Eight fund managers have kept hold of their FE fundinfo Alpha Manager rating since the accolade was first introduced 15 years ago, despite a swathe of changes to the list over the past year, according to data from FE fundinfo.

The Alpha Manager ratings are based on the performance of a fund manager over their career, including all of the funds they have managed and firms they have worked for. The awards recognise the fund managers who have consistently performed well over the longer term.

Achieving the rating is no easy task, but keeping it for a decade and a half is an even more impressive feat that few managers have achieved.

UK fund managers dominated the list of consistent Alpha Managers, with Mark Slater, manager of the Slater Growth, Slater Income and Slater Recovery funds joined by Fidelity’s Leigh Himsworth, who runs the firm’s Fidelity UK Opportunities fund.

In the UK smaller companies sector, Jupiter manager Daniel Nickols also made the list, having run money in this area since 2004. He was joined by stablemate John Chatfeild-Roberts who is the lead of the Jupiter Merlin multi-asset team.

David Dudding was the only fund manager running money in the IA Global sector to achieve the feat. He has managed a wide range of portfolios during his career at the firm and has overseen the CT Global Focus fund since 2018.

In Asia, prolific First Sentier manager Martin Lau makes the list. Lau is listed as a co-manager on 13 portfolios including FSSA Greater China Growth and FSSA China Growth, which he has run since 2002.

CRUX manager Richard Pease is the only European fund manager to hold an Alpha Manager rating in each of the past 15 years. The manager of the TM CRUX European and TM CRUX European Special Situations funds – which he has run since 2015 and 2009 respectively – has more than doubled the average return from his peer group composite over his career, as the below chart shows.

Total return of manager vs peer group over his career to last month end

Source: FE Analytics

Finally, M&G’s Richard Woolnough, who is best known for the M&G Optimal Income portfolio, is the only bond specialist to achieve the feat.

He has been co-manager of M&G Corporate Bond and M&G Strategic Corporate Bond since 2004, while he has been at the helm of the Optimal Income fund since 2006.

The rankings, which are given to the top 10% of UK retail-facing managers based on their entire career performance, have changed dramatically over the past 12 months as markets moved violently in 2022.

Many managers that had enjoyed strong returns during the bull run of the 2010s were caught out by the sudden shift towards value stocks.

In the latest rebalance, 28 new managers joined the Alpha Manager list for the first time, including Man GLG’s Jonathan Golan, Allianz’s Stuart Winchester and Premier Miton’s Matthew Tillett.

There were a further 17 managers who regained the rating, including Crispin Odey, Argonaut’s Barry Norris and JO Hambro managers Alex Savvides and Ben Leyland.

Charles Younes, research manager at FE fundinfo, said: “Alpha Manager ratings are a succinct assessment of a fund manager’s long-term track record. The ratings remain sensitive to market rotation, especially with the extreme moves we experienced in 2022. I’m glad that many newly made Alpha Managers stuck to their valuation disciplines and got rewarded for them over the past 12 months with their investment approaches.

“Looking at the list of newly rated Alpha Managers, fund houses like Man GLG and Royal London have proven their capacity to recruit well and integrate their new employees into their various investment styles which, in turn, provides them with the healthy environment for their managers to perform and achieve Alpha Manager status.”

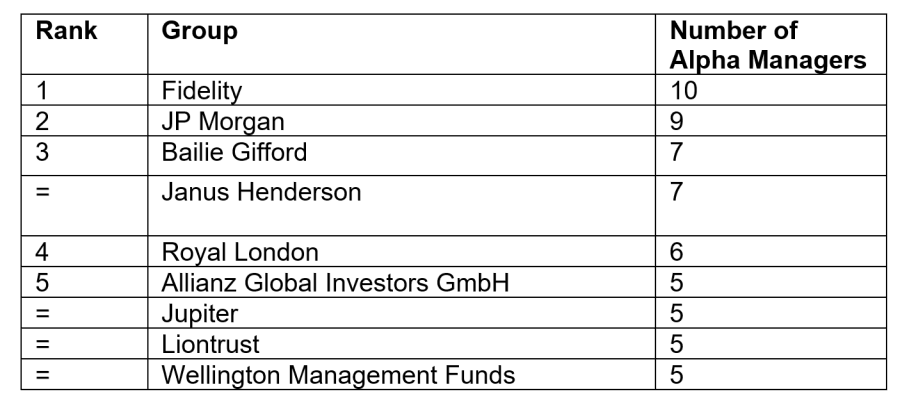

Overall, Fidelity has the most Alpha Managers, with 10 making the grade, while last year’s winner Baillie Gifford has seven, dropping it down to third place after a year in which the firm’s growth style of investing came under pressure from rising interest rates and higher inflation. JP Morgan was in second, with nine Alpha Managers.

Firms with the most Alpha Managers

Source: FE fundinfo