Bonds and equities are like a couple you are friends with – they seemed to be in a perfect relationship, always picking each other up when the other was feeling down (which is why they worked so well together in portfolios) until somebody said: We need to talk.

In 2022, things were bad: both asset classes nosedived and were not good for each other anymore – certainly not for containing risk and diversifying.

They tried to bring some spice into their 60/40 arrangement and saw other people for a while (alternatives), but confidence is broken and they are still picking up the pieces.

So will this still work, and how? Below, we asked experts (of finance, not romance) what investors should make of this troubled couple and for their equity/bond fund pairings where the relationship works.

First of all, Francis Banzon, portfolio manager at TAM Asset Management, still believes the match was made in heaven.

“If we begin to see cyclical growth and inflation continues to ease, we should see a wedge between the two assets restored.”

However, investors should consider how sensitive their portfolios are to growth and inflation, and make sure their investments are not all leaning in the same direction, said Rob Morgan, chief analyst at Charles Stanley.

For instance, a growth-orientated portfolio combined with mostly longer-dated bonds would typically lead to a very high level of sensitivity.

“One option to balance a growth-led equity portfolio would be to keep your fixed interest exposure shorter-dated,” Morgan said, “but at this juncture, better opportunities lie in using a more well-rounded portfolio for the shares component and a nicely diversified fixed interest exposure that has decent sensitivity to rates as and when they fall away.”

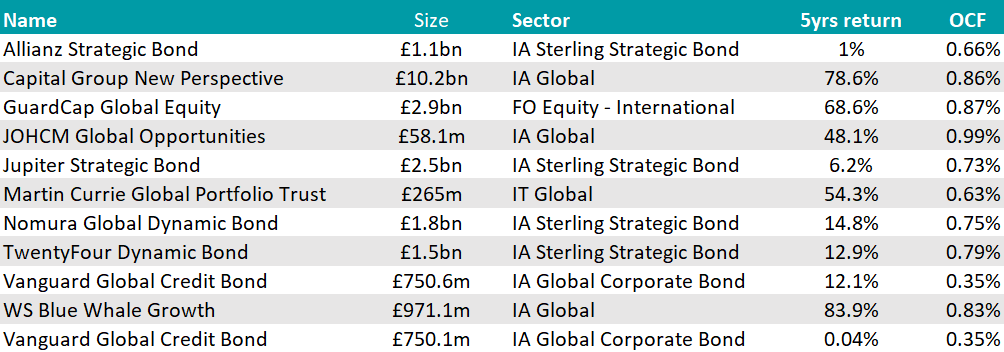

Admittedly this is hard to do with just two funds, but to give an example, Morgan picked the conservative, valuation-sensitive JOHCM Global Opportunities fund and the “very broad” Vanguard Global Credit Bond fund.

Performance of funds over 5yrs

Source: FE Analytics

While the first is not an out-and-out value fund, FE fundinfo Alpha Managers Ben Leyland and Robert Lancastle do look for underappreciated quality in less popular parts of the market.

“It aims to be something of an all-weather vehicle, with the managers willing to run up cash when they cannot find enough stock ideas of sufficient quality. As such, it tends to dampen the volatility of the global stock market to a significant degree and should be relatively resilient if inflation and interest rates surprise on the upside,” Morgan said.

On the other hand, the Vanguard fund takes an active, global approach and is “a core fixed interest holding”.

“It is sufficiently selective to add value but diversified enough to mitigate stock specific risks. The very wide portfolio of predominantly high-quality bonds should have more limited default risk during a recession, and the yield could provide investors with a solid income return. In addition, it retains a decent amount of rate sensitivity to provide some capital growth if interest rates expectations subside.”

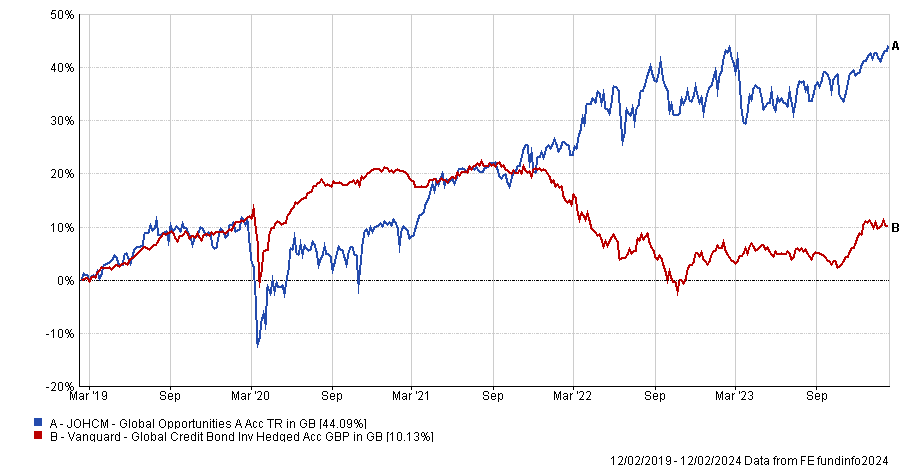

Jason Hollands, managing director at Bestinvest, also highlighted that for a portfolio consisting only of two global funds, the choices would depend on personal goals and risk profile. If focus was total return, however, then his choice would be to pair the TwentyFour Dynamic Bond fund with Guardcap Global Equity, both ‘best ideas’ funds managed by specialist boutiques.

“The bond fund has a very flexible mandate which can invest across the fixed income spectrum, including government bonds, corporate bonds and asset-backed securities, as well as in credit and interest rate derivatives for risk management and portfolio optimisation purposes,” he said.

TwentyFour takes a high-activity approach to position across duration and the credit spectrum, while the fund’s regional exposures are currently 37% Europe, 32% US and 27% UK.

Its chosen companion, Guardcap Global Equity, is managed by Michael Boyd and Giles Warren, who focus on quality, sustainable growth and value.

“While the fund has a growth stock focus, it is less rigidly style biased than many other global equity funds and the valuation discipline also makes it more defensive than many other global growth funds,” Hollands concluded.

Sheridan Admans, head of fund selection at TITTIT Invest, paired Blue Whale Growth with the Allianz Strategic Bond fund.

Performance of funds over 5yrs

Source: FE Analytics

“Blue Whale Growth stands tall with its bold strategy of meticulously curated exposure to high-quality global businesses. However, with such focus comes the potential for short-term volatility. This is where the Allianz Strategic Bond fund, a stalwart defender against market downturns and economic uncertainty, offers stability in times of market stress,” he said.

“Together, these funds offer investors a balanced pairing, combining the growth potential of equities with the stability of fixed-income securities. This strategic pairing not only aims to capture long-term growth opportunities but should also provide robust protection against downside risks during periods of volatility.”

Finally, other options from Darius McDermott, managing director at FundCalibre, included the Martin Currie Global Portfolio trust or, for those preferring a fund, Capital Group New Perspective, also paired with the Allianz Strategic Bond.

“While Allianz Strategic Bond’s performance has fluctuated recently, its significant allocation to government bonds positions it well for a risk-off market, acting as a natural hedge for your equity holdings. Other options we like are Jupiter Strategic Bond and Nomura Global Dynamic Bond,” he said.