Investors can be charged a performance fee on top of other ongoing payments when returns exceed a target hurdle with some trusts. Many argue that these fees are flawed, but they shouldn’t necessarily deter investors from buying if the trust itself is strong.

Here, Trustnet looks at which alternative trusts are worth buying despite their performance fees, and which they should steer clear of (table can be found at the bottom of the page). Previously, we looked at every equity trust charging a performance fee and asked fund pickers which ones are worth keeping an eye on.

Victoria Hasler, head of fund research at EQ Investors, chose the Schroder BSC Social Impact trust as one alternative trust worth looking into. The £77m environmental, social and governance (ESG) portfolio invests in assets that have a positive social impact.

It is down 10.3% since launching in late 2020, but it’s exposure to tricky private market assets with complex fund structures and high minimum investment sizes makes it an interesting option for those wanting to allocate to alternatives, according to Hasler.

She said: “Whilst fees look high compared to some other investment trusts, in this case we believe that the fund offers good value for money given the unique asset mix, the extremely high quality of both the managers of the trust and the underlying funds and the access that it gives impact investors to assets which they may otherwise be unable to access.”

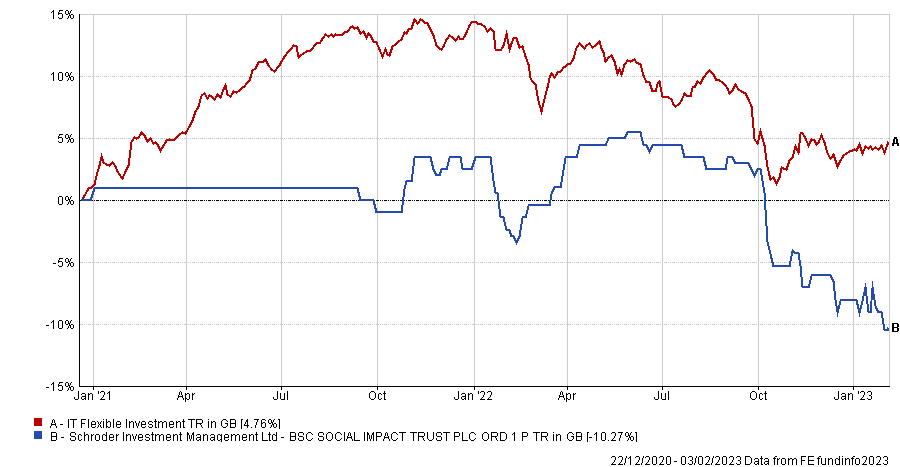

Total return of trust vs sector since launch

Source: FE Analytics

Another option according to FundCalibre research director Juliet Schooling Latter is the TR Property trust. Marcus Phayre-Mudge has been managing the £1.1bn portfolio since 2004 and she said that his expertise in the property sector is one of the main appeals of the trust.

It has made 167.8% over the past decade but fell 18.9% in the past three years, although its bumpy performance shouldn’t be an issue over the long term, according to Schooling Latter.

She said: “The trust’s share price tends to be volatile, but this volatility has been well rewarded by the returns achieved over the long term.” Indeed, she pointed out that investors could use this recent negative performance to buy the fund at a 10% discount.

Total return of trust vs benchmark over the past decade

Source: FE Analytics

Conversely, although Macau Property Opportunities is on an even steeper discount – with shares of the trust selling 64.5% below its net asset value – Schooling Latter said that this sharp discount is not enough to reassure her concerns around the trust’s exposure to the Chinese property sector.

She said: “This has nothing to do with the management, just timing. Clearly there are major concerns in China, but with such a significant discount, the question is how much is already in the price and the long-term impact this has on Macau’s high-end residential property market.”

Returns dropped a sizable 53.5% over the past three years, dragging its 10-year record down to a 57% loss.

Total return of trust vs sector over the past 10 years

Source: FE Analytics

Jason Hollands, managing director of Bestinvest, agreed that Macau Property Opportunities was the riskiest choice on the list, even if the removal of China’s zero-Covid measures provides a short-term tailwind.

He said: “The Chinese property market has been through a torrid time with the strict enforcement of Covid lockdowns until recently and so, while the recent dropping of these restrictions and reopening of the Chinese economy should help, the Chinese property market is fragile.

“Above all, the reason why I would be wary of this trust is that the approach is too risky with a niche strategy, lack of diversification and a high level of gearing.”

Instead, Hollands said RIT Capital Partners would be his vehicle of choice for alternatives exposure. The £3.2bn fund was up 105.1% over the past 10 years, climbing 51.8 percentage points ahead of its peers in the IT Flexible Investment sector.

However, returns slumped 20.2% over the past year, bringing the share price down to a 16.7% discount.

