Merchants Trust has seemingly earned back the confidence of the market after a tough period. So stark has the turnaround at the £842m trust been, that analysts at Investec switched their recommendation from ‘sell’ to ‘buy’, skipping the ‘hold’ rating altogether.

Reasons for this reversal are the rotation from growth to value in the market, which suits Merchants Trust’s investment philosophy better, the recovery in UK equities and an improved balance sheet with a reduced gearing.

Among the Association of Investment Companies’ ‘Dividend Heroes’ for upping its dividend in each of the past 41 years, it remains a popular choice among investors.

However, there are times when the trust will perform exceptionally well, and others when it may underperform. As such, below Trustnet has asked three experts what they would hold alongside Merchants Trust in a portfolio to help smooth out returns.

Shavar Halberstadt, equity research analyst at Winterflood, picked Odyssean Investment Trust, which is also one of Winterflood’s 2023 recommendations.

Unlike Merchants Trusts, which invests in UK large-caps, Odyssean belongs to the IT UK Smaller Companies sector.

Halberstadt said: “A key reason for our recommendation is that the proposition is highly differentiated from and complementary to other UK mandates in both the large-cap and small-cap sub-sectors.

“With a NAV total return of 64% and a share price total return of 58%, Odyssean has significantly outperformed its comparator index (by 3 percentage points) and the UK Smaller Companies peer group (by 9 percentage points) since its launch in May 2018.”

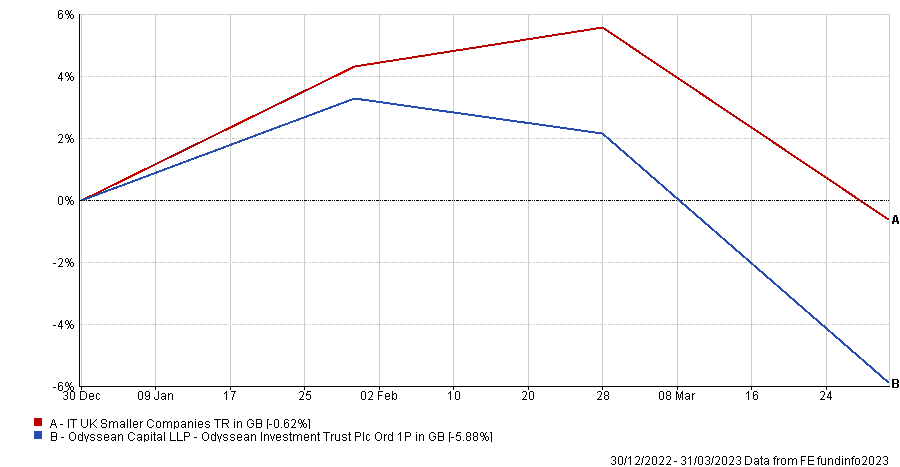

Year-to-date, the trust’s performance has been negative, but Halberstadt said that Winterflood still has confidence in the manager’s private equity investment approach over the medium term.

Performance of Trust year-to-date against sector

Source: FE Analytics

He added: “Given the highly concentrated nature of the portfolio, stock-specific catalysts including M&A will have a significant impact on returns.

“As a capital growth play with exposure to small-cap M&A beneficiaries, we believe Odyssean is a sensible complement to the large-cap income Merchants portfolio.”

The next pick is a global growth trust to add diversification in style and geographies.

Nick Wood, head of fund research at Quilter Cheviot chose Monks Investment Trust to completement Merchants Trust’s UK Income style.

He said Monks offers a broad exposure to global growth businesses, but with a flexible mandate that allows it to invest in areas such as miners.

Wood added: “Monks benefits from Baillie Gifford’s extensive research capability and would complement the UK-focused income bias of Merchants Trust.”

