US dominance and the relative bottoming out of the UK market over the past decade may have left some global investors wondering whether there is a need to look to the domestic market at all.

Murmurs have begun about a potential poor run for the US, with Temple Bar manager Ian Lance telling Trustnet yesterday that investors should expect to make a loss from American stocks over the long term from here.

Chris Rossbach and Katerina Kosmopoulou, who are in charge of the $252.4m J. Stern & Co. World Stars Global Equity portfolio, are bullish still on the prospects of the US titans, recently stating that “we are in not a tech bubble of any kind”.

They have stuck with their exposure to digital through tough times before – most notably in 2000 – and did so again in 2021-2022 when they added to stocks such as Nvidia, the leading chip manufacturer. This has rewarded the managers, with the stock rising to be the top holding in the fund, making up 8.3% of the total assets under management (AUM).

Yet even they have begun to look elsewhere, trimming some of their tech allocation as they weigh up the continued strong growth from the US giants versus the prospects of better returns from elsewhere in the future.

Thanks to successful calls on these US names and the returns they have brought in, Kosmopoulou explained that the fund is now in a strong position to take some profit and allocate to other areas.

One such area has been the UK, where, however, only one business convinced the managing duo – spirits company Diageo.

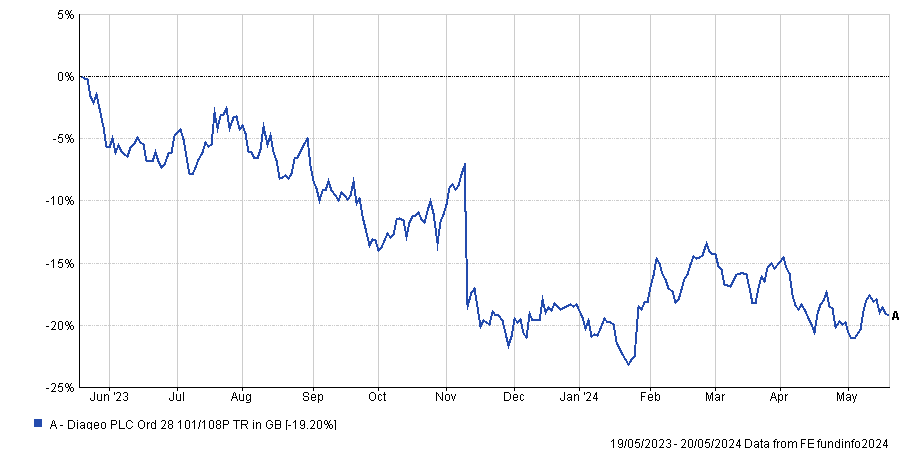

The company has been through a turbulent time in recent years, marked by a profit warning and its chief financial officer stepping down. Unsurprisingly, therefore, it has been a terrible performer of late, losing almost 20% over the past 12 months, 12% over the past three years and 6% over five months.

Performance of stock over 1yr

Source: FE Analytics

But the company is a good recovery play to Kosmopoulou, who said that Diageo is “a screaming buy”.

“Covid massively disrupted consumption and generated excess inventory throughout the supply chain. This is in the process of being corrected now, but the market hates that, so the stock is trading at more than 10% discount to its historical levels,” she said.

“Now if you could tell me that you and I will never drink again, I'm going to sell my Diageo position. But if you tell me that tonight we are likely to have a nice glass of whiskey, then to me that is that is basically a screaming buy.”

This is currently the only UK-listed company owned by the fund, Rossbach noted, with the overall country exposure adding up to 2% of the total AUM.

“We look at a global universe of companies, and the listing matters only in regards to the history of the company, the governance and the liquidity of its shares, with the UK being very strong on all of those points,” he said.

“There are a number of world-leading businesses that are here that we keep on analysing, especially in consumer products, healthcare and the intellectual property (IP) and payments-related areas of financial services, which we think are very interesting.”

Historically, Shell had been a holding in the J. Stern & Co. World Stars Global Equity fund. It was bought in 2012 at inception and sold later in 2014, when the managing team decided energy stocks weren’t for them. Since then, Diageo has been the only UK stock in the portfolio.

It is not alone in owning Diageo, with IFSL Evenlode Global Equity and Lindsell Train Global Equity among six funds in the IA Global sector also placing the stock in their respective top 10 holdings.

Nick Train also has a big position in the stock through his investment trust Finsbury Growth & Income. In the trust’s latest factsheet, the manager noted that it is “well-established” that the stock is out of favour and warned “it is still possible the next set of results will disappoint already low expectations”.

“Nonetheless, Diageo’s shares have now fallen over 30% from their peak in 2021 and we are sure it is right to be looking ahead to better trading for the company. In our view, Diageo shares will likely recover before those better conditions are confirmed,” he said.