Investors been spending more time in 2022 looking into defensive trusts such as Ruffer Investment Company and Personal Assets Trust as markets continue to sink, research activity on Trustnet suggests.

This has come at the expense of interest in growth stalwarts such as Scottish Mortgage, smaller companies and emerging markets, which have borne the brunt of this year’s inflation-fuelled market crash.

Few investors have been untouched by 2022’s market volatility, as headwinds such as persistently high inflation, interest rate hikes, the war in Ukraine, China’s zero-Covid policy and UK political uncertainty have caused almost all financial assets to tank.

To find out how investors are approaching investment trusts in this environment, we have analysed all the Trustnet pageviews in the Association of Investment Companies (AIC) universe to find out which are getting the most research over two periods: 2022 to date and all of 2021 (which serves as a baseline).

Of course, pageviews are in no way a judgement on a trust’s performance or quality, but they do represent millions of examples of research by individual investors and therefore offer a unique insight into what is catching their eyes and what isn’t.

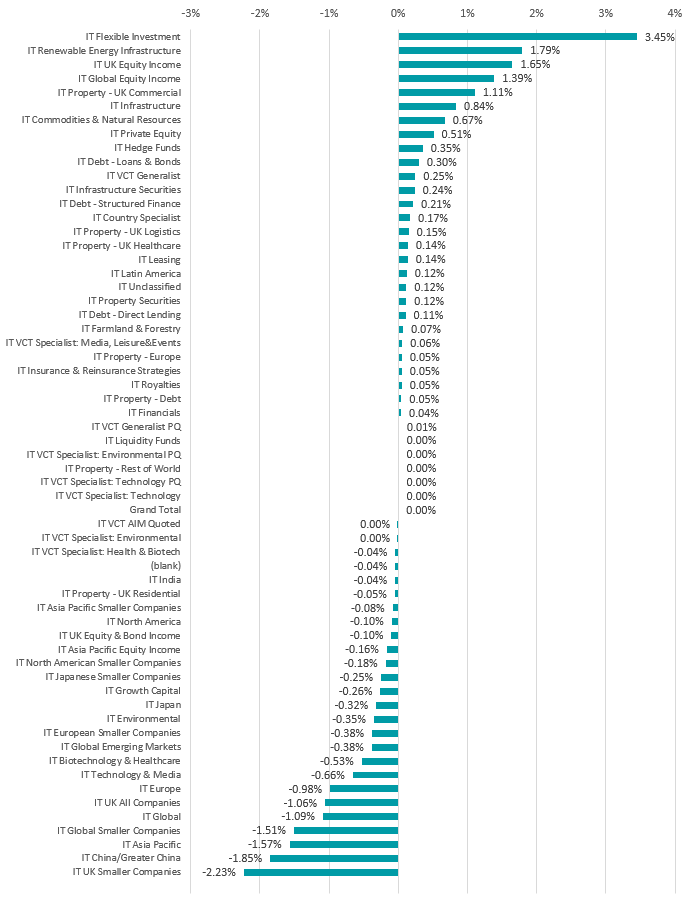

Source: Trustnet

The above chart shows the changes in pageviews between last year and this year, broken down by AIC sector. To do this, we looked at percentage share each sector had of overall pageviews in 2022 and compared with the 2021 baseline.

It’s clear there has been a big jump in interest in the IT Flexible Investment sector, which is home to mixed-asset trusts – many of which have a stated aim of protecting investors’ capital as their main priority.

The swing in research towards these trusts is far more pronounced than seen for any other sector, suggesting that investors are seeking out strategies that can stand up to continued market volatility.

Some other sectors have witnessed more research activity in 2022, however, including IT UK Equity Income, IT Global Equity Income, IT Infrastructure and IT Commodities & Natural Resources. The common theme among these sectors is they are seen as offering a way of hedging against inflation.

Conversely, there has been less interest in investment trust sectors that are built more around growth: IT UK Smaller Companies, IT Global Smaller Companies, IT Global and IT UK All Companies trusts are all being looked at less this year.

