A risk with veteran managers is that they might rest on their laurels and live off their reputation without actually delivering for their investors anymore.

Therefore, Trustnet has researched the seasoned investment trust managers across the different Association of Investment Companies (AIC) sectors that are still delivering convincing performance.

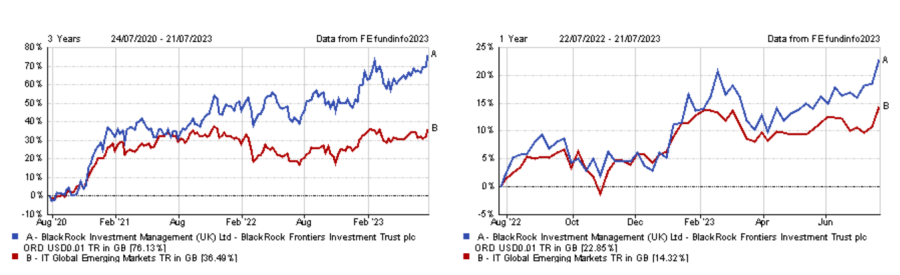

To do so, we have picked all the managers that have been in charge of their trust for at least 10 years and achieved top-quartile performance in their sector over three years and one year. We have excluded sectors with less than three constituents and removed venture capital trusts (VCTs).

Source: FE Analytics

No managers in popular sectors, such as IT UK All Companies, IT UK Equity Income or IT Global, have been able to outperform their younger rivals in recent years.

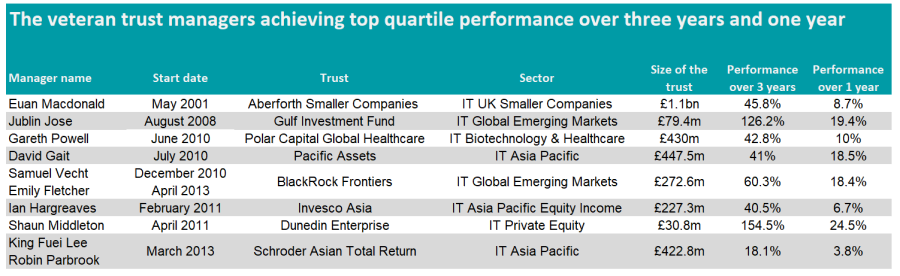

In the home market, the IT UK Smaller Companies sector is the only exception. Indeed, Aberforth Smaller Companies is the only UK trust with a veteran manager at the helm to have achieved top-quartile performance over three years and one year.

It has been managed by Euan Macdonald since 2001 who was joined by Christopher Watt and Peter Shaw in 2016, Jeremy Hall in 2018, Sam Ford in 2019 and Rob Scott Moncrieff in 2022.

Aberforth Smaller Companies seeks to invest in cheaply valued but cash generative small-caps with strong business models.

Performance of fund vs sector and benchmark over three years and one year

Source: FE Analytics

Although the trust has been one of the best performers in the IT UK Smaller Companies sector in recent years, it sits in the third quartile of the sector over 10 years.

