Investors could be putting their long-term returns at risk if they insist on building their portfolios to match up with their predictions about what might happen next in markets, warns Quilter Cheviot investment manager David Henry.

Humans consistently overestimate their ability to predict the future and failing to take steps to protect against this can cause portfolios to react in unexpected and sometimes undesirable ways.

Henry gave the US presidential election in 2016 as an example. The consensus was that Democrat Hilary Clinton would win and a victory by Republican Donald Trump would be bad for markets; what actually happened was that Trump won and the market rallied 19% in 2017.

“Even if we are right about the outcome of a certain event therefore, it does not follow that ‘A equals B’. That is to say, that if ‘A’ happens we cannot in advance necessarily determine the market reaction,” he explained.

“To do so would rely on our ability to predict the reaction of hundreds of millions of market participants around the world to said news.”

Below, he offers five tips for investors who want to guard against useless predictions.

1. Most things don’t matter

Henry’s first “obvious” point is that the fewer predictions an investor makes then the less potential there is for them to be wrong. They should therefore avoid making as many predictions as possible.

Ultimately, the “vast majority of events simply don’t matter” to the long-term path of financial markets so making predictions is often a futile exercise that puts an investor in unnecessary risk of a mis-step.

“It may be difficult in a social media age, but none of us need to have an opinion on everything,” he said.

“Making too many predictions can have worse consequences than just tying you up in knots. As we have seen, market reactions to events can be completely counter-intuitive. If you are making big bets based on a certain outcome, you can be right on the event and wrong on the market reaction.”

2. Maintain a laser focus on the long term

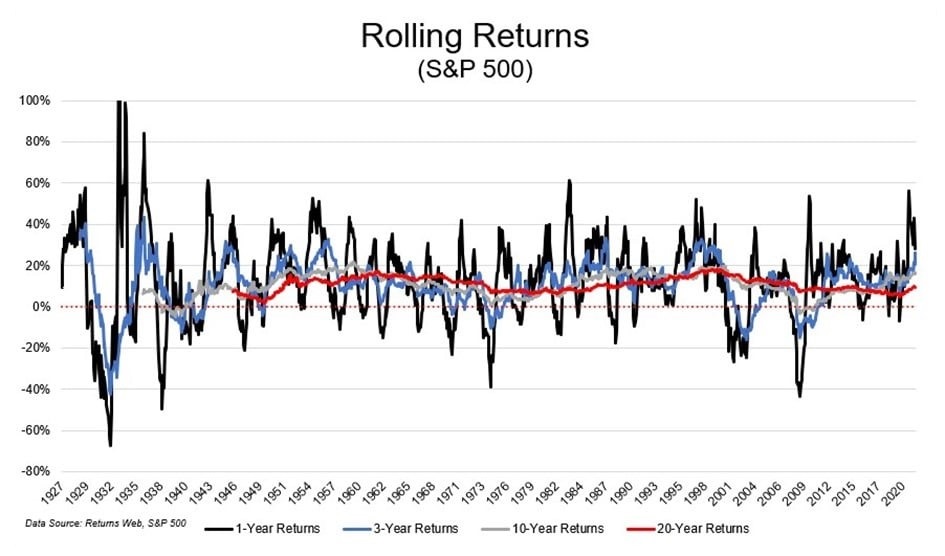

A look at the history of the stock market shows that the longer the time frame, the more predictable returns are.

For example, the returns of the market can vary widely when individual years are looked at but annualised returns over rolling 20-year periods are relatively consistent. This can be seen in the black line (one-year returns) versus the red line (20-year returns) in the chart below.

Source: Quilter Cheviot

“Being a genuinely long-term investor therefore has two potential benefits,” Henry added. “One, your likelihood of a positive outcome increases materially and, two, the predictability of annualised returns increases too.”

3. Diversify

The past year might not have been the best advertisement for diversification – stocks, bonds and most other financial assets have fallen in tandem – but Henry maintained that having a genuinely diversified portfolio is “the best way” to guard against inaccurate predictions.

This is because genuine diversification means an investor will add assets that they are not expecting to go up at the same time as the rest of their portfolio, with the benefit being that they might not go down at the same time if the market takes a turn for the worse.

“One of the most difficult elements of being a professional investor is that in order to embrace diversification, you will naturally have to add positions to your portfolios that you might not be all that positive on at any given time – maybe high quality short dated bonds, gold or commodities,” he explained.

“You need to be prepared to hedge your base case. If you don’t, you are placing all of your chips on one number.”

4. Be wary of narratives

Every good salesman knows that people buy stories and a passionate sales pitch can cause buyers to get swept up in a narrative. However, the Quilter Cheviot investment manager warned that buying into an asset solely on the basis of a story can be “a dangerous beast”.

“Without getting into a debate about the merits of cryptocurrency, one thing that fascinates me about the asset is how evangelical its investors can be,” he added.

“Without a proven utility (which may arrive one day), the buy case can only be constructed based on narratives about the future which may or may not come to pass. Narratives which are pushed hard by those who truly believe.”

5. Recognise when you are wrong and move on

No-one likes to be wrong but every investor needs to accept that sometimes their investment thesis won’t play out.

“It can be tempting to dig our metaphorical heels in and entrench our position further in our minds – but this can be ultimately unhelpful,” Henry said.

He recommended that investors set some rules in advance that force them to reassess their holdings in certain circumstances. Examples could be if a company has a change of management or if their shares fall by a certain amount.

“Making rules for ourselves in advance can lead to better decision making when emotions are high,” Henry finished.