but this is the area where the managers have taken the most action – or, to continue the gardening metaphor, where they have been sowing seeds as a long-term opportunity.

Companies such as Thermo Fisher in the US, Merck in Germany or Fujifilm in Japan have all seen earnings headwinds as a result of the biotech-related destocking cycle and a post-Covid earnings hangover, but there are many opportunities in the long-term.

“Tailwinds have to do with demographics and the need for innovation and new drugs to improve healthcare outcomes without increasing costs,” said Leyland.

“Outsourcing also caught our eye, particularly in contract drug manufacturing, where there is an increasing trend for drug development companies to rent the capacity from someone else rather than owning it themselves.”

Finally, the managers also have their eyes on consumer staples – an area “worth considering but premature to be taking action in”.

“Some staples companies have struggled to pass price increases through in order to defend margins and profits, but there will be some that are currently misperceived as lacking pricing power but will then reassert themselves,” said Leyland.

“When that happens, the market will extrapolate and we like it when that happens. When people are making sweeping statements about something, we get to be selective and take the babies out of the bathwater.”