The Topix and the Nikkei 225 have recently hit levels unseen since 1989, boosted by the country’s reopening and, more importantly, long-term structural developments within the Japanese market.

However, Masaki Taketsume – manager of the £642m Schroder Tokyo fund – said small firms are the likely winners of those two dynamics.

“The uncertainty caused by the pandemic tended to see equity investors retreat to the safety of larger company,” he said. “However, the improved economic backdrop and renewed investor enthusiasm for Japan will bring higher liquidity, which is beneficial for smaller company as it makes them easier to trade.”

Earlier this year, the Tokyo Stock Exchange (TSE) called for Japanese listed firms to come up with plans laying out how they intend to achieve sustainable growth and enhance corporate value.

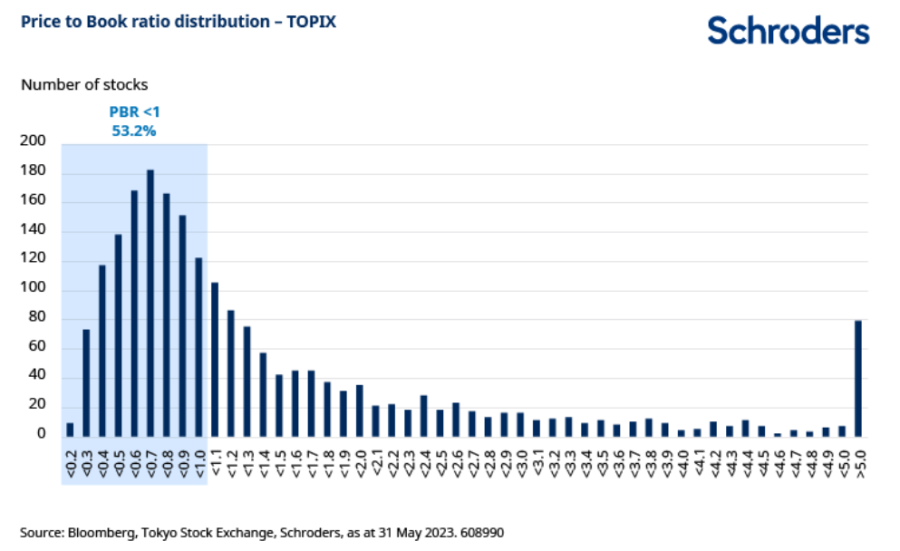

The main targets of this warning are businesses with a price-to-book (P/B) ratio of below 1, which is a ratio dividing a company’s stock price by its book value per share.

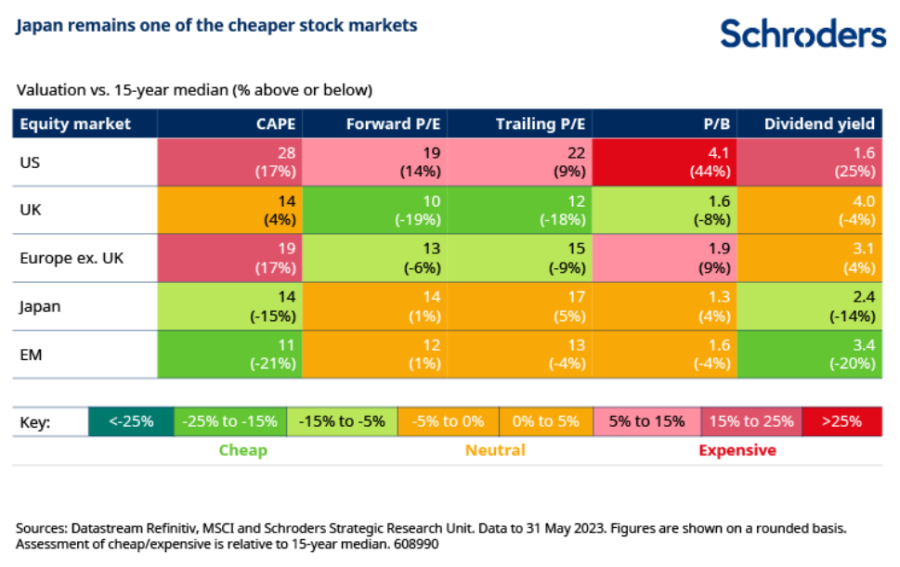

Rob Perrone, investment counsellor at Orbis Investments, said: “We love that. Five years ago, a lot of businesses in Japan might have been value traps. They would have been optically cheap but they might have remained cheap forever.

“They are now much more likely to be trading at cheap valuations, but ultimately improve their fundamentals. We think the opportunities for value investors within Japan is extraordinary.”

