Europe has had a renaissance in 2023 on the back of positive economic data, including news that the region is likely to escape recession this year despite rate rises from the European Central Bank and the prevention of a widely expected energy crisis.

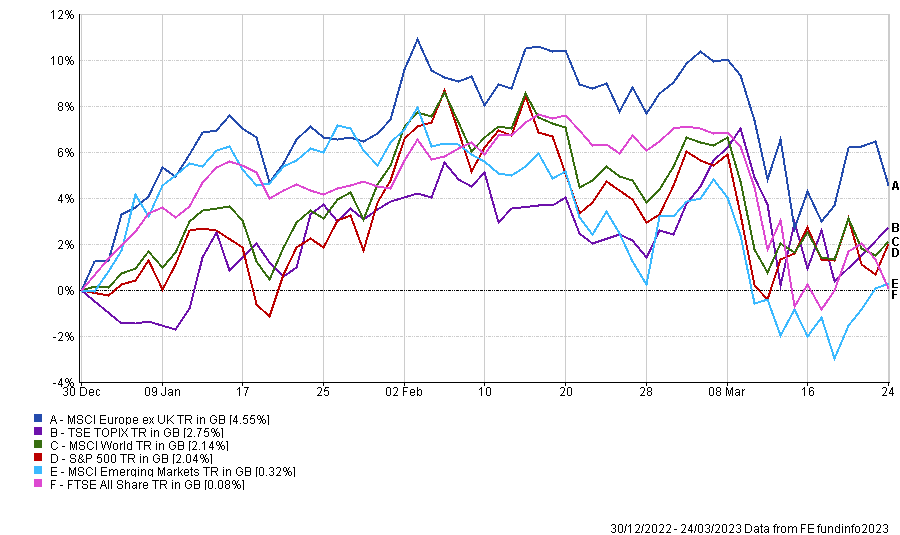

Despite the backdrop of the war in Ukraine, the market has been the best performer among major indices this year so far, as the below chart shows. The MSCI Europe ex UK index has made 4.6% year-to-date, after losing 7.6% in 2022.

Data from FE fundinfo shows it was the best performing market over the winter months, with this stretch of performance dating back to before the turn of the year.

Charles Younes, research manager at FE fundinfo, said: “Economic activity in the region has exceeded expectation” noting that smaller companies and cyclical stocks “have been the biggest beneficiaries of the better economic performance”.

“The rapid reopening of China should prove beneficial for European exports,” he added, although warned that “there are still several risks for European equities” including high inflation and the prospect of further rate rises.

Performance of indices in 2023

Source: FE Analytics

For investors who want to up their exposure to the continent, Tom Sparke, investment manager at GDIM, said there are good options available.

Despite all of the issues faced in recent years, Europe’s recent performance has been strong, but he argued that investors had to be specific, as the quality-growth approach that has been so popular in recent years has not been the winning formula in 2023.

“So I would be looking for a fund with at least some element of value exposure, but also one that was high conviction with a high tracking error to select the best opportunities and back them considerably,” he said.

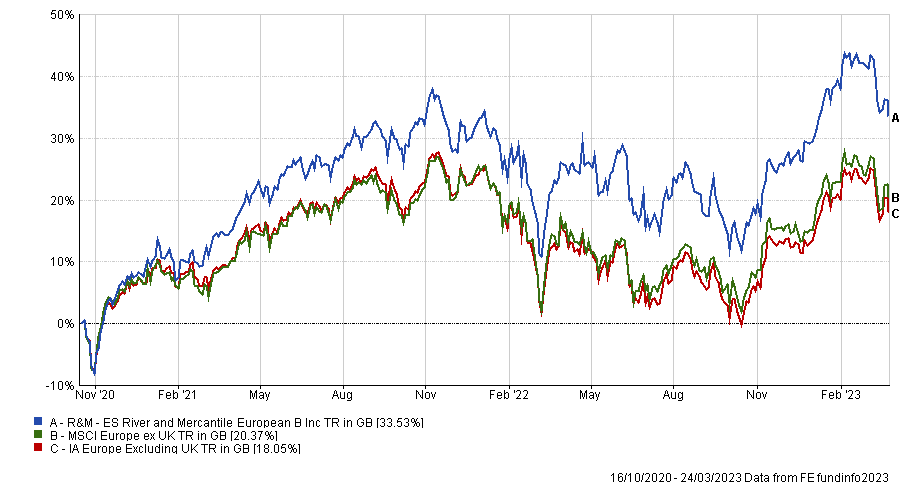

Fitting the bill is River and Mercantile European, run by former Schroders fund manager James Sym. Launched in October 2020, since inception it has been the 10th best portfolio in the 136-strong IA Europe Excluding UK sector, returning 33.5%.

