Gold has fallen so far in 2021, reversing last year's 30 per cent rise when the Covid crisis first hit and gold set new record highs. The fact this drop has coincided with rising inflation forecasts may seem odd at first glance, because gold is so often touted as the ultimate inflation hedge.

Actual inflation has barely budged to date, recovering from last spring's lockdown deflation shock but holding in the middle of 2010 decade's tight range on the US core PCE measure at 1.4 per cent per year and falling back to last summer's five-year low of 0.9 per cent on the UK's underlying consumer price index.

The next few months however will likely see inflation data push higher as last spring's crash in commodity prices sets a low base for year-on-year comparisons. On top of that, a growing number of analysts and investors, such as Ray Dalio of Bridgewater Associates, believe that "inflation pressures are rebounding" as the economy re-opens. Former Pimco boss Bill Gross predicts 3-4 per cent US inflation by mid-year.

Market-based forecasts lag that level but have jumped more meaningfully, with 10-year US breakevens rising a whole percentage point from October to reach 2.3 per cent today, the highest such annual inflation forecast since 2013.

Shouldn't gold also be surging? A more direct outcome of these rising cost-of-living forecasts has been a jump in bond yields, one which has more than negated the inflation outlook. Here again, the base effect from last spring's Covid crash is helping fuel the sense of an upwards spiral.

Ten-year US Treasury yields sank last March to a new all-time low near 0.5 per cent. Twelve months later they have rallied to peak above 1.7 per cent, and while that remains a very low nominal yield by historical standards (it was a record low when first reached in late-2011; it then marked the bottom-end of the 10-year yield's range until the pandemic depression) it has still tripled from this point in 2020, a record year-on-year rise. It has also raised the 'real yield' offered by inflation-protected Treasury securities.

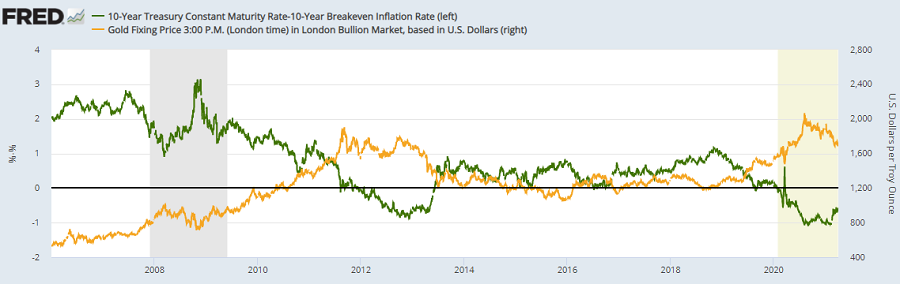

Gold priced in US dollars vs 10-year US TIPS yield

Source: St.Louis Fed

The relationship between gold prices and real yields has grown stronger in recent years, with the price of gold moving in the opposite direction to 10-year US TIPS yields in 50 out of 60 months since March 2016, some 83 per cent of the time. That compares with 34 out of 60 months across the previous half-decade, some 57 per cent.

Gold has also come to show a much stronger relationship with inflation-protected Treasury bonds than with any other major asset class. Since the start of 2016, gold's median correlation on a rolling 52-week basis has been -0.87 with the 10-year TIPS yield. That compares with an r-coefficient of -0.50 with the dollar's trade-weighted currency index, +0.32 with the S&P500 equity index, and -0.20 with crude oil.

Real interest rates are still deeply negative across the world, meaning that cash in the bank is losing value everywhere. That backdrop may well continue to encourage demand for gold coins and small bars. But our analysis suggests that it's the direction of real rates, not the absolute level, which drives the direction of gold prices. And here in month 13 of the Covid crisis, the rate offered by government bonds is now much less negative than it was at last year's record lows. Ten-year US TIPS yields rose above minus 0.6 per cent at the recent peak, sharply higher from the multi-decade low beneath minus 1.0 per cent first hit as gold peaked above $2,000 per ounce in August 2020.

While other sovereign rates have risen less quickly, the move has also been higher in real terms because while inflation forecasts have risen, they have been outpaced by the rise in UK, German and other bond yields. Gold has again mirrored this rise, retreating in sterling and euro terms to erase all of last year's gains.

Correlations are never constant, of course, and the link between 10-year TIPS yields and dollar gold prices recently reached a near perfect inverse correlation of -0.97 on a 52-week basis. While that suggests the kryptonite of real rates may lose some of its hold over gold, even if borrowing costs continue to rise, gold is likely to continue struggling if asset managers continue to reduce their exposure to sovereign debt bought as a 'safe haven' during last year's deflationary crash.

Once the Covid-19 crisis recedes however, will the landscape really have changed from what we saw before this catastophe?

So-called 'revenge shopping', plus president Biden's historic stimulus, will need to overcome the end of furlough schemes and business support loans, plus caution over socialising and the new-found savings mentality among Western households. The fact that central banks are committed to keep short-term rates at or below zero shows that they certainly fear we will face the same low-growth, low-inflation environment in which gold rose 40 per cent in the 18 months before the pandemic began.

Until then, a recovery in Asian jewellery demand is working to support prices, led by strong sales in China and India – gold's top consumer nations – after key festivals were cancelled and weddings postponed by last year's recession and lockdowns. Further ahead, and with today's central-bank stimulus fuelling ever greater risk taking in other assets, gold's appeal as a form of investment insurance may outshine its less certain (if more traditional) appeal as an inflation hedge.

Across the last half-century, the price of gold has risen from five years earlier every time that the S&P 500 has fallen from five years before. Such protracted falls in equity prices are no small risk, hitting portfolios one-fifth of the time since 1971. They have invariably been accompanied by a drop in real yields.

Adrian Ash is director of research at BullionVault. The views expressed above are his own and should not be taken as investment advice.