An opportunity to buy has opened up for investors willing to take the plunge, according to fund managers, with some suggesting now is the best time to get into markets in more than a decade.

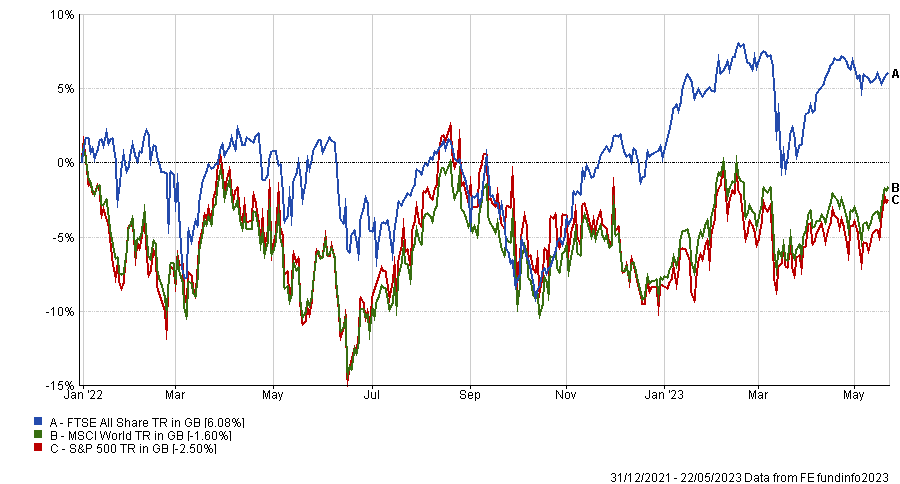

Since the start of 2022 markets have gone broadly sideways, with the MSCI World down 1.6% and the US’ S&P500 index falling 2.5%.

The best of the developed markets has been the UK, which has gained 6.1% thanks to the shift in markets away from growth areas such as technology and into value-driven stocks such as oil producers and miners.

Total return of indices since Jan 2022

Source: FE Analytics

These ordinary figures are despite a rebound so far this year, in which global and US stocks have risen more than 6%.

With interest rates rising to combat inflation, war between Ukraine and Russia and ongoing supply problems from Covid, Nathan Sweeney, chief investment officer of multi-asset at Marlborough Funds, said it was “human nature” that markets turned pessimistic last year.

However, he said that the scale of the sell-off in some areas of the market was “on the same scale” as the one in 2008.

“It is well over a decade that we have had a sell-off of this magnitude, and opportunities like that do not present themselves in markets very frequently,” he said. “Therefore people should be looking for the opportunity and not de-risk.”

In his multi-asset funds, he has brought back former holdings and added new names, with Fidelity UK Smaller Companies, Baillie Gifford Emerging Markets, BlackRock European Dynamic and Natixis Loomis Sayles US Equity Leaders all entering since the turn of the year.

“We brought the overall position from defensive to neutral and brought back in some funds that had been performing quite poorly as we expect them to mean revert,” he said.

“They are all good managers that invest sensibly but are out of vogue and are likely to come back in favour.”

Also optimistic about the future is Abby Glennie, co-manager of the abrdn UK Smaller Companies fund, who admitted that last year was a gruelling one for her smaller companies strategies.

“What was difficult for me last year was even companies that we believed in long term and were still going to meet their earnings forecast or even upgrade them, struggled,” she said.

“You knew the whole market was being driven by the de-rating and style tilt generated by the constant delta increase on inflation and interest rates – every time that we got data on that it was going up and up.”

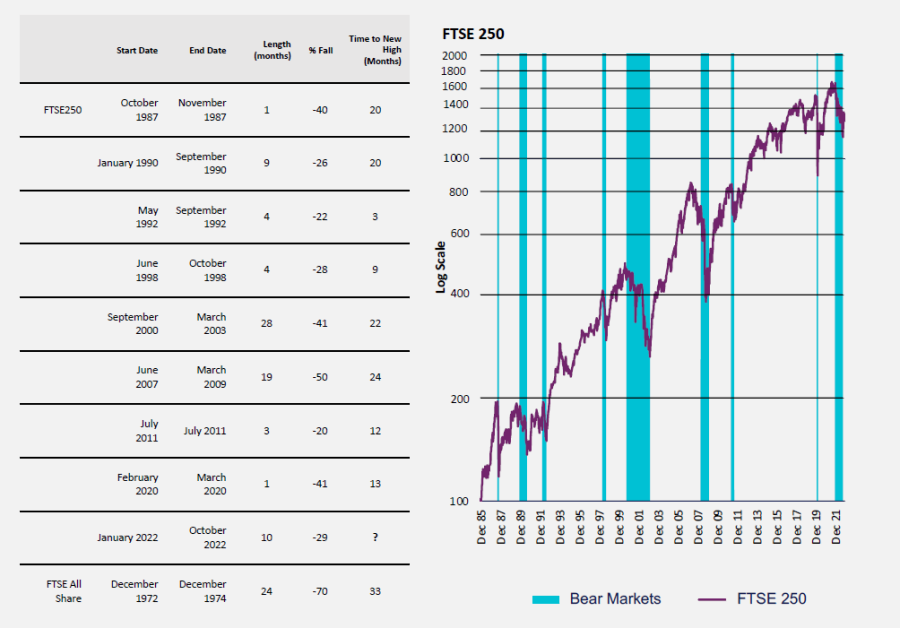

However, there is room for optimism. The chart below shows how quickly the FTSE 250 index has historically reached a new high after suffering a recession. This can range from a few months to two years.

How quickly the FTSE 250 index recovered after a recession

Source: Abrdn

“Two years is not that long for people to be in the market and reach new highs and if you are thinking about timing, you might want to participate,” Glennie added.

“At the moment we still see plenty of interesting opportunities and lots of those we have owned for years, but also some new things as well.”

Names that she has added recently include package holiday company Jet2, convenience store WH Smith and kitchen supplier Howdens Joinery.

However, not all agreed. Hugh Yarrow, manager of the TB Evenlode Income fund, said that there was a better opportunity last year for wholesale buying.

“It got very pessimistic in early autumn last year and there was a bit of an inflection in October so some of the mid-cap names have picked up somewhat since then,” he said.

At the time, the market was polarised and a lot of companies were de-rated, but that it is a “little bit more nuanced now”, with the majority of opportunities coming from the FTSE 250.

“Sentiment is very negative towards that area and the UK more broadly as well as generally regarding the global economic picture,” said Yarrow.

“Taking a five-to-10-year view, I always feel more confident when there is a level of pessimism bedded into valuations and it feels like the starting valuations are still very modest, which I find reassuring.”