Investors in high-yield bonds have been warned that default rates are likely to rise from their current lows as the global economy goes into a downturn.

Market downturns tend to be difficult environments for high yield bonds and there is some concern about the impact rising interests will have on corporate defaults.

Steve Ellis, global chief investment officer for fixed income at Fidelity, argued that “one of the biggest and most underappreciated risks” in credit markets today is the chance that default rates will start to rise.

Fidelity International research suggests the market expects default rates for high yield to stand at just 2.6% in the US and 2.8% in Europe over the next year. But Bank of America noted that realised US high yield default rates peaked at around 14% and 10% in the 2009 and 2020 recessions, respectively.

“In our view, the market is still playing catch-up with the deteriorating macroeconomic outlook,” Ellis said. “To the extent this mismatch leads to pain for investors, it’s likely to be felt most sharply in sectors such as retail that are more exposed to an economic downturn, and at the weakest ends of the market in terms of credit quality.”

Fidelity’s research on credit markets concluded that investment grade bonds (rated AAA and BBB) appear to be paying yields that adequately compensate investors for default risk, even if there were to be a significant rise in defaults.

However, this isn’t the case in the high-yield space. The analysis suggests that investors are not being compensated for this risk in B and CCC-rated bonds in the US and CCC-rated bonds in Europe.

“Market pricing of risk premia for high yield has some distance to go to before it reflects the deteriorating macro environment, especially if any recession is prolonged,” Ellis said. “Investors who can navigate these economic headwinds may be able to uncover opportunities, but they will have to pay close attention to credit risk to avoid value traps.”

Stefan Isaacs, deputy chief investment officer for public fixed income at M&G, is one manager who thinks some parts of the high-yield market look attractive at the moment.

Among his reasons to be positive are the fact that yields have risen over recent months (creating more of a ‘cushion’ for investors), cheaper bond prices after 2022’s sell-off, improving credit quality and relatively strong corporate fundamentals across the high yield markets.

However, Isaacs expects that high-yield investors will have to contend with rising defaults as central banks continue to increase interest rates and the economy slows down – although he remains sanguine on how severe this will be.

“As ever, the entry point, default rates and ultimately loss given default will be key in determining future returns for high yield investors,” Isaacs said.

“We anticipate default rates will rise but ultimately peak below levels we have associated with past recessions. Risk premia may still have to rise given the challenges at a macro level but all is far from bad in the world of high yield.”

A note by Brian Kim, head of high yield research in Vanguard’s fixed income group, and Kunal Mehta, head of fixed income specialist team at Vanguard Europe, said: “Average default rates on high-yield bonds are currently very low by historical standards, at around 1%, and are well below the long-term average of 3.5%.

“When you consider the impact of rising interest rates on the cost of capital for bond issuers, it is natural to expect that default rates will increase from these low levels, especially if economic headwinds intensify.”

However, they argued that they see “no need to panic just yet about defaults”.

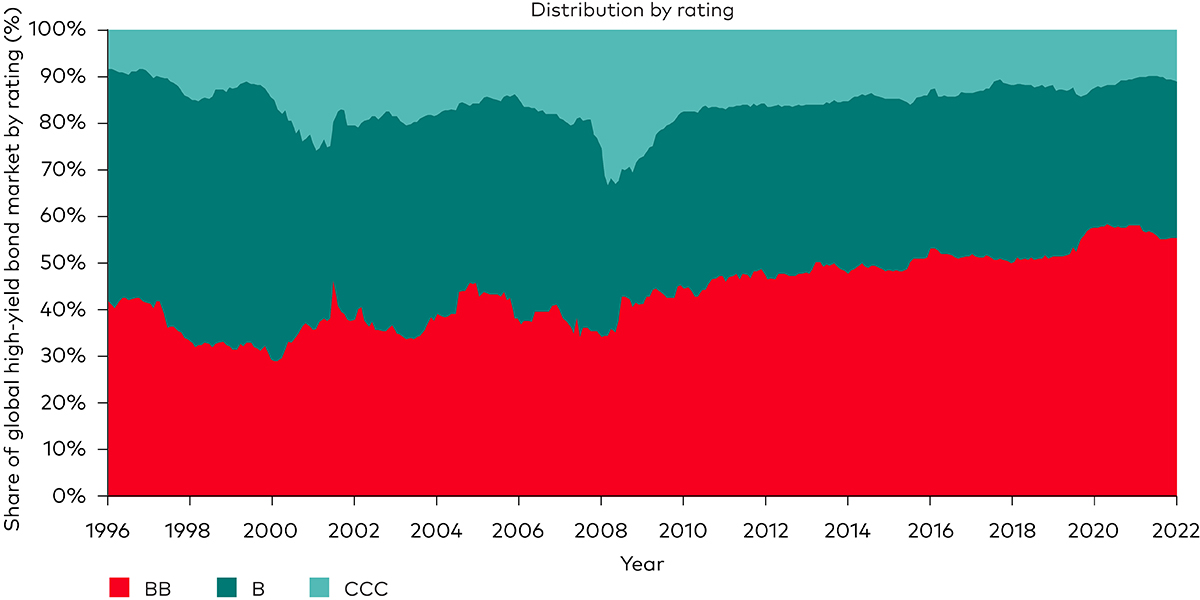

Like Isaacs, Kim and Mehta noted that the quality of the high-yield universe has been improving over time: the proportion of the high-yield index in BB-rated bonds (the highest-quality bonds within high yield) has grown from around 35% at the start of the 2008 global financial crisis to more than half today.

At the same time, the proportion of the index in CCC-rated bonds (the lowest quality) has decreased from 20% to 10%.

Source: Vanguard, Bloomberg. Bloomberg Global High Yield Index USD Hedged distribution by rating between 1 Jan 1996 and 30 Jun 2022

In addition, the strategists said default rates might not reach the levels they have in previous recessions because the rapid injection of liquidity from central banks during the 2020 pandemic means there has not been much time for the “overleveraged excesses” that characterised past credit crises to build up.

“After the broad sell-off that hit fixed income markets during the first half of 2022, valuations on below-investment-grade bonds became markedly more attractive, with yields now hovering around 9%,” Kim and Mehta finished.

“What’s more, our credit analysis teams believe that companies on the whole are well positioned to manage any challenges in the economic environment that lie ahead. But while there are now more high-yield opportunities than six months ago, a focus on selection remains key.”