The prospect of monetary loosening could provide a significant tailwind for some funds that suffered last year when sharp interest rate hikes were introduced by central banks to combat inflation.

Optimism that interest rates are nearing a peak in the UK was a main driver for the rally in FTSE 100 companies at the start of the year, according got Ben Laidler, global markets strategist at eToro, and that sentiment could translate to other global equities once inflation appears more under control.

Laidler said: “The more benign outlook for inflation and rates is giving investors greater confidence to explore opportunities in the UK market, which is why we have seen domestic shares perform better than they usually would at this time of year.”

Here, Trustnet asks industry experts which funds they expect to benefit from falling interest rates later this year.

Andy Merricks, fund manager at 8AM Global, said that he expects IA UK Smaller Companies to take advantage of unwinding monetary policy the most.

Funds invested in UK small caps were some of the most vulnerable to rate hikes, with the sector dropping 9.1% last year, so a change in the Bank of England’s policy could boost returns considerably.

Investors should consider allocating to the sector this ISA season, as long as they are prepared for some further volatility in the short-term, according to Merricks.

He said: “I think that smaller companies, over time, will give you a better return than large-caps, but they do go through quite difficult periods and rising interest rates are probably their worst enemy.

“They’ll be a few casualties but they're more likely to come out on the other end in a healthier standard. Tentatively, I'd start dipping in now for the better times ahead.”

Merricks’ preferred fund in the sector is VT Downing Unique Opportunities, mostly due to the skill of its manager, Rosemary Banyard.

The fund is up 47.5% since the FE fundinfo Alpha manager launched the portfolio in March 2020, yet this fell 14.9 points short of the peer group average over the period.

Total return of fund vs sector since fund launch

Source: FE Analytics

However, Merricks pointed out that Banyard joined Downing just as Covid struck the UK, leading to a difficult first few years for the fund.

He said: “She’s got an excellent record that you wouldn't necessarily pick up from the fund’s figures because she joined at the start of a really horrible time to be a UK smaller companies manager.”

Banyard previously managed the Schroder UK Mid Cap trust and Schroder UK Smaller Companies fund before moving to head up the CFP SDL Free Spirit fund. Since 2000 she has made a total return across all of her portfolios of 734.5%, beating a peer group composite by 313 percentage points.

Investors wanting exposure to the rebound of other depressed sectors may want to look at technology funds, according to Shavar Halberstadt, equity research analyst at Winterflood.

The IA Technology and Technology Innovations sector has been the best performing Investment Association group over the past decade, climbing an impressive 492.5%.

A prolonged period of low interest rates and on-target inflation boosted the performance of tech companies over the past 10 years, but monetary tightening pushed returns down 27.5% in 2022.

Halberstadt: “Growth stocks have been particularly hard hit by the tightening of financial conditions, compounding the shift of investor sentiment towards cyclicals in the wake of a post-pandemic reopening.

“Falling interest rates would benefit growth stocks in general, and the technology sector in particular, as valuations are driven by the discounting of distant cashflows.”

Investors wanting to allocate towards the sector may want to consider the Allianz Technology trust, according to Halberstadt, who said it was his “favoured vehicle to access the technology sector”.

The £906m portfolio is up 508.3% over the past 10 years, beating its peers in the IT Technology and Media sector by 127.1 percentage points.

Total return of trust vs sector over the past decade

Source: FE Analytics

Walter Price managed the fund for almost 15 years before Mike Seidenberg took over last year, but Halberstadt said that his “deep expertise” in the sector makes him “well-positioned to deliver”.

Indeed, deratings across technology stocks have allowed the trust to invest in new opportunities that otherwise would have been overvalued, according to Halberstadt.

He said: “The team has become more valuation-focused as the technology sell-off has been relatively indiscriminate and companies with high earnings growth potential are expected to eventually see the dual benefit of a re-rating and strong cash flows.”

