Investors have sought an extra stream of revenue through equity income funds in 2022 as the cost-of-living crisis squeezes people’s spending budgets and the first port of call for many income seekers has been the Fidelity Global Dividend fund, which attracted a sector-topping £750m in fresh inflows over the past year.

New investors were likely attracted by its top-quartile performance since launching in 2012, with returns up 193.2% over the past decade.

However, now that £3.3bn of investors’ money is held in the fund, those building up their portfolios may wonder what else they can buy that will complement it.

Here, Trustnet asks fund pickers for the best portfolios to hold alongside Fidelity Global Dividend.

Total return of fund vs sector and benchmark since launch

.png)

Source: FE Analytics

The fund may have delivered a strong return over the long-term, but Ollie Rubinstein, investment analyst at City Asset Management, is cautious of equities in general in the current environment.

Stock markets could continue to be unpredictable in 2023, he argued, and investors may find safer income opportunities in bonds.

Rubinstein recommended pairing the Ninety One Global Total Return Credit fund alongside Fidelity Global Dividend, as it can provide a yield without the price volatility and pay-out risks when equity markets are down.

He said: “Although we may have seen peak inflation, in the US at least, central banks still have the opportunity to surprise markets, as do politicians across the globe.”

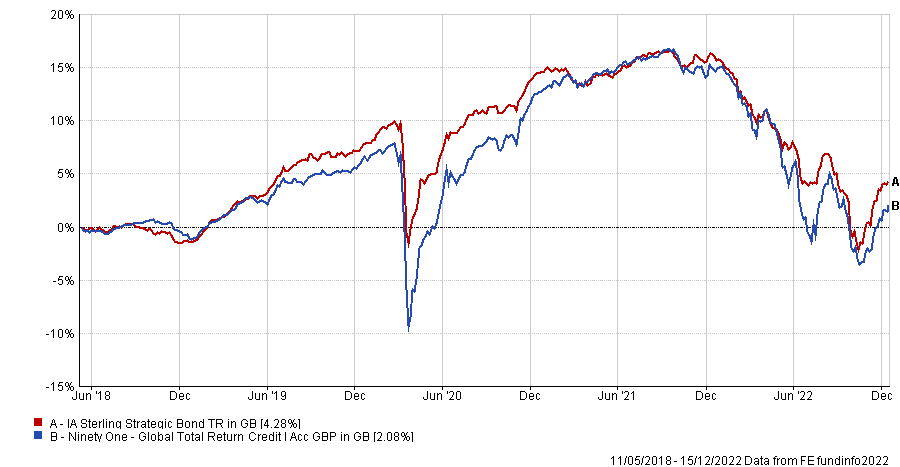

The fund is up 2.1% since it launched in 2018 (trailing 2.2 percentage points behind is sector) and its 4.6% yield offered investors a reasonably high pay-out.

Total return of fund vs sector since launch

Source: FE Analytics

It increased exposure to higher-quality investment grade credit after positive results in the third quarter made US high yield bonds more expensive, which has improved the fund’s yield, according to Rubinstein.

Indeed, the fund’s managers have shortened durations in recent months, which could “mitigate any potential base rate surprises”.

Rubinstein added: “A portfolio of fundamentally scrutinised debt offers makes for an attractive investment in this environment.”

Investors who want to stay with equities may want to consider the Jupiter Income Trust as a second dividend provider, according to Darius McDermott, managing director of Chelsea Financial Services.

While Fidelity Global Dividend’s yield of 2.8% is attractive, McDermott said that investors could benefit from also having exposure to Jupiter’s 4.1% yield.

The managers at Fidelity Global Dividend are sensitive to valuations and have built a portfolio of quality companies without overpaying. Jupiter Income Trust, on the other hand, has focused on high yielders, adding dividend giants such as BP, Shell and Imperial Brands among their top 16.1% of holdings.

Another difference is the geographic split. UK assets only make up 13.6% of Fidelity’s holdings whilst Jupiter invests purely in the FTSE All Share, so it could offer some regional diversification.

It is up 90.4% since launching in 2013, delivering a higher return and above average yield than its peers in the IA UK Equity Income sector over the period.

Total return of fund vs sector since launch

Source: FE Analytics

A third option for investors who want to broaden their portfolio with a more contrasting fund is the Kayne Anderson Renewable Infrastructure fund, suggested by Ben Faulkner, marketing and communications director at EQ Investors.

The driving themes behind its performance are completely different to that of Fidelity Global Dividend, so holding them together could capture more opportunities.

It gives investors exposure to the transition to net-zero, which was bolstered this year by energy shortages caused by the conflict in Ukraine.

Faulkner said: “This fund would sit well alongside a dividend-paying strategy as it benefits from different drivers and should perform well in an environment of higher inflation, and particularly of higher energy prices, thus offering the potential for capital appreciation.”