Investors have been spending more time researching funds that invest in European stocks, dividend-paying companies and cash over 2023 so far, the readership trends on Trustnet suggest.

Although the likes of Vanguard LifeStrategy 60% Equity, Fundsmith Equity and Baillie Gifford Managed are some of the most viewed fund factsheets on Trustnet, an enlightening exercise is to look at how the share of pageviews for funds changes over two periods in order to see which are being researched more or less.

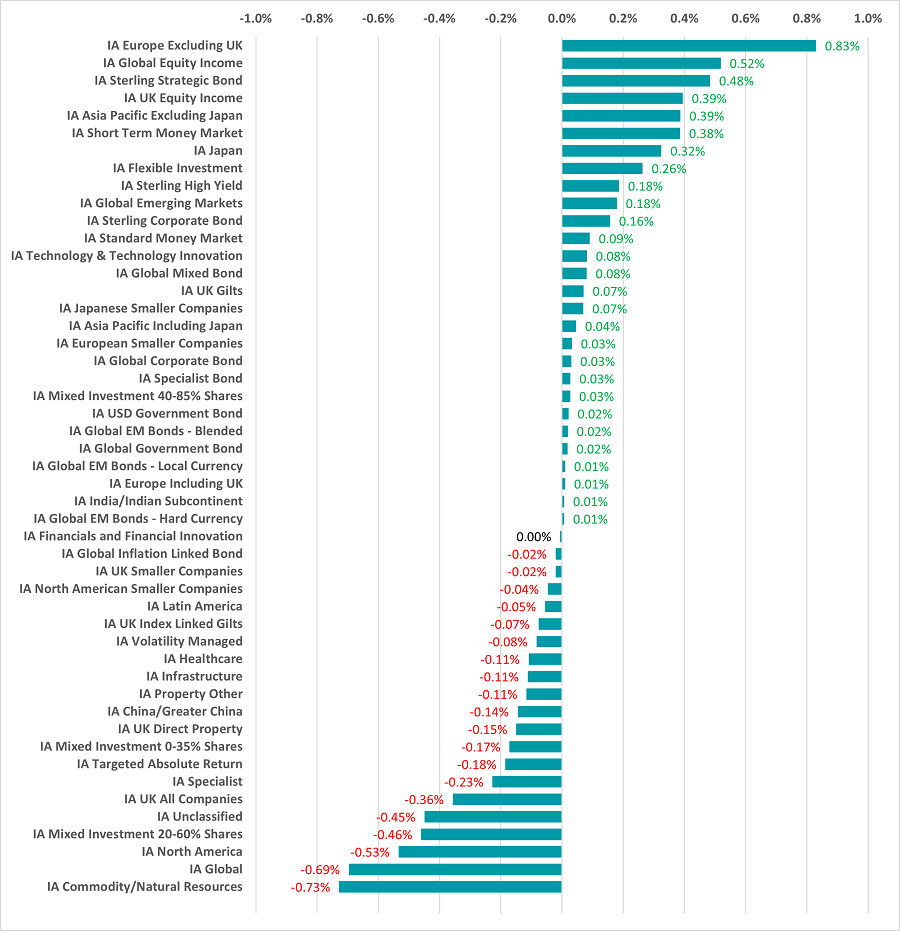

On the Investment Association sector level, IA Europe Excluding UK has benefitted from the biggest jump in interest when compared with last year’s pageview numbers. In 2022, the sector accounted for 3.63% of research in the Investment Association universe but this climbed to 4.46% in 2023’s first half.

Although the European economic picture is challenged with Germany falling into recession and other countries looking weak, stocks on the continent have had a decent run in the past six months. FE Analytics shows the IA Europe Excluding UK sector made a 7.9% total return in the first half, which is the fourth best result of the 57 peer groups.

Among the European equity funds being researched most by Trustnet readers are Fidelity European, Jupiter European, BlackRock European Dynamic, Liontrust European Dynamic and BlackRock Continental European.

Change in research by Investment Association sector

Source: Trustnet

A few other themes can be drawn from the chart above including the rise in research into equity income strategies. The IA Global Equity Income and IA UK Equity Income sectors have had the second and fourth biggest increases in Trustnet research share over the past six months.

Dividends were hit hard during the Covid-19 pandemic when many companies slashed or cancelled payouts to protect their balance sheets but they have recovered from this slump and yields are now more healthy. This is especially attractive at the moment, as high inflation and rising interest rates prompt investors to work their money harder.

BNY Mellon Global Income, JPM Global Equity Income, Artemis Income, M&G Global Dividend and Schroder Income Maximiser were the equity income funds with the most factsheet views on Trustnet in the opening half of 2023.

Linked to this, investors have been researching fixed income funds more despite bonds having a difficult run more recently as further interest rate hikes loom large. Bond yields had fallen to historic lows but rising rates have pushed them to more attractive levels.

Strategic bond funds have benefitted from the largest uptick in research over the past six months, with Invesco Monthly Income Plus, Royal London Sterling Extra Yield Bond, Artemis High Income, Jupiter Strategic Bond and Janus Henderson Strategic Bond being the most popular with Trustnet readers.

Turning to how individual funds are being researched, the below table shows the 25 that have increased their research share the most in 2023’s first half.

Source: Trustnet

Royal London Short Term Money Market has grown its research share by the biggest margin, reflecting the higher yields on offer in cash and a desire for safe havens in a time of uncertainty. This is not a one-off as the chart showing changes in research by Investment Association sector also reveals more interest in the two money market peer groups.

Fund flows appear to back this up – the latest Calastone’s Fund Flow Index shows that UK investors poured £2.4bn into money market funds over the past 12 months, compared with a £3.7bn outflow from equity funds. Bond funds have attracted another £7.3bn.

Edward Glyn, head of global markets at Calastone, said: “Fixed income funds and their money market cousins have not looked so attractive since before the global financial crisis. At the same time, recession fears are stalking equity and property markets – investors are nervous.

“The result is a flight to safety. Money markets currently enable investors to earn an income of 5% or more at very low risk, while fixed income funds, which invest in longer-dated bonds than money market ones, offer the chance to lock into the highest yields in years.”

In addition to the themes identified in the sector chart, a few more can be seen here. BNY Mellon Multi-Asset Balanced had the second biggest increase in research share, in keeping with wider interest in the IA Mixed Investment 40-85% Shares sector.

This, combined with falling research into IA UK All Companies funds, means that the IA Mixed Investment 40-85% Shares sector is now the second most viewed on Trustnet. This marks a continued fall for the IA UK All Companies sector, which used to be the most researched, then was usurped by IA Global and has now fallen another notch into third place.

The strong returns made by tech and Japan funds in the first half of 2023 are also reflected by increased research into the likes of Fidelity Global Technology, FTF Martin Currie Japan Equity and M&G Japan.