Bonds have suffered as much as any other asset class in 2022. As a consequence of the Covid shocks and the interest rate hikes operated by central banks as an inflation-containment measure, to curb inflation, bond yields are at levels not seen for some time.

While stocks have sold off because of fears of a looming recession, bonds – which usually do well when investor sentiment is low – have suffered as higher interest rates push down their value.

Rathbone Strategic Bond, managed by Bryn Jones, is designed to detach itself from this dynamic, reducing risk and giving investors the lowest possible correlation to bonds and equities.

Its management team was highlighted in a recent Trustnet feature for its “aptitude to achieve a high level of risk-adjusted returns and pro-active management”.

Jones spoke to Trustnet about how he handles risk and the benefit of low correlation.

Can you sum up your process in three sentences?

We have three steps to our process.

When we launched the fund, our approach was to back-test several indices to look for the best risk-adjusted returns and to get allocation to the indices that delivered them. We introduced a mini-max on either side, so we had a way to mitigate risks and avoid excessive exposure to high-yield or emerging markets (EM).

The second step is driven by our fixed-income investment process. It involves themes, meaning that we will only own sectors that we like; fundamental work, which is about understanding the underlying companies if it's a corporate, or a government; and valuation work, where we look at relative value.

Lastly, we are always trying to find the highest yielding asset with the lowest level of volatility, because that gives you a better Sharpe ratio, which is what investors want.

Why should investors pick Rathbone Strategic Bond?

The fund acts as a diversifier within a portfolio and people are using it because it is designed to generate a long-term positive return with low correlations with equities and bonds. If you had it sitting at the bottom of the portfolio, it would slowly transit along, while other assets are much more volatile.

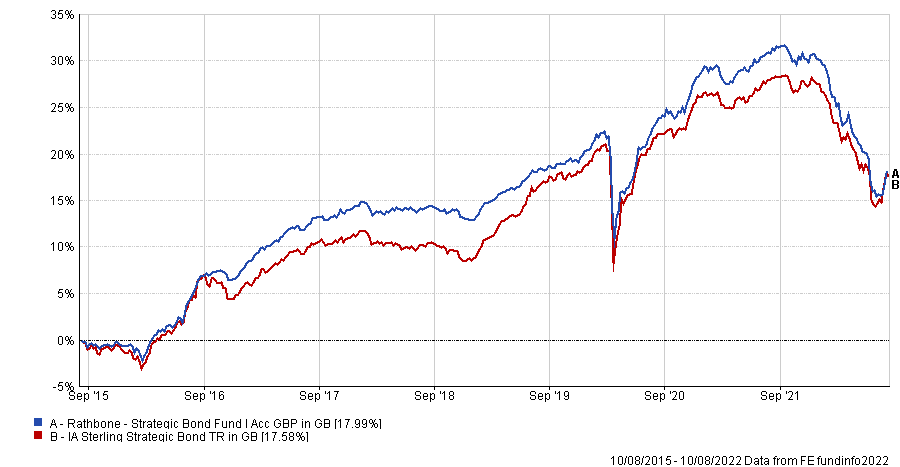

This year has been pretty tough for everybody and our correlations have been higher than we’d like them to be. But if we go back seven years, Rathbone Strategic Bond was generating somewhere between 3 and 5% per annum.

Performance of fund vs sector over 7 yrs

Source: FE Analytics

How risky is the fund at the moment?

Being priced into investment grade credit and high yield is probably some of the worst default rates for a very long time. Spreads have backed out quite a long way and prices are significantly below some of the recovery rates. So we actually put some risk on.

But in terms of the fund itself, it continues to have fairly low correlation with equities and is still significantly below the risk of an equity.

Are there areas you won’t invest in?

The underlying framework of the fund is that there are core weights of which we can either go overweight or underweight depending on the cycle.

We've been very low in retailers through the pandemic, for example. At the moment, we are backing insurance because it delivers the highest yielding in the investment grade space with low levels of volatility. We are also avoiding cyclical single-cashflow businesses.

What have been your best calls of the past years?

In 2019 we reduced our risk because we thought spreads were tight. We might have got lucky, but we were able to go into Covid with a lot of cash.

Another great call was when we added a huge amount of risk in March 2020. In fact, we had been looking at a Norwegian credit fund and then when it collapsed, we bought it at its lowest possible price.

We were also able to buy some Asian credit at its lowest possible price and some high yield.

And your worst calls?

We have an opportunity cost in not being in index-linked. But index-linked assets performed really badly since their peak because inflation expectations have dropped quite significantly and government bond yields have risen. So whilst that was a bad call originally, it turned out to be quite good.

Probably another weak call not in hindsight was not taking enough risk off early enough in March this year, when we took some losses and decided to sell down of risk in emerging markets and credit.

But it’s like running an ultramarathon. Sometimes you have to reassess your goals and change your conviction on what you're doing.

Can you elaborate on this parallel?

You know the old adage: investing is not a sprint, it's a marathon.

I run ultramarathons. Both in running and in investing you have a goal to achieve and to get there you're going to have both tough, dark periods and good experiences. But most importantly, along the way, when these periods happen, you've got to make sure that you're checking how you are, reconsider your view and maybe you’ll have to change your goal.

What’s the next marathon you’re running?

I am running for Great Britain in the Spartathlon this September, which is a mere 250 kilometres from Athens to Sparta in just over a day.