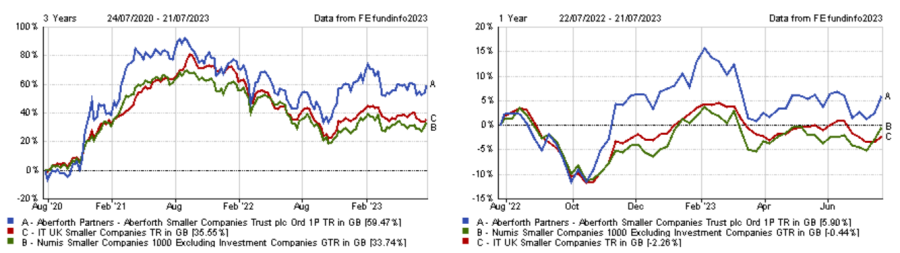

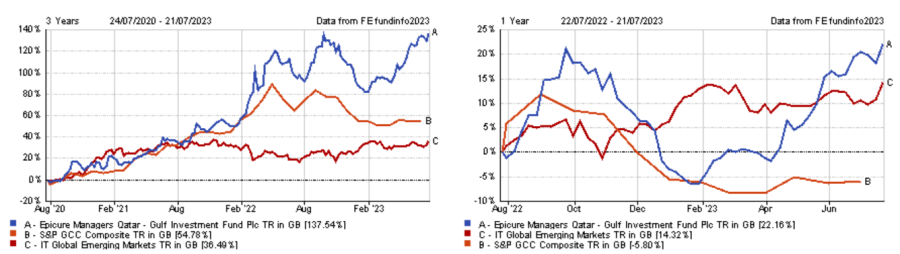

Veteran managers have been more successful in emerging markets. For instance, Jublin Jose from the Gulf Investment Fund as well as Samuel Vecht and Emily Fletcher from BlackRock Frontiers have achieved top-quartile performance in the IT Global Emerging Markets sector in recent years.

Jose has been managing the Gulf Investment Fund, which invests in the six countries of the Gulf Cooperation Council (GCC), since August 2008.

Performance of fund vs sector and benchmark over three years and one year

Source: FE Analytics

The trust has been a consistent outperformer in the IT Global Emerging Markets sector, beating all its peers over 10 and five years.

BlackRock Frontiers also has exposure to GCC countries such as Saudi Arabia and the UAE as it invests in frontier markets across the globe, but its largest country allocation being Indonesia.

The trust has been managed by Samuel Vecht since December 2010 and Emily Fletcher since April 2013 and has regularly made top-quartile returns in the IT Global Emerging Markets.

Performance of fund vs sector over three years and one year

Source: FE Analytics

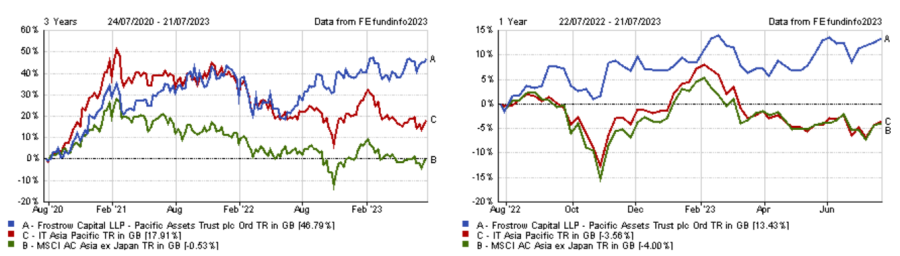

Focusing specifically on Asia, three trusts run by veteran managers have demonstrated their ability to still deliver for investors: Pacific Assets Trust, Schroder Asian Total Return and Invesco Asia Trust.

Pacific Assets Trust has been managed by David Gait since July 2010, who was joined by Douglas Ledingham in September 2018.

The trust has regularly sat in the top quartile of the IT Asia Pacific sector and has only been outperformed by Pacific Horizon over 10 years.

Performance of fund vs sector and benchmark over three years and one year

Source: FE Analytics

Pacific Assets has a strong tilt towards Indian equities, with an allocation of 48.1% to India compared to 16.8% in the MSCI AC Asia ex-Japan index.

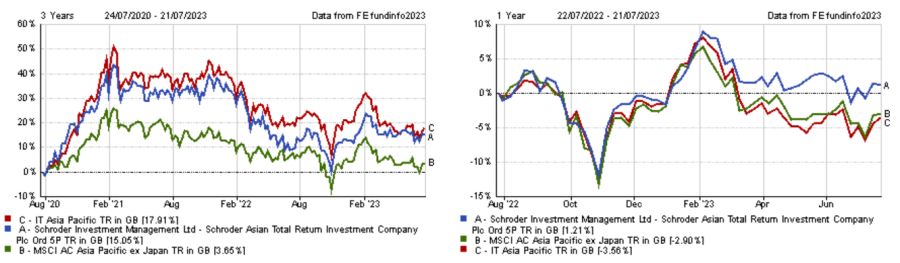

Schroder Asian Total Return meanwhile has an underweight to India, but also to China. Instead, the trust is overweight Taiwan and Hong Kong.

