RIT Capital Partners is one of the largest most popular trusts in the IT Flexible Investment sector that analysts have been recommending since the beginning of the year.

In January, it featured in Numis’ list of equity trusts worth buying at their discounts (currently at 21%) and at the end of February, Winterflood researchers said that “there are several interesting dynamics at play in the underlying portfolio”, mostly due to the range of asset class exposures in areas that "remain attractive to long-term investors”.

“Furthermore, the managers justifiably point out that the fund has yet to produce a negative return over any 3-year period since its launch in 1988,” they said.

But not everyone is a fan of the investment company with close to £3bn of assets under management.

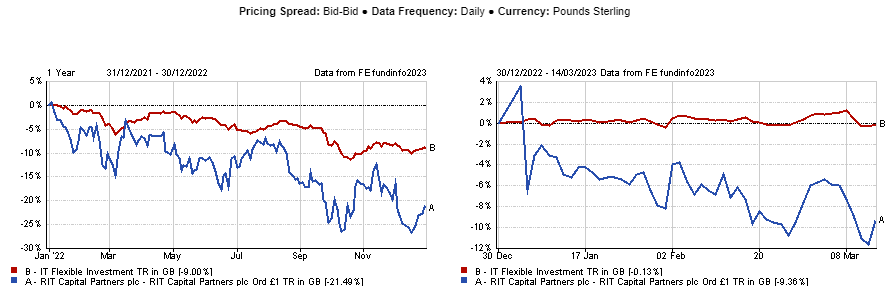

One notable critic was the Telegraph’s Questor column, which gave it a ‘sell’ note at the beginning of the year due to its tilt to venture capital. Additionally, the trust has had a difficult run since 2022, underperforming its IT Flexible Investment sector by 12.5 percentage points and falling short of closing the gap with its peers over the year to date, as the chart below illustrates. This, for some, adds reasons to think that the large discount might be justified.

Below, three experts discuss RIT Capital and explore other investment opportunities that might do well when combined with it.

Performance of fund against sector in 2022 and over the year to date

Source: FE Analytics

Ewan Lovett-Turner, head of the investment companies research team at Numis, said this remains an “attractive time to buy RIT Capital, as it offers exposure to an attractive range of assets that is difficult to replicate, sourced through the managers’ network with specialist asset managers”.

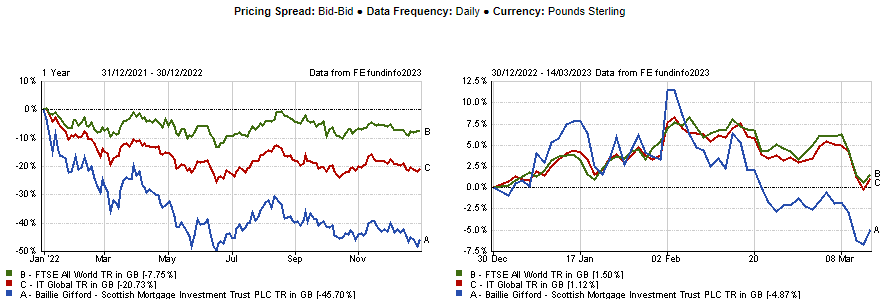

Should investors want to couple it with a trust that is doing something different, he suggested a more growth-focused vehicle such as Tom Slater’s Scottish Mortgage. The trust plummeted in 2022 but was able to recover a lot of what it had lost in the new year, as the graph below shows. It currently trades on a 16% discount.

Performance of fund against sector in 2022 and over the year to date

Source: FE Analytics

For someone looking for mandates that are highly defensive or focused on capital protection, Lovett-Turner highlighted Capital Gearing or Personal Asset as other alternatives.

The former, a £1.2bn trust with a five-crown rating from FE fundinfo, returned 4% over two years against a 1% loss from its average peer. Currently, it has 40% weighting to UK corporate fixed interest and 29% globally, while 30.5% is in equities and 1.8% in cash.

The latter, managed by Sebastian Lyon at Troy Asset Management, has even less in equities (23%). Instead, he has 35% in US Treasury inflation-protected securities, 24% in short-dated bonds, 11% in gold and 7% in cash.

This strategy was also picked by Jason Hollands, managing director at Bestinvest.

“While RIT Capital looks to temper volatility through holdings in hedge funds, absolute return strategies and private companies, the Personal Assets trust is less exotic in nature, focusing on listed equities, inflation-linked bonds, gold and short-term bonds,” he said.

“The approach is more conservative than RIT Capital and the portfolio is currently very defensively positioned reflecting the view of the team that the environment remains risky. This strategy won’t shoot the lights out in a bull market, but it does have a track record of downside protection.”

Hollands also remarked that most of RIT Capital Partners’ high exposure to unquoted companies (through both commitments to private equity funds and direct holdings) is in “relatively mature businesses” rather than early-stage venture capital.

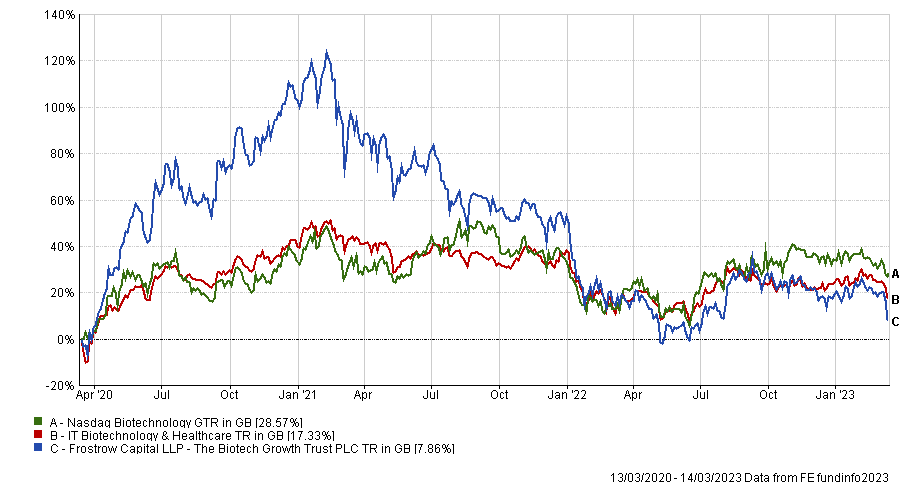

This wasn’t enough to convince Andy Merricks, fund manager at 8AM global, who said he’s “not a fan of private equity” and preferred to look elsewhere entirely. For those that wanted to look at a trust that had fallen to a big discount and was now attractively valued – one of the reasons an investor may look at RIT Capital – his pick was the Biotech Growth trust.

Performance of fund over 2yr against sector and index

Source: FE Analytics

“Given the longer-term potential for biotech development and the apparent injection in urgency to deliver solutions to a whole range of diseases and ailments in recent months, this is an attractive entry point in a sector that is not going away in terms of need any time soon. And I like investing in what the world needs,” he said.

Its discount is just under 10% and, having soared after the pandemic, “it’s given back all those gains to be sitting slightly down on its pre-pandemic price, which makes little sense to me”.