Investing in emerging market (EM) debt is half as risky as buying US debt, according to a study by S&P Global, which showed that in the 40 years leading up to 2021, 24% of US high yield corporate debt loans resulted in defaults, compared with just 13% in emerging markets.

This may shock those accustomed to the consensus view that the US is a more secure market than emerging markets, but this could be used to investors’ advantage, according to Dimitry Griko, chief investment officer of Arkaim Advisors.

He said that investors tend to accept a lower yield for US debt believing it is safer, when they could actually make a higher return for less risk in overlooked emerging market opportunities.

“That difference in defaults is massive and at the same time you get paid for taking more risk, which is higher within emerging markets,” Griko added. “You’re basically getting paid more for taking less risk.”

Emerging markets do contain a higher volume of risky companies than developed markets, Griko admitted, but plenty of strong opportunities do exist – it’s a case of “picking out the bad apples that create that perception of risk” until you’re left with a portfolio that has “good downside protection and lower volatility than developed markets, especially the US”.

In fact, outperforming businesses in the emerging markets have to work harder to prove their credibility because there is an associated risk with the region, while US corporates benefit from a the country’s favourable reputation among international investors, according to Griko.

He said: “To get financing, EM corporates have to work harder and they have to be better just because of that perception that they are riskier.

“In order to get that financing, they have to be better and that means they have to have lower leverage and basically their credit metrics overall have to be better.”

However, Michael Davis, global high yield manager at Schroders, said the idea that US corporates defaults more often than those in the emerging markets was slightly misleading.

Back in 1981 when the S&P data starts, the high yield market was “a fraction of the size it is today” so it is not fully representative of what to expect now, according to Davis.

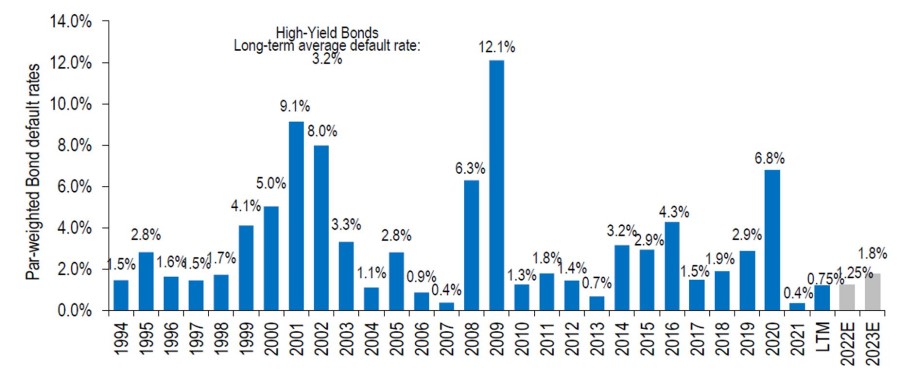

For example, most of the US defaults over the past 40 years happened in the 1980s and the average rate has dropped to 3.2% since 1994.

High yield bonds long-term average default rate since 1994

Source: Schroders

Likewise, many of the US names that defaulted since 1994 have been large companies, meaning a small part of the market held a lot of debt.

Davis said: “Large issuers have had an outsized impact on default rates when measured as a notional amount.”

Over the long-term, Davis added that many EM companies facing defaults have received financial support from government, which was not often the case in the US.

“Much of the EM high yield corporate market is quasi-sovereign/state-sponsored debt. When those companies get into trouble, the country steps in and infuses cash to prevent a default,” he said.

Griko agreed, stating that the strong government backing that emerging market companies can fall back on in times of hardship has helped keep default rates low.

He said: “Sometimes it can be bad depending on the jurisdiction, but there's often a lot of government support and that really helps.”

This might not be relied upon so much in regions with a significant amount of geopolitical risk this year, but this can be solved by screening out a few counties.

Griko said: “Default expectations are higher this year, even in emerging markets, but if you take away Ukraine, Russia and China, the default expectations are absolutely tiny – they’re around 3%.”

Similarly, US companies tend to borrow significantly more than emerging rivals, meaning it can be more difficult to pay back when times get tough.

Griko added: “The average corporate leverage of an EM pork company, for example, is around 30% lower than that of a US company. US companies are levered much more and I think that's quite a big reason for the higher defaults.”