A company’s P/B ratio can be increased if a company generates higher return on equity (ROE) over their cost of capital. A P/B ratio below 1 indicates that investors are sceptical of the company’s future profitability and growth potential.

However, smaller Japanese firms are even more lowly valued than their larger peers.

As a result, Taketsume believes there should be greater scope for smaller businesses in Japan to improve their P/B ratios.

Perrone added: “Half of the Japanese stocks are trading below a P/B of 1, but not half of the market cap. That tells you that most of those deep value opportunities are in mid-caps or in small-caps.

“We're looking at where the flows are going and they are going into large-caps. This doesn't make sense. The reason people are excited about Japan is the stock exchange pushing to get businesses that are trading below book value. Yet, the money is flowing into the stocks that are already above book value. Investors who are pushing into Japan on a passive basis are missing some of the best opportunities.”

To increase P/B ratios, the TSE requested listed Japanese firms to “push forward initiatives such as R&D (research & development) and human capital that leads to the creation of intellectual property and intangible assets that contribute to sustainable growth, investment in equipment and facilities, and business portfolio restructuring”.

Other methods to improve a P/B ratio is to increase returns to shareholders via dividends or share buybacks.

Taketsume said: “There are already encouraging signs that many Japanese firms are heeding TSE’s call and are increasing their returns to shareholders. We started to see a number of examples during Japan’s full year earnings season in May to June, which was a welcome surprise.

“For the last fiscal year, finishing March 2023, the amount of share buyback plans announced by companies has recorded historical high, far exceeding the level in the past two financial years.”

He added that they are seeing firms announcing new medium-term businesses plans which include better dividend pay-out policies, especially with small- and mid-cap businesses.

To tap into Japanese small firms, Numis recommended AVI Japan Opportunity Trust, while Hawksmoor Investment Management has a preference for its rival Nippon Active Value Fund. Baillie Gifford Shin Nippon featured in Winterflood’s recommendation list at the beginning of the year.

In the open-ended space, Janus Henderson Horizon Japanese Smaller Companies and M&G Japan Smaller Companies have rewarded investors well.

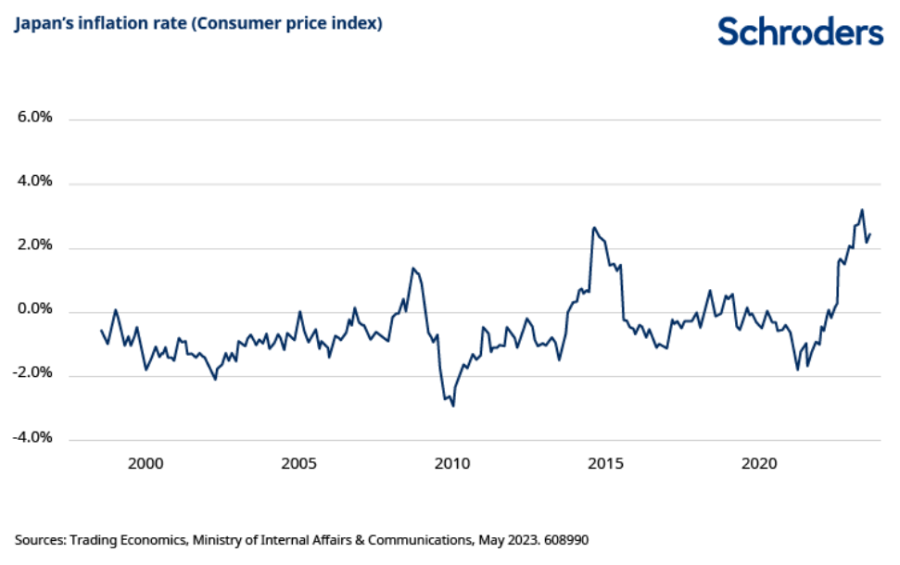

Another tailwind for Japan is the return of inflation after three decades of low inflation and even deflation.

Taketsume said: “Deflation leads firms and consumers to delay investment and put off purchases; there’s little point buying something now if it will be cheaper tomorrow. By contrast, moderate inflation gives firms the confidence to invest for the future, and also spurs consumers to spend.

“Rather than facing a downward deflationary spiral, Japan may now be entering a sustained period of higher corporate investment, wage growth and increased consumer spending.”

This will, however, depend on whether wages keep pace with the inflation.

Perrone added that higher interest rates and a stronger yen could be a headwind for certain industries in the country.

He said: “In an environment where the yen strengthens, exporters might sell off. That could be a headwind at the market level. However, many of the exporters are in tech or hardware firms as well as some of the automakers. We don't believe they are the most attractive stocks in the market anyway.”