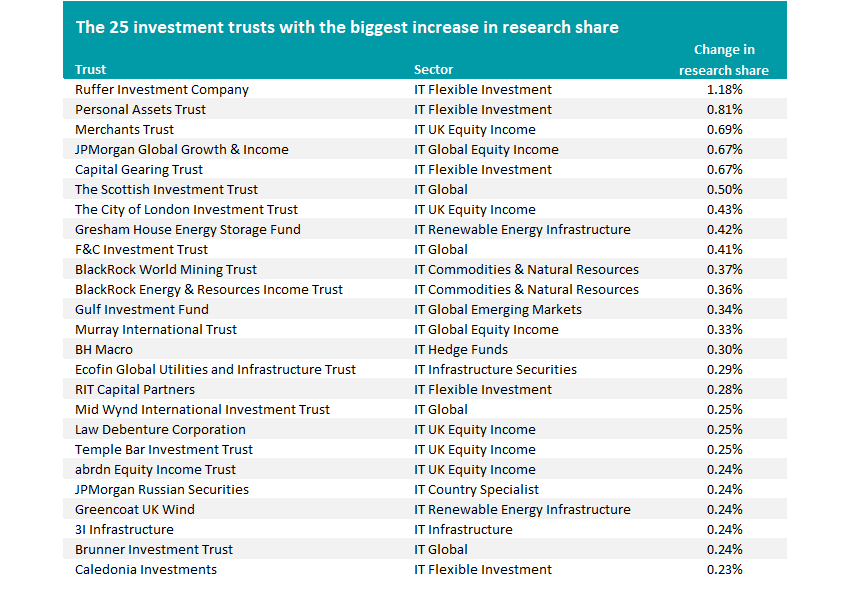

Source: Trustnet

The individual trust that has benefitted the most from a relative increase in attention is Ruffer Investment Company. It was responsible for 0.56% of Trustnet’s investment trust pageviews in 2021 but this has jumped to 1.73% in 2022; looked at another way, it has gone from being the 52nd most-viewed trust factsheet to the fourth.

This trust is well known for its defensive positioning – which is backed up by the fact that it has made 7.5% in 2022 so far, when losses have been widespread.

Analysts at Kepler Partners said: “Ruffer Investment Company is designed to be an all-weather solution for investors who want to grow their capital over the long term without suffering significant drawdowns.

“The portfolio is built around a core outlook which sees the world re-entering a period of structurally higher inflation and is designed to do well in such an environment, which would be poor for conventional bond and equity funds. However, the manager, Duncan MacInnes, draws on a variety of assets and exposures which should prosper in different environments in pursuit of generating steady returns in all markets.”

Personal Assets Trust, which is run by Troy Asset Management, a fund house known for putting capital preservation at the heart of its process, was already popular with Trustnet users as it accounted for 1.02% of trust pageview in 2021. But it grown its research share to 1.83% this year and become the third most popular trust.

Capital Gearing Trust, RIT Capital Partners and BH Macro are other trusts that have made names for themselves for their defensive approaches and have been getting more attention during 2022’s market turmoil.

Many of the other funds in the above table also fit in with the inflation-protection theme mentioned earlier, such as Merchants Trust, JPMorgan Global Growth & Income, City of London, BlackRock World Mining Trust, BlackRock Energy & Resources Income Trust and 3i Infrastructure.

Change in research share by AIC sector

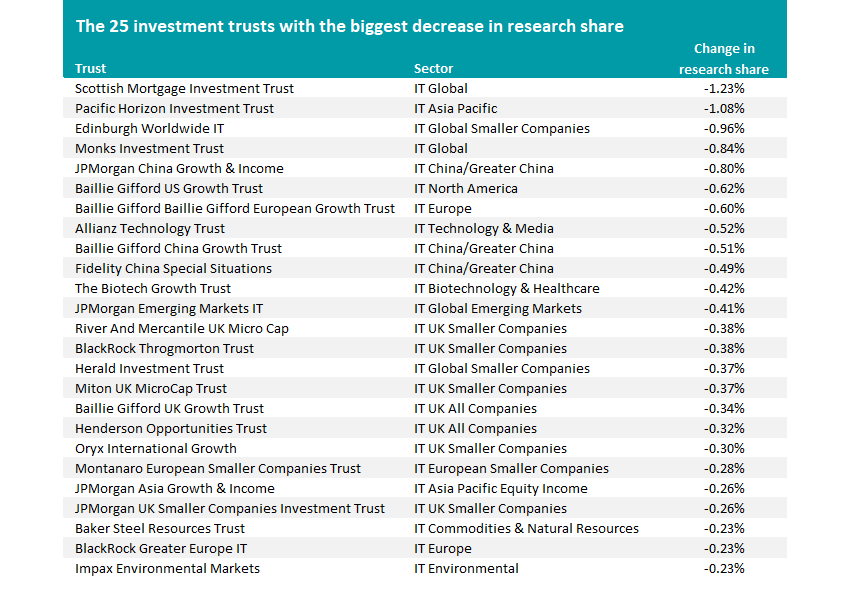

Source: Trustnet

When it comes to the trusts with the biggest decline in research activity, the list is topped by Scottish Mortgage. It is still the most researched trust on Trustnet but its share of overall pageviews has fallen from 8.05% in 2021 to 6.82% this year.

Scottish Mortgage has built up a very strong long-term track record after investing in disruptive growth companies, which enjoyed a decade-long bull run on the back of ultra-low interest rates. Over 10 years, the trust is up close to 480%.

However, it has lost 44.3% over 2022 to date after rising interest rates caused investors to flee from richly priced growth stocks, especially those in the tech space. Higher interest rates make investors less willing to hang on for the future cash flows of these businesses, instead preferring those that can pay out today, such as income stocks or companies in more cyclical industries.

Many of the other trusts on the above list fit into these theme as areas such as emerging markets, smaller companies and tech tend to be avoided by investors when they are in ‘risk-off’ mode.