Investors who have been caught by surprise by the end of the cheap-money era should think carefully about diversification, according to analysts at Investec.

In the firm’s latest report on investment companies, analysts Alan Brierley and Ben Newell said the highly supportive macroeconomic backdrop and unprecedented actions by financial authorities which fuelled “spectacular” returns in the past 10 years are done and investors should adapt to a new regime of higher inflation and volatility paired with lower growth.

“In the fourth quartile of 2022, global equities rallied on hopes that inflation had peaked, the Fed would pivot, and we would swiftly see a return to the previous regime. We are not as sanguine and fear the next few months could be challenging,” the report read.

“While valuations have fallen from historically elevated levels, we do not believe an earnings recession is priced in, while an increase in quantitative tightening will further drain liquidity, and a sharp slowdown in the US housing market is bringing back painful memories.”

In the new regime, diversification will be key. In the US, traditional 60/40 portfolios experienced their worst year since 1937 in 2022 as equities and bonds fell in tandem, long-duration assets that had performed so strongly for more than a decade endured a brutal sell-off, and the crypto industry imploded.

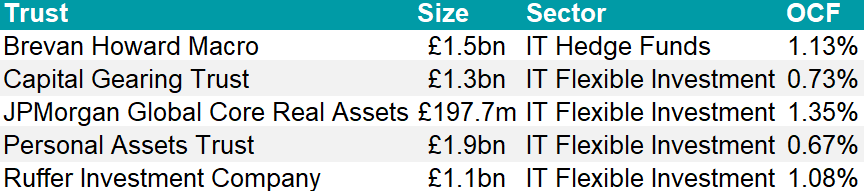

As we transition to the new era, Investec highlighted the strategic value of five investment companies, whose defensive characteristics had historically resulted in very low participations with falling equity markets, with many delivering absolute returns.

BH Macro

First up is BH Macro, a “unique” vehicle within the closed-end industry, with its key feature being an inverse correlation with global equities, which has tended to be most pronounced during times of peak distress.

As noted in the report, during the global financial crisis, when the MSCI ACWI lost 54.1%, BH Macro rose 43.9%, and during the peak-to-trough MSCI ACWI total return of -22.1% in 2022, it was up 20.8%, as shown in the graph below.

Performance of trust over 1yr against sector and MSCI ACWI index

Source: FE Analytics

“We believe BH Macro has a natural role to play in improving portfolio diversification. We expect ongoing headwinds within global financial markets to provide a fertile environment for the trust, and these fundamental attractions are enhanced by a premium that is trading towards the low end of the one-year trading range,” the analysts said.

Capital Gearing Trust

For the past 40 years, the trust has been managed by Peter Spiller, whose achievements have been “genuinely remarkable”, according to Brierley and Newell.

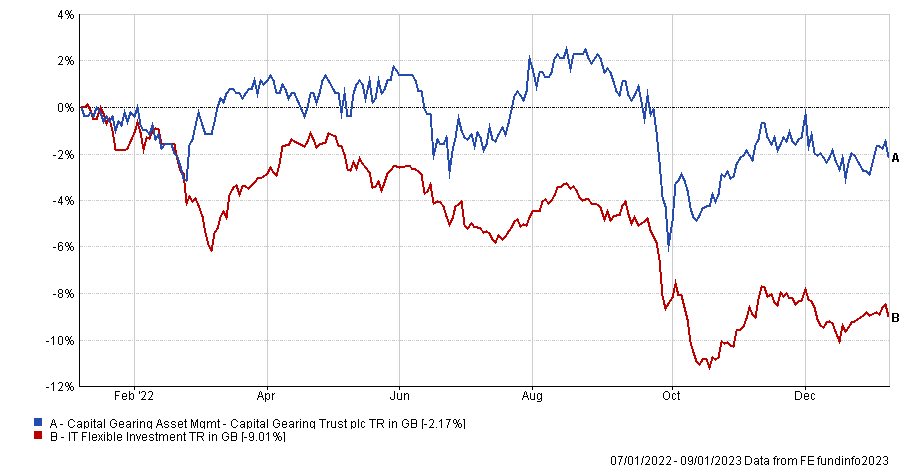

Performance of trust over 1yr against sector

Source: FE Analytics

During this period, the company has delivered absolute returns in 39 out of 40 financial years, while its market capitalisation has increased from less than £1m to £1bn, adding £250m since March 2022, and it has been promoted to the FTSE 250 index.

The manager believes that interest rate volatility, combined with a likely recession, could prove a headwind for equities, so the portfolio remains defensively positioned, with a focus on inflation protection and dry powder to invest when opportunities arise.

JPMorgan Global Core Real Assets

Another trust materially outperforming global equities was JPMorgan Global Core Real Assets, with a net asset value (NAV) total return in the year to 30 November 2022 at 12.6%.

