The Chinese property sector is once more causing concerns as Country Garden has become the latest property developer to face financial difficulties, two years after the Evergrande’s liquidity crisis.

Country Garden, one of China’s largest property developers, reported a loss of between 45bn and 55bn Chinese Yuan (£4.9bn and £6bn) for the first half of the year. This compares with earnings of around 1.9bn Yuan (£206m) during the first half of 2022. The company also announced it had missed interest payments on two bond payments.

The Chinese property market is the largest asset class in the world, with an estimated market value of $62trn. In comparison, the S&P 500’s market value is $15.6trn. Therefore, a collapse of the Chinese real estate sector would have wide implications not just domestically buy far outside of China.

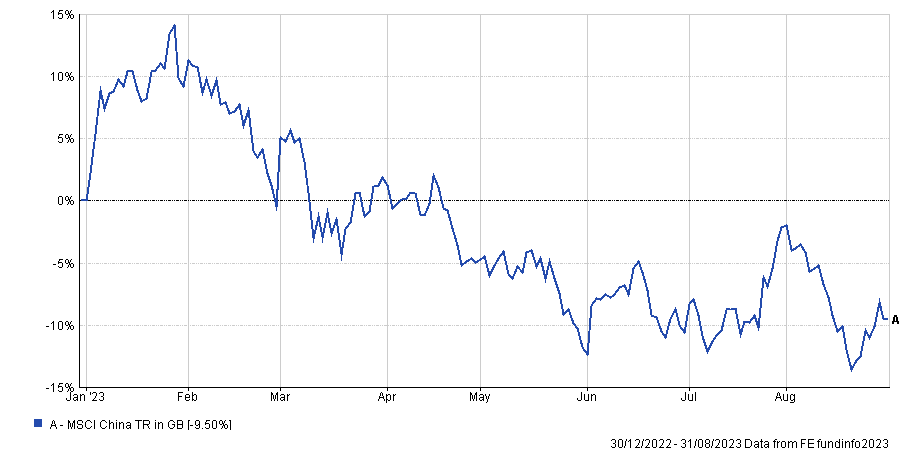

According to Standard & Poor’s, about 50 Chinese property developers have defaulted on debt payment in the past three years. A direct casualty of those commotions have been Chinese equities, with the MSCI China falling 9.5% year-to-date.

Performance of index YTD

Source: FE Analytics

Yet, Sharukh Malik, manager of the Guinness Best of Asia and Guinness Greater China funds, claimed that this crisis in the Chinese property sector is mostly government-induced and manageable.

He said: “Property has accounted for about 20% to 25% of GDP over the past few decades, therefore, the government was fine with letting the property sector drive a big portion of the economic growth. But that has led to a debt build-up that needed to be addressed at some point.

“Back in 2020, when the Chinese economy was probably the strongest major economy worldwide, the government thought it was time to rein in the property developers and try to stop the bubble in a controlled manner.”

The positive side of the situation, according to Malik, is that nearly three-quarters of property developers’ debt is owned by Chinese state-owned banks and the rest by credit funds. It means loans could be extended by 10 years to give time to property developers to work through their issues.

Malik said: “That's quite different to the Western financial system where we don't really have state-owned banks. In China's case, as it has done in the past, it can give itself a decade if it needs to build a breathing space for the property developers.

“At least for now, it's unlikely that the weakness in the property market will lead to a contagion within the financial system, because it's mostly a debt Chinese owe to themselves.”

The negative side of the real estate sector crisis is that it could harm the Chinese long-term growth story, as it would extend the life of firms that should go bankrupt today.

Malik said: “We would get zombie funds like we saw in Japan. They were basically insolvent but were allowed to keep going for more years than needed.

“That's bad, because you could potentially have capital being deployed to support those property developers instead of the interesting areas of the Chinese economy such as electric vehicles, renewable energy, semiconductors and so on.”

Malik also warned that there could be further commotions in the future and expects credit funds with significant exposure to the real estate sector to run into problems. This is the case of Zhongrong International Trust, for example, a major Chinese investment trust that has recently missed payments to corporate investors.

Malik said: “You're going to see more of those credit funds, which have bet the whole house on property, run into trouble. That is inevitable. But to say, that the whole sector is going to collapse is a big stretch, at least for now.”

While Malik does not exclude that things could get even weaker before they get better, he said that the risk-reward ratio of Chinese equities is currently very attractive.

He added: “As long as investors are willing to stomach the fact that there could be more volatility, today's prices are very attractive relative to other major equity classes.

“Considering where Chinese equities stand right now, you at least have the possibility of a re-rating in valuation multiples. If you target structural growth areas, you can get access to good quality compounding stocks trading at their cheapest prices in 10 years.”

A thing that could help Chinese equities in the short-term for Malik is more transparency and a clear plan from the government.

Malik said: ”It doesn't help that China is not disclosing certain data points. The Chinese have stopped reporting consumer confidence and youth unemployment data. That is exactly the wrong signal to be sending in this situation and I don't offer a defence for that.

“We need a plan from the government on what they are going to do about the property developers and distressed assets. That confusion is not helping Chinese equities.”