St. James’s Place (SJP), one of the largest wealth management companies in the UK, has experienced a decline in the value of its shares in recent years as a result of slowing client inflows, funds underperformance and increased scrutiny around the firm’s charging structure.

The latter point is of particular importance as City watchdog the Financial Conduct Authority (FCA) is aiming to enforce “fair value” and “good outcomes” for customers across the financial services industry through its Consumer Duty legislation.

This new set of rules was introduced last summer and has caused a severe blow to the company’s shares. In response to the Consumer Duty, SJP has recently overhauled its fee structure, but some have questioned whether it can maintain the same level of profitability with these lower fees.

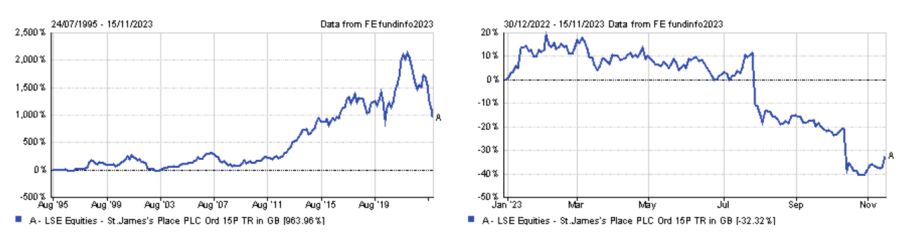

Performance of stock since listing and YTD

Source: FE Analytics

Despite the turmoil, Liontrust, which holds the company in its Sustainable Future UK Growth and UK Ethical as well as in its Managed range, has kept faith in what has long been a darling of the UK stock market.

Peter Michaelis, head of the Liontrust sustainable investment team, explained that SJP’s fee structure is reasonable, albeit distinctive, and that the company is moving in the right direction in response to the Consumer Duty.

He said: "We have long recognised that the charging approach from the company is distinctive, however felt that, over the lifetime of a client, it was reasonable given the comprehensive advice and overall value of their service. This view is supported by consistently high customer satisfaction scores and the industry leading advisor training SJP provides.

"Earlier this year we met with the management team following the reduction of long-term client fees in light of the new Consumer Duty rules from the FCA. We felt it was taking proactive sensible actions to the benefit of customers and incentivise long-term investing.”

Michaelis also stressed that financial matters are becoming increasingly complex as people are receiving less support from both employers and the government.

Liontrust is seeking to identify companies that can help people prepare for their financial future amid this challenging backdrop as part of its investment theme “Saving for the Future”, which includes SJP.

Michaelis added: "We still believe there is a value for the financial advice offered and that individuals are comfortable paying for this service where they see there is value for money in it.

“We will have to look at any changes that the company makes to its fee structure and how that impacts the financial picture for the company before we revise our investment view."

David McCann, director, diversified financials research at Numis, also sees a long-term structural growth in the UK wealth market that should benefit SJP. This is driven by an ageing and wealthier population with individuals increasingly expected to take responsibility for their own retirement outcomes.

He also believes that SJP’s new charging structure could enhance earnings quality, as the wealth manager is moving to a model fully based on recurring revenues and does away with more cyclical upfront fees. McCann warned, however, that further tweaks are not off the table.

He said: “We do question whether the fee and investment management model will need to evolve further in time, as the views of the regulator are not known, the competitive environment could change, the incoming CEO might want to change things and the client is ultimately still paying close to 2% per annum all-in (max.). “

He expects SJP should return to strong growth once through the transition but forecast falling earnings and dividends in the short term.

McCann said: “We continue to consider SJP as a long-term top pick but see no immediate rush to own the shares. We think until the company actually reports a year of earnings recovery/growth, we can't see the shares meaningfully re-rating.”

Jeffries, another broker firm, was more positive and published a ‘buy’ recommendation with a price target of £8.20.