Performance of trust over 1yr against sector

Source: FE Analytics

Sterling weakness has enhanced returns and fluctuations in the domestic currency have added a level of volatility. This was a strong tailwind through the end of September, but the recent recovery in sterling has been a drag on the headline NAV.

“The ‘Trussonomics’ circus ignited a sharp de-rating at the end of September and the discount has struggled to recover,” the Investec analysts said.

“However, the trust achieved a credible outcome in highly challenging circumstances and we continue to believe that this company has a role to play in improving portfolio diversification, with the discount enhancing underlying fundamentals.”

Personal Assets Trust

Despite losing 3.7% in 2022, the Personal Assets trust, which scores a FE fundinfo Crown rating of five, was still recommended by Investec.

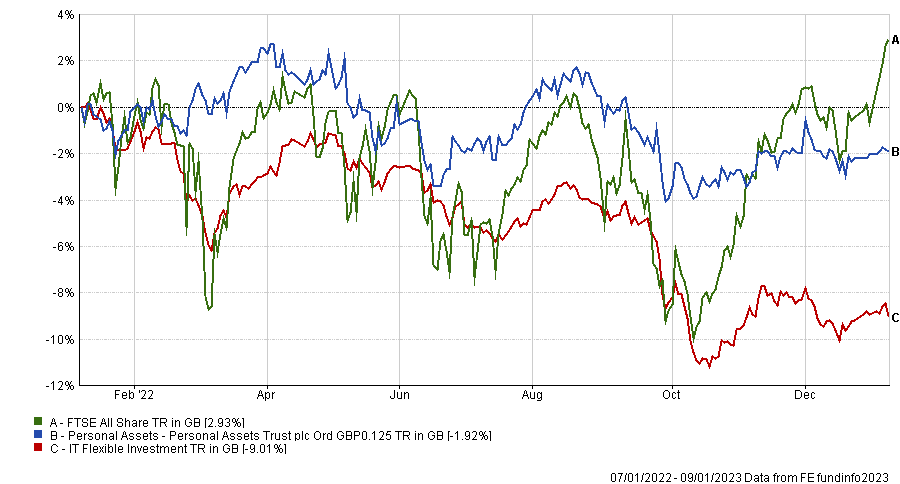

Performance of trust over 1yr against sector and index

Source: FE Analytics

Equity exposure was reduced in 2021 and cut further in last summer’s bear market rally, now reaching just 24%, the lowest level since 2008.

Global fixed income is therefore the main asset class, taking up 35% of the whole portfolio, while the top holding, at 9.4%, is the gold bullion.

FE fundinfo Alpha Manager Sebastian Lyon recently noted that “bear markets generally end with disinterest and revulsion, but the siren voices to buy the dips today remain strong”, concluding that this bear market has room to run.

Ruffer Investment Company

Another trust scoring five FE fundinfo crowns, Ruffer Investment Company outperformed its sector by 15 basis points in the past year, as illustrated below.

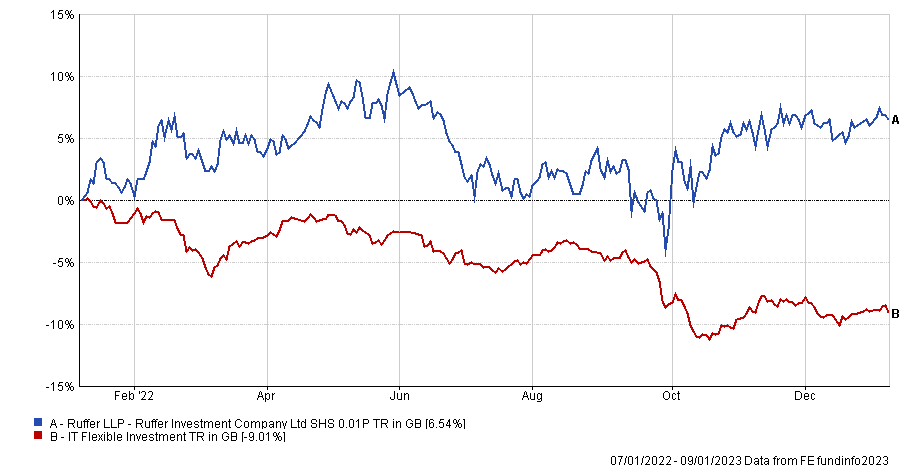

Performance of trust over 1yr against sector

Source: FE Analytics

The manager, Jonathan Ruffer, regards “plentiful liquidity” as “overwhelmingly attractive” in this environment, as it will allow the company to make the most of opportunities in the aftermath of a crisis.

A key differentiating factor is the willingness to use derivatives to enhance returns, which was “clearly demonstrated” in 2022 by a NAV total return of 7.9%, according to the Brierley and Newell, while the illiquid strategies and options basket, which includes less conventional protective assets and has a current weighting of 18.2%, made an important contribution in the year.

Ruffer described these as “tungsten-tipped instruments for extreme danger”, and the analysts said they give the manager added portfolio flexibility, particularly with the active management of duration risk.