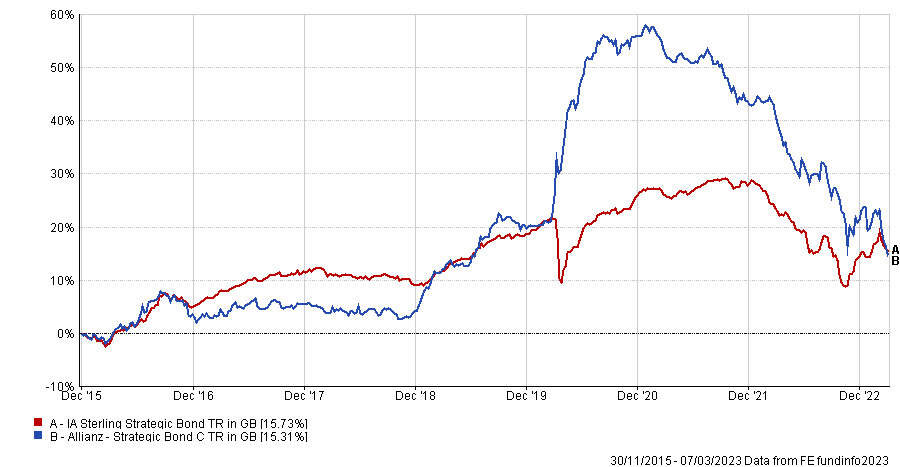

Another fund managed by the same firm – Allianz Strategic Bond – is also likely to receive a significant tailwind from declining interest rates this year, according to James Yardley, senior research analyst at Chelsea Financial Services.

The £2.1bn fund is up 15.3% since Mike Riddell took over in late 2015, narrowly underperforming the IA Sterling Strategic Bond sector, but Yardley said that returns could be in for a rebound.

He said that the fund’s view is that markets are “massively overpricing” how high interest rates will go, adding that “for every 1% fall in interest rates you can expect a 10% increase in capital” this year.

Total return of fund vs sector since Riddell became manager

Source: FE Analytics

There is a lag of around 12 months before rate hikes hit the economy, so those invested in the fund could see a shift in returns over the coming months, according to Yardley.

He said: “Riddell is expecting growth to slow quickly later this year. As a result, he expects the market to start pricing in further interest rate cuts and his fund should benefit as a result.”

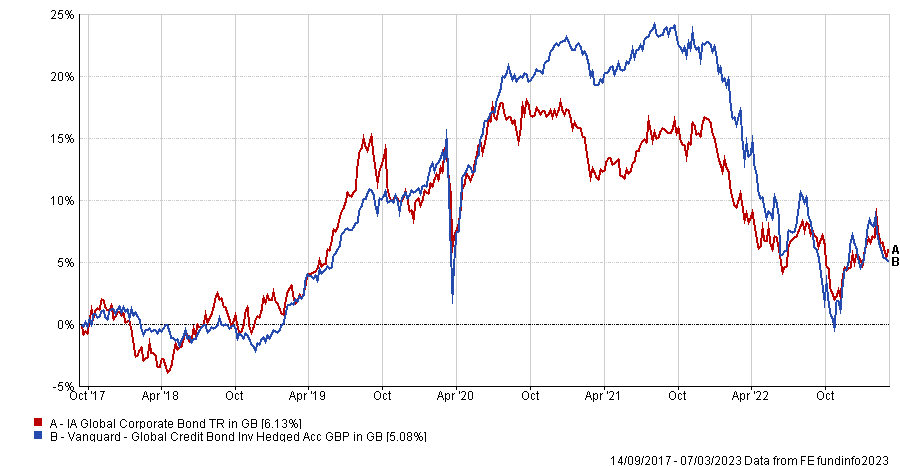

Ben Johnson, analyst at Charles Stanley, said that the Vanguard Global Credit Bond fund is another “obvious beneficiary of falling interest rates” in the fixed income space.

The $737m (£623m) fund is up 5.1% since launching in 2017, but returns were 1.1 percentage points below the rest of the IA Global Corporate Bond sector over the period.

Total return of fund vs sector since launch

Source: FE Analytics

It has underperformed over its lifetime but Johnson said that wider market volatility detracted from otherwise good credit selection.

He added that the fund doesn’t take big bets on relative duration versus its benchmark, so performance is highly influenced by rate moves. This could spell a strong recovery once central banks unwind monetary policy.

“The team have done a great job in terms of this credit selection, but this good work was undermined by the historic move in rates last year, which hurt all investment grade strategies that don’t run a short duration bias,” Johnson said.

“A more stable or even a falling rates environment would provide a supportive backdrop for the fund, with the team’s skill at credit selection and ability to navigate the credit cycle potentially providing a kicker to returns.”

| Name | Sector | OCF | Fund Manager |

| Allianz Technology Trust | IT Technology & Media | 0.8% | Michael Seidenberg |

| Allianz Strategic Bond | IA Sterling Strategic Bond | 0.66% | Mike Riddell, Joe Pak, Ravin Seeneevassen |

| Vanguard Global Credit Bond | IA Global Corporate Bond | 0.35% | Vanguard Fixed Income Group |

| VT Downing Unique Opportunities | IA UK All Companies | 0.88% | Rosemary Banyard |