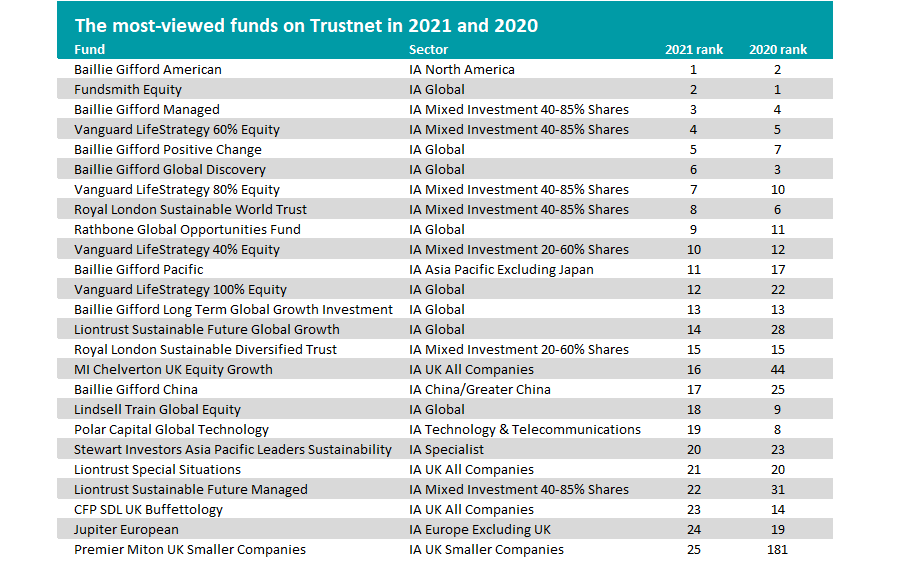

The £6.4bn Baillie Gifford American fund was the most-viewed factsheet on Trustnet in 2021, knocking the £28.6bn Fundsmith Equity from the top of the popularity table.

FE fundinfo Alpha Manager Terry Smith’s Fundsmith Equity fund had been the most visited Trustnet factsheet for several years on the trot, a position cemented by the fund’s strong long-term track record and presence in many investors’ portfolios.

In 2020, Fundsmith Equity accounted for 2.08% of the Investment Association factsheet views on Trustnet but this eased to 1.73% last year and pushed the fund into second place with our readers.

However, Baillie Gifford American, which is headed by FE fundinfo Alpha Manager Tom Slater and his US equities team, went into 2021 on the radar of many investors thanks to a 121.8% total return in 2020 – the best performance of the entire Investment Association universe.

While the fund accounted for 1.76% of Trustnet factsheet views in 2020, this climbed to 1.91% in 2021. But it must be noted that last year was not as profitable for the fund as the previous one; a loss of 2.8% over 2021 means it was the second-worst performer in the IA North America sector.

Source: Trustnet

The table above shows the 25 most-viewed Trustnet factsheets over 2021 (from the Investment Association universe) and how those funds ranked in 2020.

Baillie Gifford comes out especially well, with seven of the top 25 funds being from its stable. All of these funds generated top-quartile returns in 2020 but five of the seven were bottom quartile in 2021 and one was in the third.

Baillie Gifford Pacific, which is run by FE fundinfo Alpha Manager Roderick Snell and Ben Durrant, is the only one of the seven to have maintained its first-quartile ranking last year.

The majority of the funds on the above list were also among the most-viewed in 2020, with a degree of ‘reshuffling’ going in. New entrants include Liontrust Sustainable Future Global Growth (previously 28th most-viewed, now 14th), MI Chelverton UK Equity Growth (44th to 16th) and Liontrust Sustainable Future Managed (31st to 22nd).

But the fund on the list with the biggest jump in factsheet views is Gervais Williams and Martin Turner’s Premier Miton UK Smaller Companies fund. This was the most successful UK equity fund in 2020 with a total return of 77.3% although it turned in third-quartile numbers last year.

