September was a tough month for investors, with just one Investment Association sector making an average gain above 1% (IA USD Government Bond up 1.25%), while there were only six peer groups in positive territory at all.

These included the IA USD Mixed Bond and USD Corporate Bond sectors, which, along with the government bond sector above, benefited from the weak pound and strong dollar, rather than a particularly strong month for the underlying asset class.

Indeed, in dollar terms, the average fund in the IA USD Government Bond sector made a 0.33% return for the month.

At the other end of the spectrum, the IA UK Index Linked Gilt sector was at the bottom of the list, registering a loss of 17.6% (in sterling). Markets did not react kindly to chancellor Kwasi Kwarteng’s mini-Budget later in the month, with UK stocks, gilts and sterling selling off.

Ben Yearsley, director at Fairview Investing, said the reaction was “dreadful” but noted that the Bank of England also disappointed markets with a tame 0.5 percentage point interest rate hike for the second meeting in a row when the Fed has been hiking by 0.75 percentage points a time.

Source: FE Analytics

Meanwhile, the “global story” has been dominated by Fed tightening and a strong dollar. “The UK isn’t immune from this but at the same time doesn’t uniquely stand out as being that much worse. In fact, the FTSE continues to be one of the best performing indices this year,” he said.

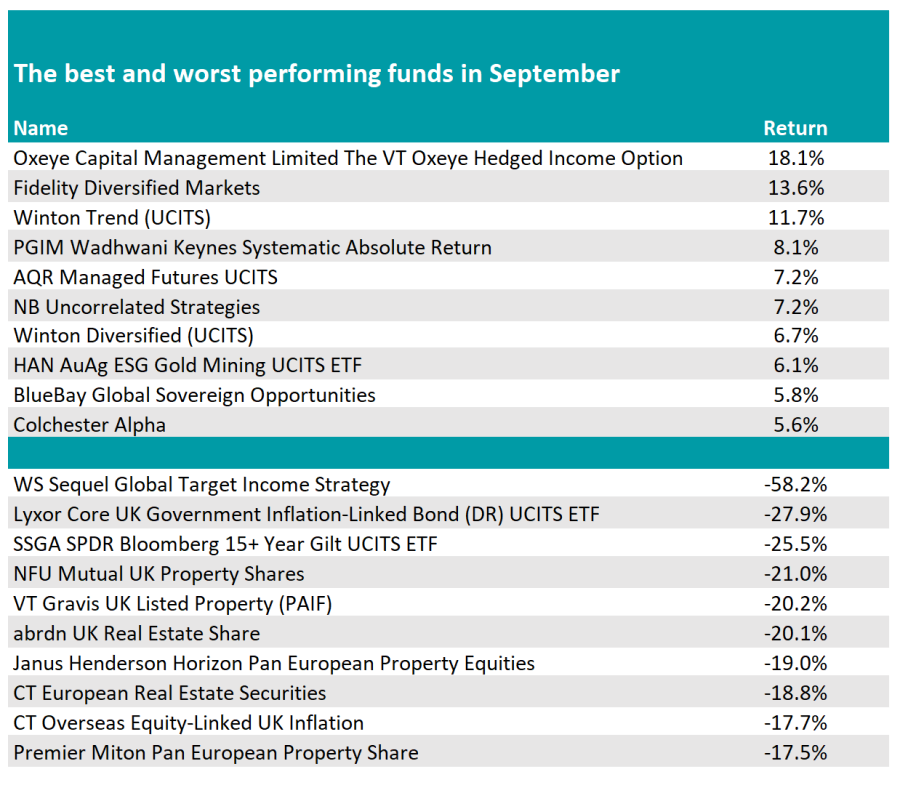

Turning to individual funds, there were some stand-out performers. The £2.7m Oxeye Hedged Income topped the tables with an 18.1% return, while the top 10 was dominated by esoteric strategies.

One of the more mainstream funds to perform well was Axa Framlington Biotech, Yearsley noted. The fund gained 4.5% over the month boosted by a weak pound (an ongoing theme among the top performers) as well as a “resilient healthcare sector”.

Source: FE Analytics

Conversely, at the bottom of the tables, listed property funds dominated the worst performers. The IA Property Other sector lost 10.8% but some funds performed much worse.

Seven of the 10 worst performers were all listed property funds, both from the UK and Europe, with NFU Mutual UK Property Shares coming off the worst, down 21%.

