Equity income funds managed by Artemis, Jupiter and Troy are among those that Hargreaves Lansdown thinks can offer investors an attractive combination of income and capital growth by investing in the home market.

The UK is regarded as a prime hunting ground for income investors thanks to a strong dividend culture and the fact that the bulk of payouts come from blue-chips that operate around the globe, meaning they aren't reliant on the UK economy. In fact, Hargreaves Lansdown labelled the UK “the world’s leading income market”.

Joseph Hill, senior investment analyst at Hargreaves Lansdown, said: “Dividends have long been a key element of the UK market, perhaps more so than any other. The FTSE All Share index, which is the broadest representation of the UK market, yields a healthy 4.11%.

“While this may not beat the current rate of inflation, over time investing in a dividend-paying company can mean your income and capital grows as the company grows.”

Below, Hill highlights four UK equity income funds that the investment platform thinks can generate a combination of income and growth over the long term.

Artemis Income

Hill’s first pick is the £4.2bn Artemis Income fund, noting that managers Adrian Frost, Nick Shenton and Andy Marsh have a combined seven decades of investment experience and have developed “a strong working partnership” at Artemis.

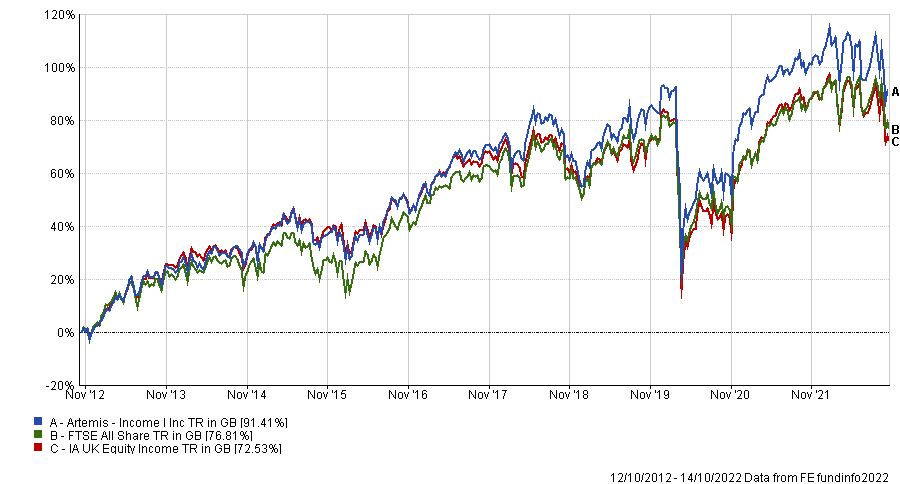

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

“They invest in businesses they think can pay a stable and sustainable level of income, through the market cycle and regardless of the economic backdrop,” he added. “We’re confident in the team’s ability to add value through stock selection over the long term. This more conventional UK equity income fund could work well alongside other asset classes in an income focused portfolio.”

Artemis Income’s underlying process focuses on free cash flow generation to identify companies that can reliably pay out a decent dividend. However, while there is an emphasis on income, the managers describe the fund as having a ‘total return’ approach as they also want to secure a degree of capital growth alongside income payouts.

Aviva Investors UK Listed Equity Income

Next up is the £888m Aviva Investors UK Listed Equity Income fund, which is headed by Chris Murphy and James Balfour. They run a blended portfolio of companies with some able to offer a high yield now and others capable of strong dividend growth in the future.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

“They look to invest in businesses that have a sustainable competitive advantage over their peers, which will enable them to continue to grow their dividends,” Hill said.

Murphy, who has managed the fund since 2009 and has three decades of investment experience, builds the portfolio with long-term total return in mind. He has a value bias when it comes to stock selection but will also invest in growth or recovery opportunities.

Jupiter Income

For his third equity income pick, Hill opted for a fund that has an approach unlike many other members of the IA UK Equity Income sector: the £1.4bn Jupiter Income fund.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

“Vastly experienced manager Ben Whitmore does something quite different from most other equity income managers. He invests in fundamentally good companies that are undervalued and out of favour with the market but capable of recovery,” the Hargreaves Lansdown analyst explained.

“This means there’s significant emphasis on balance sheet strength. The fund has a distinct value style bias and this contrarian approach means it can look quite different to the index.”

Trojan Income

The final fund pick for funds that could deliver a combination of income and growth is the £1.6bn Trojan Income fund, which is headed up by Troy Asset Management’s Blake Hutchins.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Like all of the funds run by Troy, capital preservation is at the heart of the fund’s approach and its portfolio is built from high quality, resilient companies that can generate a sustainable and growing income over the longer term, rather than those paying a high income today.

Hill said: “These businesses are often market leaders and dominant within their field. This more cautious approach could help to shield investors from the worst of market falls.”