Total return of fund vs sector and benchmark since launch

Source: FE Analytics

It was a top-quartile performer in both 2021 and 2022 but has dropped to below average this year as the market rotated back towards quality growth.

“The fund, which is currently £120m in size, contains a core, concentrated collection of stocks with a bias toward those trading below their perceived value. The fund has performed admirably well since its launch in 2020 and boasts a decent yield of around 2% too,” said Sparke.

Amaya Assan, head of fund origination at Square Mile Investment Consulting and Research, also picked a portfolio with a relatively short track record.

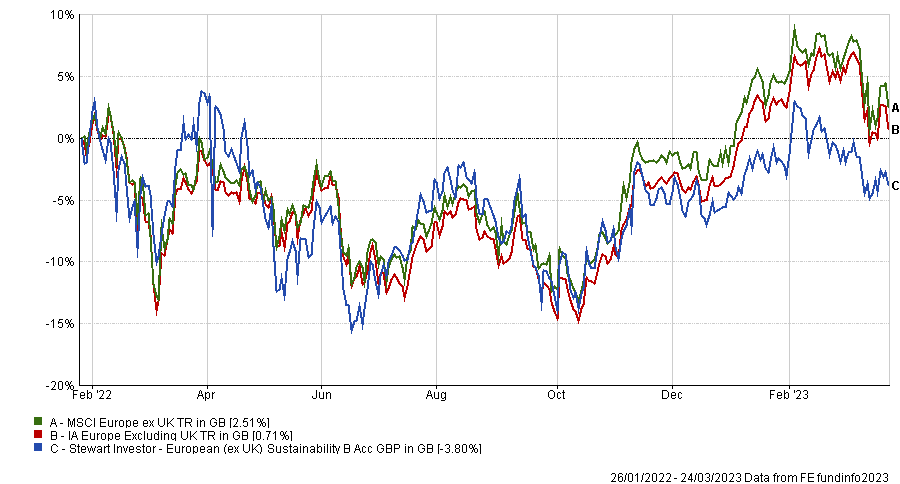

Launched in January 2022, Stewart Investor European (ex UK) Sustainability is run with a team-based approach and looks for high-quality stocks with a product or service that make the world more sustainable.

Environmental, social and governance funds have had a tough time in recent months as investors have moved towards value stocks such as financials and energy companies – typically not found in these portfolios.

Indeed, Stewart Investors European (ex UK) Sustainability has currently made investors a 3.8% loss, compared with small gains for the IA Europe Excluding UK sector and MSCI Europe ex UK benchmark.

Total return of fund vs sector and benchmark since launch

Source: FE Analytics

“The process behind the fund seeks to identify investment opportunities based on three key metrics: quality of management; quality of the company including its social usefulness, their environmental impacts, efficiency and responsible business practices and quality of the company's finances and their financial performance,” Assan said.

“The managers take a long-term perspective and we believe the fund shows promise as a long-term responsible investment offering. However, it is very early days for the strategy – the team has been investing in European companies in their global equity strategy since 2012, but as a standalone European product, this is new for them as a group.”

For investors wanting proof of a portfolio with a longer track record, she recommended Liontrust European Dynamic headed by James Inglis-Jones and Samantha Gleave.

“The strategy underlying this fund has gradually evolved over time, but has always focused on completely objective measures of a company’s wellbeing,” she said.

“The managers believe that cash flow is the primary, long-term determinant of shareholder returns and that investors frequently undervalue free cash flow.”

They therefore prefer attractively valued companies with strong cash generation, giving the portfolio a tilt towards quality companies.

Over the long term this has proven a winning strategy. It has been the third best performer in the sector over three and five years and is sixth over a decade.

Total return of fund vs sector and benchmark over 10yrs

Source: FE Analytics

“The fund’s long-term performance record is excellent suggesting that the managers are identifying anomalously priced securities. However, there will be periods where the market does not support this strategy and it is unlikely to suit investors looking for brief forays into Europe or for those seeking index-like returns,” said Assam.