“There aren’t many crumbs of comfort for investors after a torrid September, except that yield and income are now much easier to find,” said Yearsley.

“Gilt yields were so attractive I actually bought two last week and became an investor for the first time since 2009. Fixed interest generally looks far more attractive now on a risk/reward basis than it has in many a year. US treasuries and gilts have seen yields increase and spreads on some fixed interest have widened. Yields may of course increase further.”

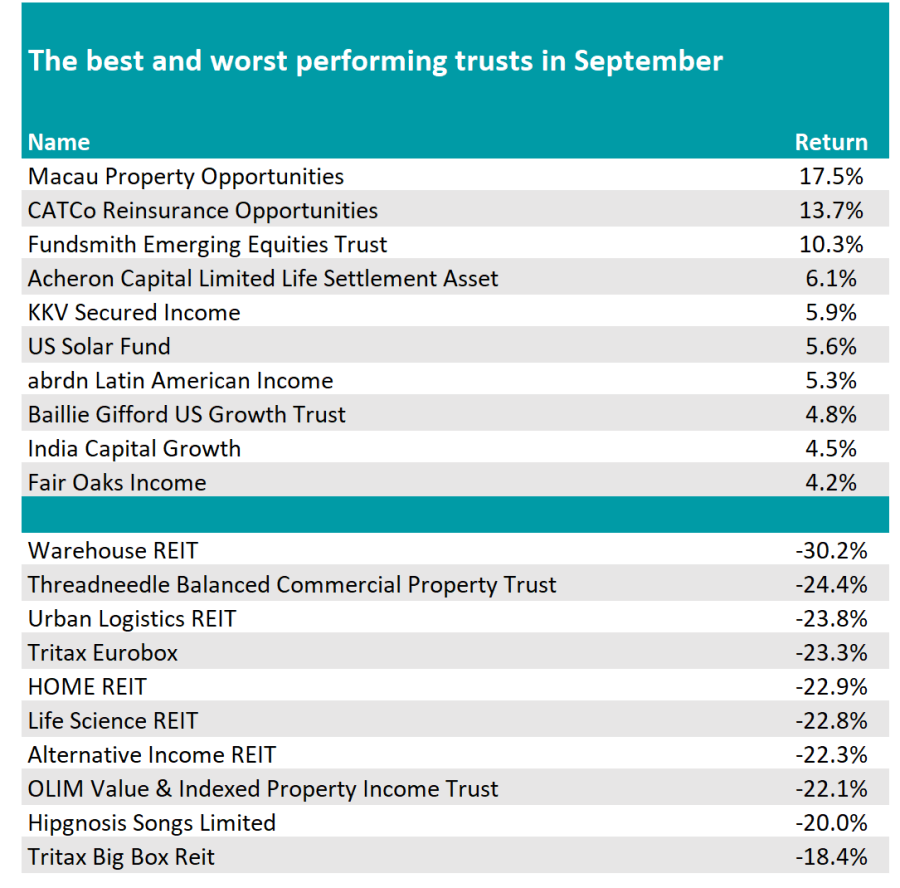

Turning to investment trusts, property trusts were hit hard during the month, with the IT Property UK Logistics (down 24.4%), Property Securities (18.1%), Property UK Commercial (14.7%) and Property UK Healthcare (13.9%) among the five worst sectors for the month. IT Royalties is the only non-property sector in the bottom five.

While trusts that invest in real assets (such as property) are thought to protect during times of inflation, rising gilt yields impact their relative yield and therefore make them less attractive to own, particularly if new projects are funded by debt rather than capital.

Real estate investment trusts dominated the worst performers in September, as the below table shows.

Source: FE Analytics

On the positive side, the IT Property Rest of World sector led the way, although it only has two trusts and one was up 17% while the other made a small loss.

Latin America and India trusts performed well as investors looked for investments away from the UK, with both continuing their upward trends of 2022.

Yearsley said: “The investment trust universe gave different outcomes to the open-ended world, due to the esoteric nature of many trusts.”

The Macau Property Opportunities was the best performing trust last month gaining 17%, closely followed by Catco Reinsurance which was up 13%.

Third place went to the soon-to-be wound-up Fundsmith Emerging Equities, which delivered a 10% return as the discount narrowed sharply.

“All isn’t shiny in trust world with a sharp widening of discounts in many areas with infrastructure and many of the newer specialist sectors and trusts particularly hard hit as the long-term discount rate increased on the back of rising yields, which results in falling values,” Yearsley noted.