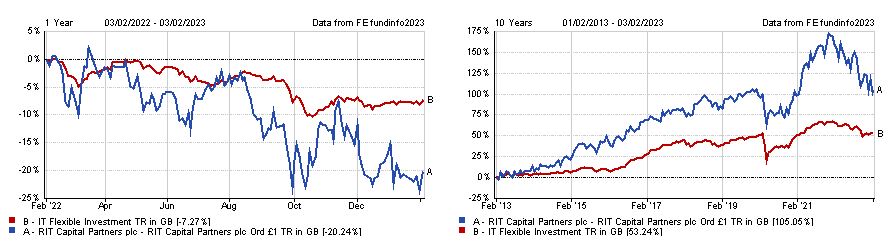

Total return of trust vs sector over the past year and past decade

Source: FE Analytics

Hollands said RIT Capital Partners’ multi-asset investment approach, which provides the portfolio with a broad mixture of quoted equities, is one that should attract cautious investors.

He added: “In essence, RIT gives investors a portfolio that is not unlike what a very wealthy individual might receive through a family office arrangement.”

Indeed, it was also the trust of choice for Andy Merricks, fund manager at 8AM Global, who said that he liked the portfolio’s “longevity and diversification”.

Nevertheless, Merricks said that he often avoids alternatives as an asset class due to their illiquid nature.

“Too often in the past we’ve seen people locked into an investment they can’t get out of,” he said. “Personally I don’t think it’s worth taking an unnecessary risk on liquidity when investing in ‘vanilla’ equity or bond funds is risky enough.”

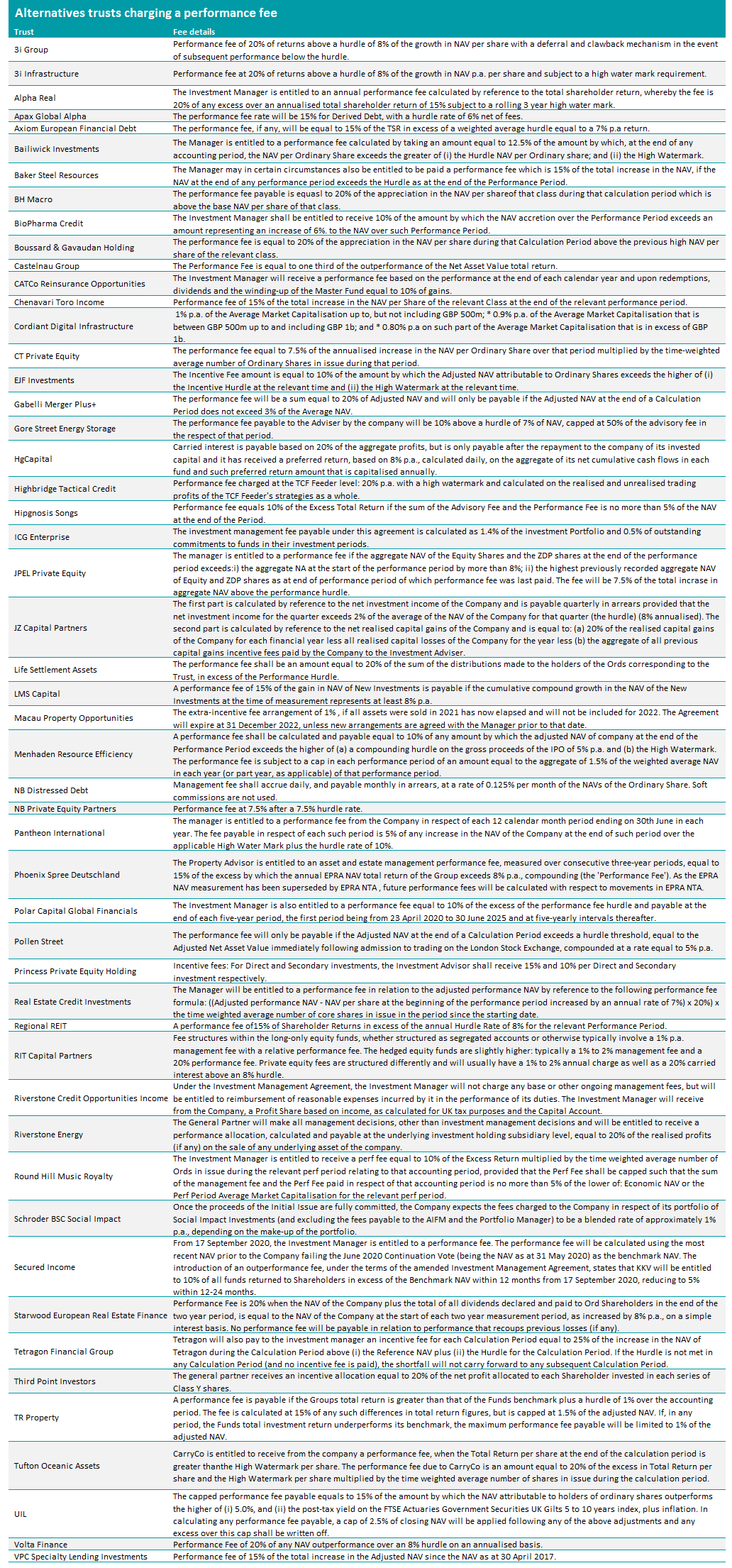

Source: AIC