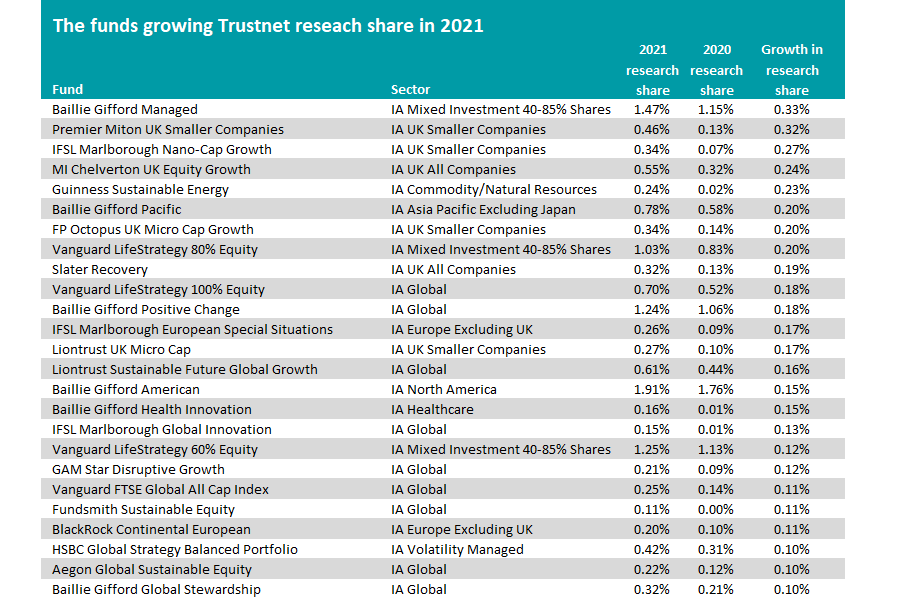

To look at the entire Investment Association universe to see which funds proved to be more popular in 2021 than they were in 2020, we examined each fund’s share of Trustnet factsheet views over both years.

Source: Trustnet

Baillie Gifford tops this list too, after Iain McCombie and Steven Hay’s £9bn Baillie Gifford Managed fund took its research share from 1.15% of the Investment Association universe to 1.47%. This moved it from being the fourth most-viewed factsheet in 2020 to the third in 2021, but – as noted above – its performance went from first quartile to bottom over the two years in question.

UK smaller companies have had a decent run in recent years and this is reflected in the rising popularity of funds such as Premier Miton UK Smaller Companies, IFSL Marlborough Nano-Cap Growth, MI Chelverton UK Equity Growth, FP Octopus UK Micro Cap Growth and Liontrust UK Micro Cap.

The rise of environmental, social and governance (ESG) investing is also apparent on the above this, through the inclusion of funds such as Guinness Sustainable Energy, Baillie Gifford Positive Change, Liontrust Sustainable Future Global Growth, Fundsmith Sustainable Equity and Aegon Global Sustainable Equity.

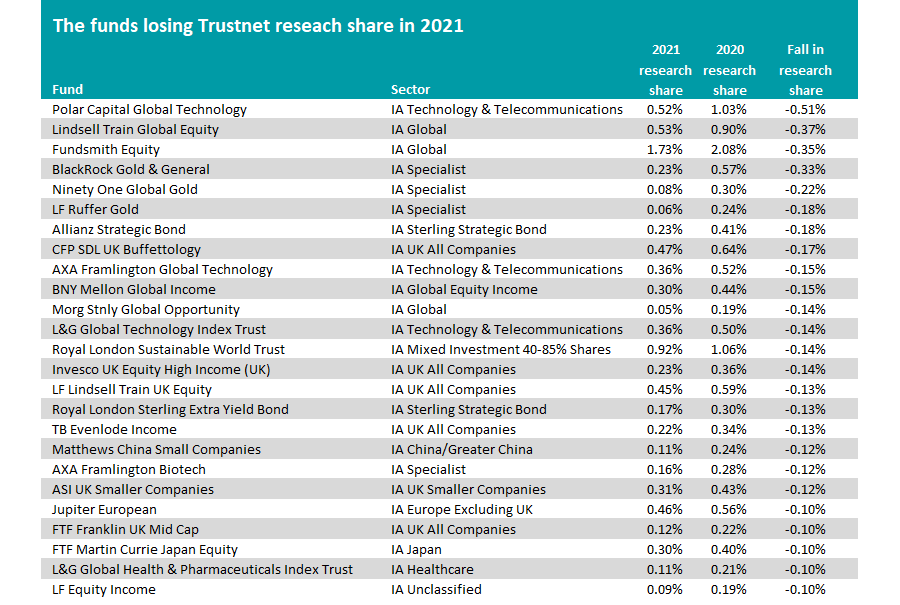

Source: Trustnet

Flipping things on their head, the above table shows the Investment Association funds with the biggest fall in their share of Trustnet total factsheet views in 2021.

Several tech funds are on the list (Polar Capital Global Technology, AXA Framlington Global Technology, L&G Global Technology Index Trust), possibly reflecting the shift in market leadership away from the growth style and towards value that started to take place last year.

Likewise, funds such as Fundsmith Equity, Lindsell Train Global Equity, LF Lindsell Train UK Equity and CFP SDL UK Buffettology – which have established strong track records through growth investing – have slipped down the research rankings on Trustnet.

Finally, gold struggled to gain ground in 2021 even though the yellow metal is traditionally seen as a good hedge against inflation. BlackRock Gold & General, Ninety One Global Gold and LF Ruffer Gold were researched less as a result.