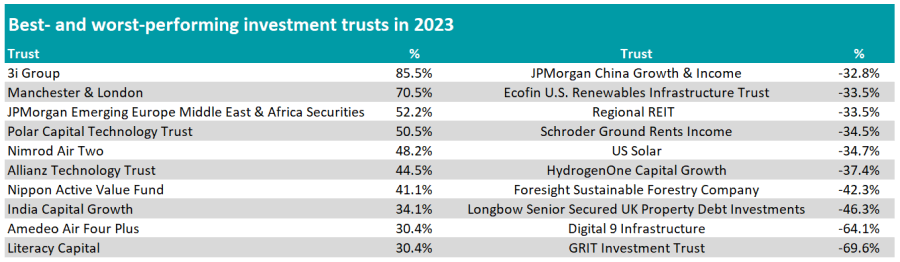

The list of top-performing investment trusts in 2023 was dominated by the technology sector and aircraft leasing strategies.

Enthusiasm for artificial intelligence (AI) helped the technology sector to bounce back last year after a disastrous 2022, with the ‘Magnificent seven’ (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla) leading the charge.

As a result, both Polar Capital Technology Trust and Allianz Technology Trust feature among the best performing investment trusts of 2023, having returned 50.5% and 44.5% respectively. The two trusts have six of the seven US tech mega-caps among their top 10 holdings, according to FE Analytics.

Global equity trust Manchester & London also benefited from the AI rally thanks to its two large positions in Microsoft and Nvidia, which account for 32.1% and 20.3% of the portfolio respectively according to the trust’s latest factsheet.

For the second year in a row, Nimrod Air Two and Amedeo Air Four Plus made the list of the best performing investment trusts. The two specialise in aircraft leasing and have made 48.2% and 30.4% in 2023.

Both trusts suffered during the Covid pandemic, but have been recovering since the resumption of international travel.

Japanese equities also had their moment in the sun in 2023 as the local stock market hit its highest level in 33 years. Activist investor Nippon Active Value Fund particularly shone as it returned 41.1%, seuuring itself a place in the list of the best performing investment trusts of 2023.

The trust also absorbed its competitors abrdn Japan Investment Trust and the Atlantis Japan Growth Fund last year and boasts a market capitalisation of £306.4m as of 2 January 2024 as a result.

In India, the mid- and small-cap rally last year benefited India Capital Growth, which specialises in this segment of the Indian stock market. The trust made 34.1% in 2023, which grants it a place in this list.

Yet, the best performing investment trust of 2023 has been private equity specialist 3i Group, which benefited from the strong growth of its largest holding, Dutch discount retailer Action.

Source: FE Analytics

The bottom of the list was dominated by investment trusts from the IT Renewable Energy Infrastructure sector, including Ecofin U.S. Renewables Infrastructure Trust, US Solar and HydrogenOne Capital Growth.

The sector has been suffering among others from higher inflation and interest rates, concerns around energy security following the Russian invasion of Ukraine and idiosyncratic issues related to cost disclosure.

Several investment trusts from different property-related sectors also did poorly in 2023. That includes Regional REIT from the IT Property – UK Commercial sector, Schroder Ground Rents Income from the IT Property – UK Residential sector and Longbow Senior Secured UK Property Debt Investments from the IT Property – Debt sector.

Chinese equities also had a dreadful 2023 due to weak economic data, continued geopolitical tension with Western countries and the worsening crisis in the local property sector. JPMorgan China Growth & Income is the vehicle in the IT China/Greater China sector that suffered the most from those headwinds and is, as such, part of the worst performing investment trusts of 2023.

Yet, the worst-performing investment trust of 2023 was GRIT Investment Trust, which backs small- and mid-cap natural resources and mining companies. The trust reported a loss of £83,000 in the first half of 2023.

The trust’s chairman, Richard Lockwood, stated in the company’s half-year results for the six months ended 30 June 2023: “The past six months have seen a continued increase in interest rates and high inflation in the UK. The economic uncertainties in global capital markets largely associated with the Russia-Ukraine conflict, have continued.

“However, this challenging economic background has presented a number of opportunities to the company's board in its pursuit of a suitable reverse takeover target.”