While headlines have focused on the reforms of the Tokyo Stock Exchange in recent times, Korea is also looking to improve its own stock market.

The planned reforms aim to correct South Korean stocks’ tendency to trade at lower valuations compared to not only their global but also Asian peers – also known as ‘Korea discount’.

Ben Preston of the Orbis Global Equity fund said: “The under-pricing of Korean stocks has often been attributed to the fact that, for an advanced economy, South Korea has not been an easy place to be a shareholder.

“Weak shareholder rights, opaque Chaebol [large family-owned business conglomerates] ownership structures and laborious registration requirements have often deterred investors.”

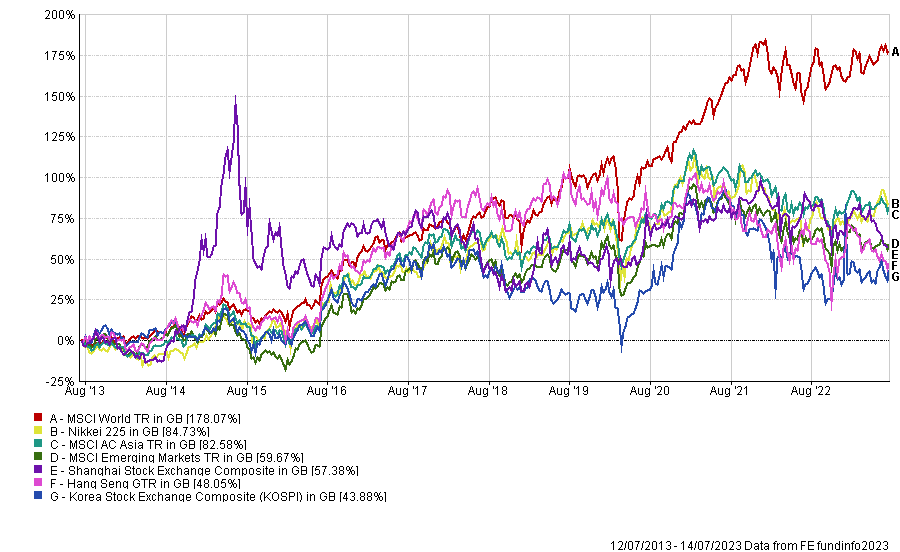

In the past 10 years, the Korea Composite Stock Price Index (KOSPI) has largely underperformed the MSCI World, but also emerging markets and Asian peers.

Performance of indices over 10yrs

Table: FE Analytics

However, plans to reform the Korean stock market have improved investor sentiment. For instance, the Nikko AM Asia ex-Japan fund has increased its allocation to Korean equities as a result of the efforts to improve governance, profitability and shareholder returns.

The fund’s co-portfolio manager, Peter Monson said: “This is resulting in modestly higher dividend pay-outs, buybacks and improvements in historically opaque and circular shareholder structures.”

Monson also said that Korean firms are well placed to benefit from the US inflation reduction act and opportunities stemming from rising geopolitical friction. Those factors would favour electric vehicle supply chains, green energy equipment and biological drug manufacturing.

He added: “There are early indications of a turn in the technology memory cycle, particularly for high end, high speck used by hyperscalers for artificial intelligence (AI). This could be a significant lift for benchmark heavyweights like Samsung Electronics.”

With tailwinds that could enhance the returns of Korean stocks, Trustnet looks at how UK investors can increase their exposure to South Korean equities.

Pure Korea plays

Unlike Japan, China or India, South Korea does not have its own sector in neither the Investment Association or the Association of Investment Companies universes, but there are funds purely focusing on Korean equities.

Barings Korea Trust and the JPM Korea Equity Fund are two actively managed portfolios in the IA Specialist sector focusing on Korea. The Barings’s fund was launched in 1992, 15 years older than its JPMorgan rival.

Both funds have Samsung Electronics, SK Hynix, LG Chem and Naver among their top five holdings.

