St James’s Place (SJP) has changed the manager line-up of its Global Smaller Companies, Global Emerging Markets and Emerging Markets Equity funds to reduce total ongoing charges.

This is part of a wider effort from SJP to adjust to the Financial Conduct Authority’s Consumer Duty. This new piece of regulation, introduced by the City watchdog last summer, aims to enforce value for money and good client outcomes across the financial services industry.

For its Global Smaller Companies fund, SJP has replaced current manager Paradice with Northern Trust Global Investments Limited. Robert Bergson will take over from Paradice’s Kevin Beck as lead portfolio manager.

The external fund manager charge for the fund will reduce from 0.60% to 0.06% per annum, although it could evolve into a multi-manager fund over time.

Performance of fund since launch vs benchmark Source: FE Analytics

Source: FE Analytics

Elsewhere, Somerset Capital was replaced by Robeco Institutional Asset Management as manager of its Global Emerging Markets fund. The external fund manager charge will be cut from 0.30% to 0.15%, while Tim Droge and Han van der Boon will take over from Edward Robertson as lead portfolio managers.

Tom Beal, executive director of investments at SJP, said: “The changes we are making to the Global Emerging Market and Global Smaller Companies funds are designed to specifically add lower-cost strategies to our platform and therefore continue a theme of providing investors with more choice.

“Active quantitative strategies can be incredibly effective when accessing less covered areas of the market at an attractive price point. This is key to our fundamental belief to offer choice, innovation, and variety to investors of all type.”

Performance of fund over 10yrs vs benchmark

Source: FE Analytics

Yet the manager charge on the Emerging Markets Equity fund will increase from 0.37% to 0.39% with the introduction of Aikya Investment Management to the current manager line-up, which already includes ARGA Investment Management, Lazard Asset Management and Wasatch Global Investors. Aikya’s Ashish Swarup will be the lead portfolio manager, with Somerset Capital removed.

Beal explained: “The Emerging Market Equity fund is already a top-decile performer amongst peers over the past five years and this change should help maintain the fund’s strong track record. The team’s defensive, quality oriented approach blends especially well with the existing growth and value managers in-situ.”

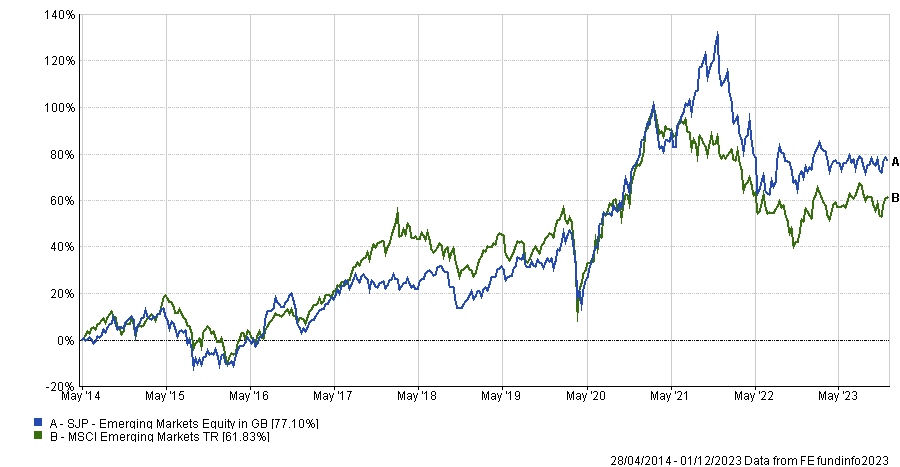

Performance of fund since launch vs benchmark

Source: FE Analytics

These changes come two months after Justin Onuekwusi joined SJP as chief investment officer to lead the development of the firm’s investment proposition, asset allocation approach and selection of external fund managers.

The wealth management firm also scrapped its controversial exit fees from most of its new investment bonds and pensions products in October.

While SJP’s share price has stumbled in recent years, experts still keep faith in the prospects of the UK’s largest wealth manager as an ageing and wealthier population is likely to result in a higher demand for financial advice.