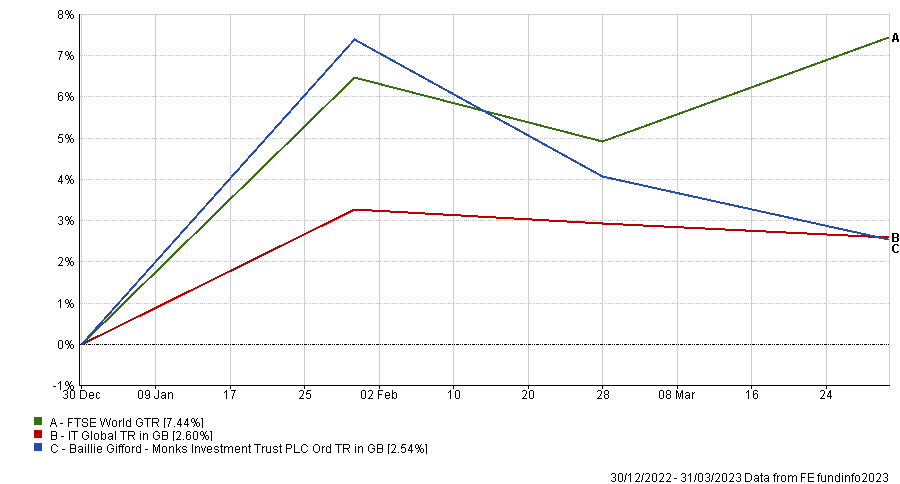

Performance of Trust year-to-date against sector

Source: FE Analytics

Year-to-date, Monks Investment Trust has underperformed both its sector and benchmark amid a tough period for the global growth style. However, Woods said that it also means that now is a good entry point.

The third pick is Law Debenture Corporation, which is also in the IT UK Equity Income sector and the recommendation of Anthony Leatham, research analyst at Peel Hunt.

He said that there are still important differences with the Merchants Trust despite similar biases toward large/mid-caps and the value style.

Leatham added: “Merchants Trust has greater exposure to defensive sectors and Law Debenture Corporation’s portfolio has more in cyclical and economically-sensitive sectors. The income generation is also a differentiating factor.

“Thanks to its unique structure, 20% of Law Debenture Corporation’s portfolio is invested in the Independent Professional Services (IPS) business. The IPS business has recorded robust growth and a high level of contracted or repeat revenues, which has helped it to fund more than 30% of Law Debenture Corporation’s dividend over the past decade.”

Leatham said that the IPS business provides the board with significant visibility on cash flows and allows the managers of the trust greater scope to invest in an unconstrained manner.

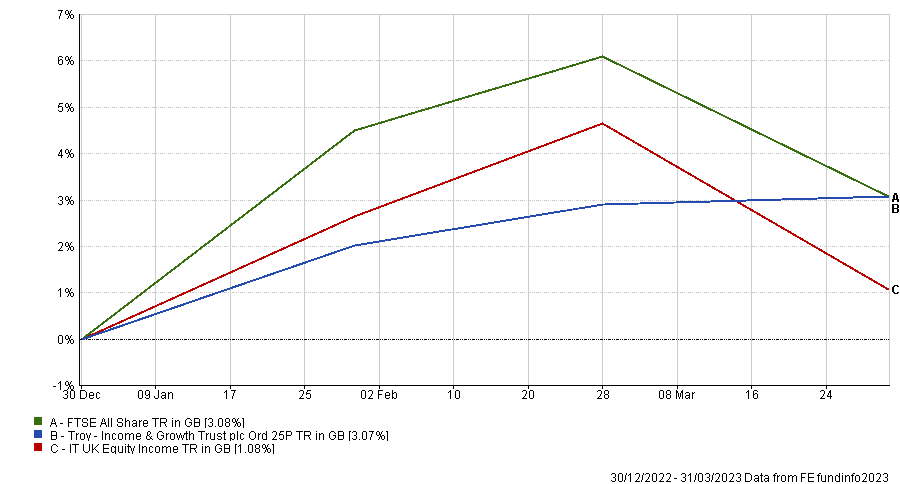

Performance of Trust year-to-date against sector and benchmark

Source: FE Analytics

The trust has beaten the sector average year-to-date and has been on par with the FTSE All Share benchmark, as the above chart shows.