It has been managed by King Fuei Lee and Robin Parbrook since March 2013. While it’s made top-quartile returns over three years and one year, the trust sits in the second quartile of the IT Asia Pacific sector over 10 and five years.

Performance of fund vs sector and benchmark over three years and one year

Source: FE Analytics

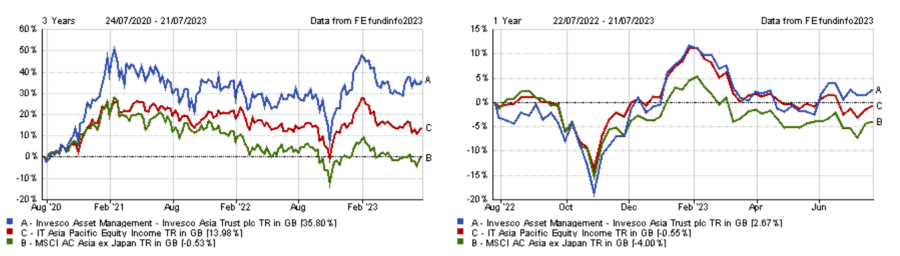

Unlike the two previous trusts, Invesco Asia Trust has an income mandate and has been managed by Ian Hargreaves since 2011 and Fiona Yang since last year.

The trust has been the best performer in the IT Asia Pacific Equity Income across different periods over the past 10 years.

Performance of fund vs sector and benchmark over three years and one year

Source: FE Analytics

Its five largest holdings are Taiwan Semiconductor Manufacturing, Samsung Electronics, Tencent, Housing Development Finance Corporation and Alibaba.

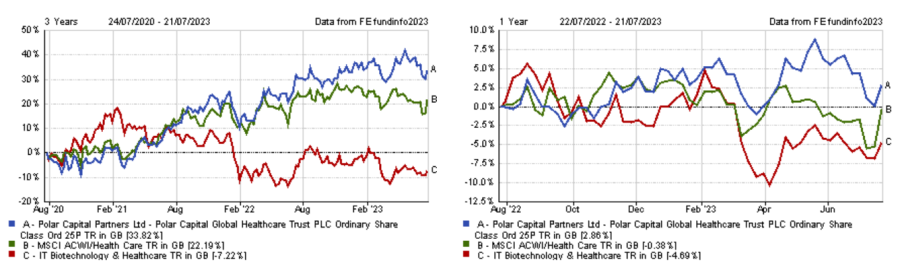

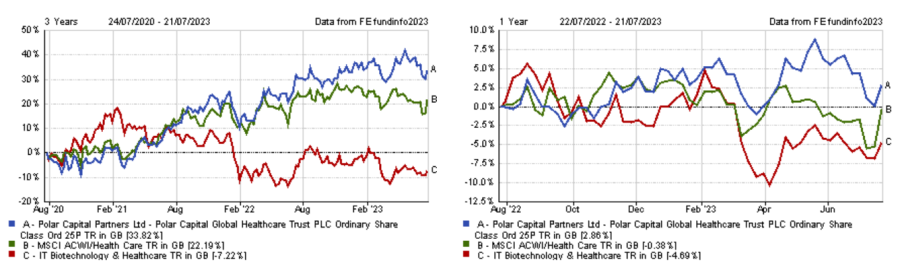

Polar Capital Global Healthcare is the only industry-specific investment trust managed by a veteran manager to have shined in recent years. Gareth Powell has been the trust manager since June 2010 and was joined by James Douglas in 2018.

Performance of fund vs sector and benchmark over three years and one year

Source: FE Analytics

The trust sits in the third quartile of the IT Biotechnology & Healthcare sector over 10 years and in the first quartile over five years.

It has its highest allocation to US equities, with Johnson & Johnson, Eli Lilly & Co and AbbVie as its top three holdings.

Finally, Dunedin Enterprise is the only private equity trust to reflect our criteria. Managed by Shaun Middleton since 2011, the trust is the best performer in the IT Private Equity sector over three years.

Performance of fund vs sector and benchmark over three years and one year

Source: FE Analytics

Over 10 years, the trust sits in the second quartile of its sector and in the first quartile over five years.