Premier Miton Optimum Income is the most consistent IA UK Equity Income fund of the past decade, beating the FTSE All Share, the most common benchmark in the sector, in seven of the past 10 years and its peer group average in eight.

However, it underperformed both measures on a cumulative basis over this time.

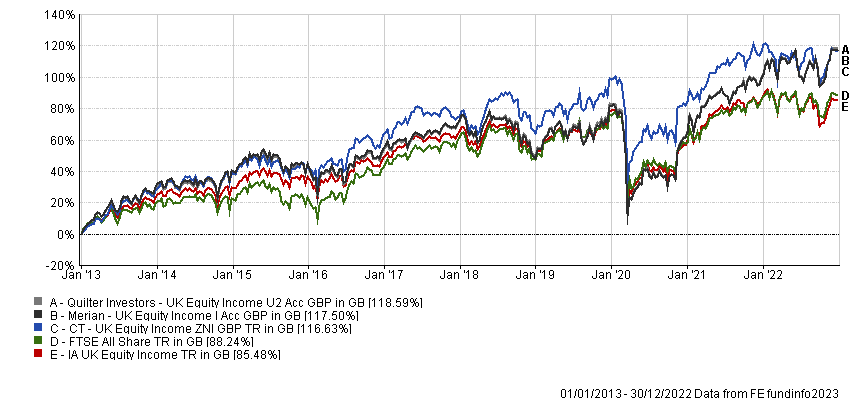

Of the 65 funds with a track record long enough to be included in the study, another three – Quilter Investors UK Equity Income, Merian UK Equity Income and CT UK Equity Income – beat both measures in seven of the past 10 years.

Performance of funds vs sector and index

Source: FE Analytics

Premier Miton Optimum Income aims to provide a yield of 7% per annum together with the prospect of capital growth over periods of at least five years. To deliver on this pledge, it sells covered call options.

Emma Mogford, who runs the fund alongside Geoff Kirk, said this characteristic helped the fund hold up in the volatility of the past few years – it beat its sector and benchmark in 2020, 2021 and 2022 – as the option premium delivered a positive return when markets fell.

She added that since she joined the fund two years ago, performance has benefited from overweights in sectors that are relatively immune to inflation such as tobacco and defence.

These cancelled out the fund’s underweight position in energy, the best-performing area of the FTSE All Share in the past two years, where Mogford said she had concerns about the impact of slowing oil demand over the fund’s five-year investment horizon.

Over the whole decade in question, however, Premier Miton Optimum Income made 74%, compared with gains of 88.2% from the FTSE All Share and 85.5% from its peer group composite.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Again, this can be attributed to its sale of covered call options, which give the holder the right but not the obligation to buy securities at a pre-determined price – effectively meaning the seller, in this case Premier Miton Optimum Income, gives up any gains made by its holdings above a certain level, restricting returns in a rally.

The £95m fund is yielding 7.1% and has ongoing charges of 0.98%.

The other three funds mentioned above all made higher total returns than Premier Miton Optimum Income over the 10-year period.

Top of the list was Quilter Investors UK Equity Income, with gains of 118.6%, followed by Merian UK Equity Income, with gains of 117.5%.

Merian UK Equity Income aims to deliver an income greater than the yield of the FTSE All Share and a total return greater than that of the IA UK Equity Income sector over rolling three-year periods.

Again, it has done better in the recent past, which can be partly attributed to its overweight position in energy – it had 13.9% of its portfolio in this area at the end of November, compared with 11.2% from the FTSE All Share.

Quilter Investors UK Equity Income is run by Merian, which helps to explain why it has a perfect correlation with Merian UK Equity Income over the 10-year period. The Quilter fund’s slight outperformance can be attributed to lower ongoing charges: 0.65% compared with 0.9%.

The £117m Quilter Investors UK Equity Income fund is yielding 4.3%. Merian UK Equity Income has £60.6m in assets under management and is yielding 4.9%.

Performance of funds vs sector and index over 10yrs

Source: FE Analytics

CT UK Equity Income made 116.6% over the period in question. All of these gains came under the tenure of former manager Richard Colwell, who recently retired. While this led some fund buyers to suspend or drop the fund from their best-buy lists, incoming manager Jeremy Smith claimed he is the “continuity ticket”. He worked with Colwell for close to two decades and has pledged to run the fund with the same contrarian approach to picking dividend-paying companies.

“The fund has been constructed by a large team of people, all of whom are still in place, and the technical input is continuing with the same personnel,” he previously told Trustnet.

“I have worked with Richard for 17 of the past 27 years. It is not as though I have come in from the outside and there is a style reset.

“The fund will however evolve over time and it is an important period to be on the front foot as the market leadership changes.”

The £3.9bn CT UK Equity Income fund is yielding 3.6% and has ongoing charges of 0.82%.