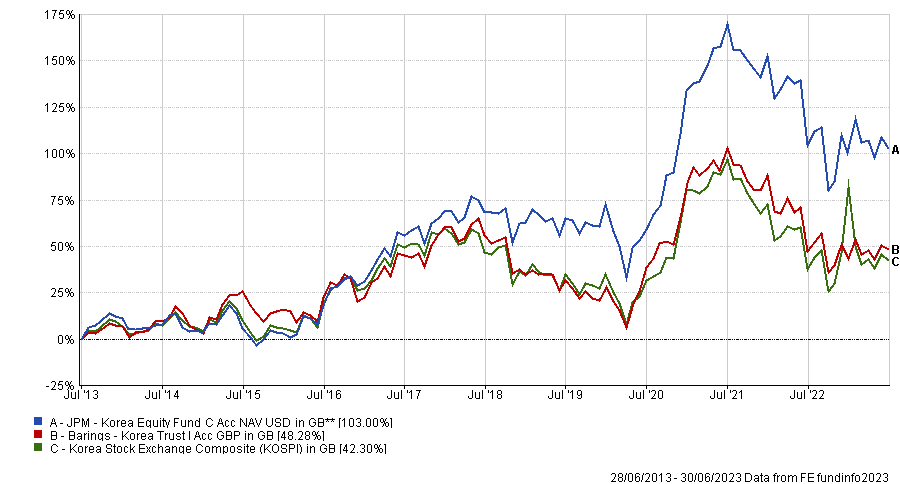

Performance of funds over 10yrs vs benchmark

Source: FE Analytics

The two funds have outperformed the KOSPI index over 10 years, but the JPM Korea Equity Fund has beaten its rival. However, Barings Korea Trust is a bit cheaper with an ongoing charge figure (OCF) of 0.93%, while the JPM Korea Equity Fund charges 0.97%.

Weiss Korea Opportunity Fund is the only close-ended fund focusing on Korean equities in the IT Country Specialist sector.

Unlike the two previous open-ended funds, the trust benchmarks its performance against the MSCI Korea index, which it has beaten over 10 years.

Performance of trust over 10yrs vs benchmark

Source: FE Analytics

The trust has a specific strategy, which is about exploiting an anomaly in the South Korean stock market. It has a penchant for preference shares, which often trade at deep discounts (possibly more than 50%) to their common shares equivalents becausethey do not carry voting rights, but benefit from a higher dividend yield.

Its five largest holdings are LG Chem, Hyundai Motor, LG Electronics, Hanwha and Mirae Asset Securities.

For investors preferring passive strategies, there are three funds tracking the MSCI Korea index in the IA Specialist sector.

Xtrackers MSCI Korea has been the best at replicating the performance of the index over 10 years, with a tracking error of 1.61%. With an OCF of 0.50% HSBC MSCI Korea Capped UCITS ETF is the cheapest fund tracking the MSCI Korea.

Another passive fund, tracks the FTSE Korea index. Over 10 years, the FTSE Korea has done slightly better than the MSCI Korea.

Passive funds tracking the MSCI Korea and FTSE Korea indices

![]()

Source: FE Analytics

Other active funds with a significant exposure to Korea

While the country has a lower weighting than China, India or Taiwan among emerging markets and Asia indices, some active funds have taken big bets on the market.

Here we researched the active equity funds with an allocation to South Korea above 25%. One options is Federated Hermes Asia ex-Japan Equity, with an allocation of 28.8% to South Korea.

In an article, James Cook, head of investment specialists at Federated Hermes wrote: “In our view, the valuations in Korea are incredible. It is a unique market where you can find high-quality businesses trading extremely cheap, and lower-quality (not low quality) businesses at exceptional prices. So, the question shouldn’t be why should Korea do well, but rather why should these businesses do well.”

He also said that Korea has none of the idiosyncratic or geographic pressures of its neighbours.

Performance of fund over 10yrs vs sector and benchmark

Source: FE Analytics

The fund is has been the second best performer in the IA Asia Pacific Excluding Japan sector over 10 years. Samsung Electronics, Samsung Fire & Marine and KB Financial Group are the three Korean stocks among its top 10 holdings.

In the IA Global Emerging Markets sector, Robeco Emerging Stars Equities has a 25.4% allocation to South Korean equities. The fund has been a top-quartile performer against its peers over 10 years, returning 82.9% versus the 53.3% from the sector average and 59.6% gain of the MSCI Emerging Markets index.