Wealth management firm St. James’s Place (SJP) has removed its controversial exit fees from most of its new investment bonds and pensions products after the introduction of the Consumer Duty by the Financial Conduct Authority (FCA) earlier this year.

The initiative aims to ensure firms in the financial services industry focus on delivering value for money and good client outcomes.

In response, SJP has removed one of its most punitive charges on new investment bonds and pensions. Customers will still pay initial charges and ongoing charges, but there will be no penalty for leaving early.

The firm has come under criticism for these fees, which charge up to 6% for leaving early, with 1 percentage point taken off per year of loyalty – meaning there is no charge after six years.

However, early withdrawal charges will still apply to existing investment bond and pension products until the end of their applicable six-year period.

Andrew Croft, chief executive officer at SJP, said: “We have always been confident that SJP offers its clients real value that helps individuals and families achieve financial wellbeing.

“However, it is increasingly evident that consumers are seeking simple comparability, and this has been reflected in regulatory trends too, as highlighted with the Assessment of Value and Consumer Duty regimes. The review of our charging model reflects these developments.”

The firm is also separating its charges into component parts, such as advice charges, fund charges and product charges. This change aims to enable clients to consider whether the £158.6bn wealth manager is providing value for each element of its services. SJP also expects this change to allow more relevant benchmarking of investment performance.

As part of this, SJP is also rebalancing its advice and product charges towards the value of advice, with initial product charges to be removed for all products in this area and ongoing product charges to be reduced and tiered for large investments.

Croft said: "The changes announced today are about positioning our business for continued success by putting in place a future charging structure that reflects the evolution of consumer engagement with retail financial services, and is aligned to the long-term value that we deliver to clients through the partnership.”

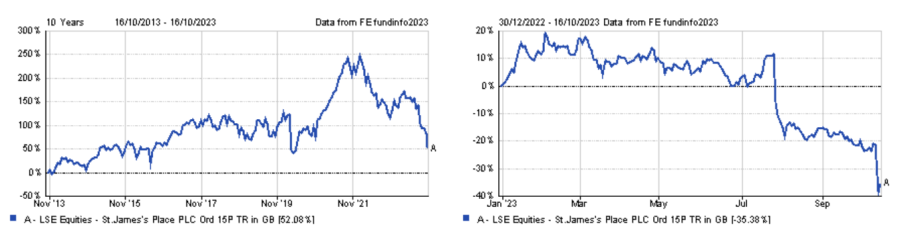

Shares had been tumbling in recent days (down 17% over five days) as investors geared for an announcement around fees. SJP has warned shareholders that these changes and the associated implementation costs will impact results in the short-term before growth returns over the medium and long-term.

However, the firm said that there were no changes to its strategic priorities and ambitions set in its 2025 business plan. The company did not change either its dividend guidance and expects it will distribute 70% of the full year underlying cash result.

Performance of share over 10yrs and YTD

Source: FE Analytics

SJP has long been a UK stock market darling. Yet, its share price started tumbling in 2021 as a result of slowing client inflows, funds underperformance and increased scrutiny around its charging structure. The shares also experienced a sharp fall in July 2023 when the FCA’s Consumer Duty came into force.