Investors are familiar with the US ‘Magnificent Seven’ that have been dominating the headlines since the beginning of the artificial intelligence (AI) frenzy, but the UK has its own version too, according to James Lowen, manager of JOHCM UK Equity Income fund.

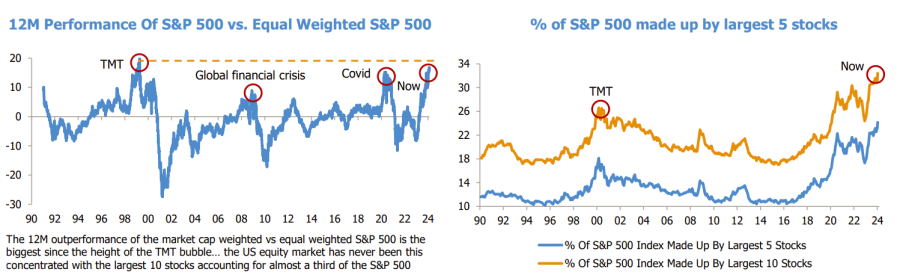

The meteoric rise of the seven well-known US names has resulted in high valuations and an overly strong position in index funds – they account for nearly 30% of the S&P 500. This has left some market participants questioning whether there is an AI bubble.

Yet, this overconcentration in a few ‘expensive’ names is not unique to the US, but also applies to the FTSE 100 in the UK too.

If the Magnificent Seven are Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla in the US, their British cousins would be Astrazeneca, British American Tobacco, Diageo, GSK, London Stock Exchange Group, RELX and Unilever, Lowen said.

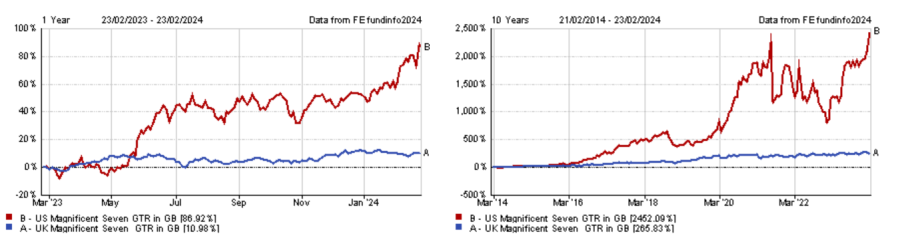

While they are not direct beneficiaries of the AI story and haven’t performed nearly as well as their US counterparts, these seven defensive stocks account together for about a quarter of the FTSE 100 and are significantly more expensive than the other constituents of the UK’s blue chip index.

Performance of UK and US Magnificent Seven over 1yr and 10yrs

Source: FE Analytics

He said: “10 years ago, those seven defensive stocks accounted for 12% to 13% of the index, but their valuations have gone up. If you look at Diageo or Unilever, they are trading on price-to-earnings (P/E) ratios of 20x and Astrazeneca is on 34x.

“In the UK, there are two markets: a very expensive one and a cheap one with companies trading on single-digit P/E ratios.”

Defensive stocks are supposed to be less sensitive to the macroeconomic environment, as they are, in theory, less sensitive to changes in consumer spending patterns. Therefore, investors would expect them to provide stable returns across the market cycle.

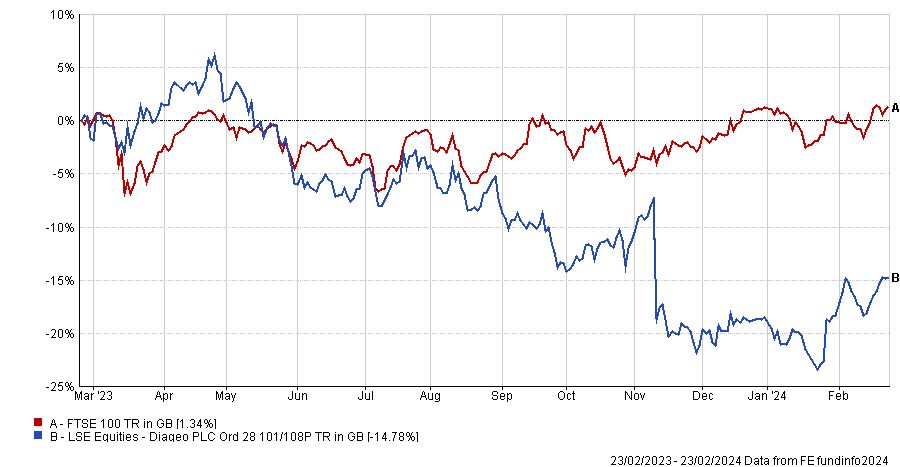

Yet, Lowen warned that these stocks might not be as safe as some investors believe as issues are starting to develop within the companies. For instance, Diageo issued a profit warning late last year, which has led to a fall in the share price.

Performance of stock over 1yr vs FTSE 100

Source: FE Analytics

Lowen also noted that European rival Nestle recently failed to meet sales growth expectation and suggested it could read across to Unilever.

Another thing Lowen highlighted is that the UK group leveraged up in the low interest rates era, something which is starting to bear consequences.

He said: “British American Tobacco had to stop doing share buybacks – which didn't go down very well – as it has too much leverage.”

While some international allocators have recently started to overweight the UK, Lowen stressed that money has flown into the domestic Magnificent Seven, as they are cheaper than their overseas equivalents, albeit being more expensive than the rest of the FTSE 100.

Lowen said: “It is keeping their valuations high in an absolute sense, but this rotation will stop if we see more hiccups similar to those of Diageo and British American Tobacco.”

Although their performance has been much stronger, Lowen also warned that the weight of the US Magnificent Seven in the S&P 500 is becoming dangerous.

For example, the one-year outperformance of a market-cap weighted S&P 500 tracker relative to an equal-weighted fund is the biggest since the dot-com bubble.

Lowen said: “We've only been here before during the tech bubble, the global financial crisis and Covid. We're at extremes when the market normally does not go further. Usually, there's a snapback right, as it happened when the dot-com bubble burst or after the Covid vaccine.

“Everyone thinks growth stocks are going to continue to outperform, but the elastic is so stretched, you can't really stretch it much more.”

Source: JO Hambro Capital Management Group, Bloomberg, FactSet, Morgan Stanley Whitephone, BofA Global Fund Manager Survey as at February 2024.

However, Stephen Innes, managing partner at SPI Asset Management, argued that some of the US Magnificent Seven – Nvidia, in particular – are not in a bubble.

He explained that the perception of a bubble around Nvidia is shifting as the company’s earnings keep surprising on the upside. While Nvidia was trading on a P/E of approximately 65x in the first quarter of last year, it fell to 33x later in 2023 and has now fallen to 25x.

Innes concluded: “If the entire market trades at 33 times earnings, that might signal a bubble. However, it's essential to clarify that a stock with remarkable growth, such as Nvidia, increasing sales by 265% and profits by nearly 500%, isn't indicative of a bubble at 33 times earnings. It simply isn't.”