The top-performing Royal London Global Equity Select fund is so popular it had to soft close, barring the door to new investors, but now that its three portfolio managers are leaving, anyone with money currently in the fund faces a tough choice.

Should they stick with the £803m fund or follow its managers, Peter Rutter, James Clarke and Will Kenney, who are establishing a new boutique? The same choice awaits investors in the £4.9bn Royal London Global Equity Diversified fund, which the trio also manages.

They will be joined at their new venture by Nico de Walden, who manages the £1.2bn Royal London Global Equity Income fund, and Chris Parr, who runs the £369m Royal London US Growth Trust. The team has already secured financial backing from Australian multi-affiliate firm, Pinnacle Investment Management.

Stick don’t twist

Ben Yearsley, director of Fairview Investing, and Jason Hollands, managing director of Bestinvest, think investors in RLAM’s global equity range should remain there for now.

Hollands said the portfolios are unlikely to change dramatically in the short term and, besides, there are not many other comparable options. “The approach on these funds was very distinct and there aren’t highly similar funds that spring to mind,” he noted.

The investment process centres upon the life cycle stages of a company. Rutter and his colleagues define companies according to whether the business is accelerating, compounding, slowing and maturing, mature, or in a turnaround situation. Slowing and maturing businesses tend to pay higher dividends and although the fund’s holdings are split across the stages, this is the only area where it is overweight versus its benchmark.

Global Equity Select, a concentrated portfolio of 44 holdings, will pass to Mike Fox, head of sustainable, who Hollands and Yearsley both rate.

“Fox is a veteran fund manager with a very strong track record on the Royal London Sustainable Leaders fund (which is on the Bestinvest best-buy list) although it is focused on UK equities,” Hollands said.

Yearsley agreed: “He is a top quality investor so I’ve got no qualms with sticking with that fund even though the Select fund hasn’t got a sustainable mandate.”

RLAM’s chief investment officer Piers Hillier, meanwhile, is taking over the Global Equity Diversified fund and Yearsley noted he would give him “the benefit of the doubt”.

“The diversified fund has done an excellent job over the long term and gives decent equity exposure at a low cost. It’s arguably their flagship so why would they do anything to jeopardise the long-term excellent performance?” he said.

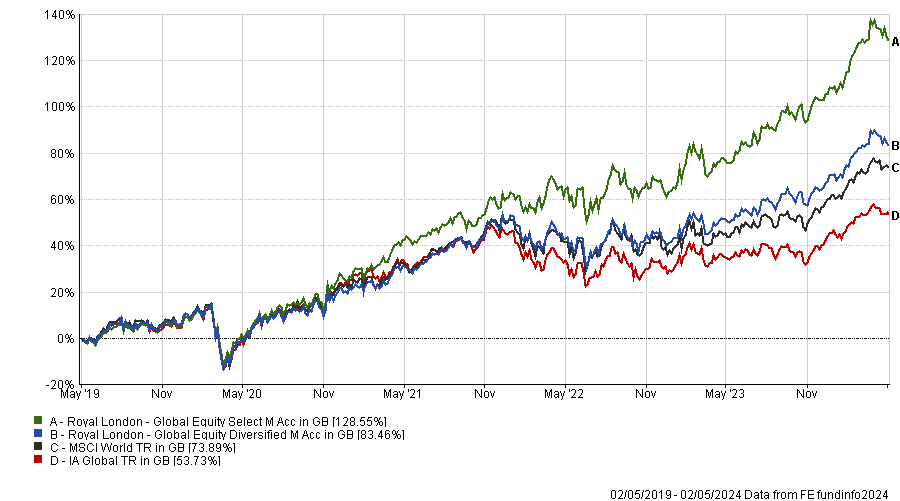

Performance of funds vs sector and MSCI World over 5yrs

Source: FE Analytics

Fold don’t hold

On the other hand, Chelsea Financial Services is selling its holdings in the Global Equity Income fund, said managing director Darius McDermott.

“Royal London has built an incredible franchise, due in large part to the expertise of the outgoing team. Their departure creates uncertainty regarding the future direction of these funds,” he explained.

In a similar vein, FE Investments was conducting due diligence on the income fund with a view to investing but has decided against going ahead. Analyst Zach Ryan and Sophie Turner said the individual portfolio managers and their investment philosophy were the key selling points.

FE Investments had originally wanted to invest in Global Equity Select but as it was soft-closed, Global Equity Income was another way to access the team’s intellectual property. It was a good fit because the analysts were looking for a global income fund with a slight value bias.

Another attraction of Global Equity Income is, unlike many other income funds, it has a meaningful allocation to the US – not a typical income market because American companies tend to prioritise share buybacks and capital gains over dividends.

Ryan said the fund’s performance has been “absolutely exceptional, across the board, through time”. Not only has it captured the upside during value rallies but it has held its own through periods when growth stocks were in the ascendancy, outperforming other value-biased funds. It has also exceeded its target to deliver a yield 20% higher than the benchmark.

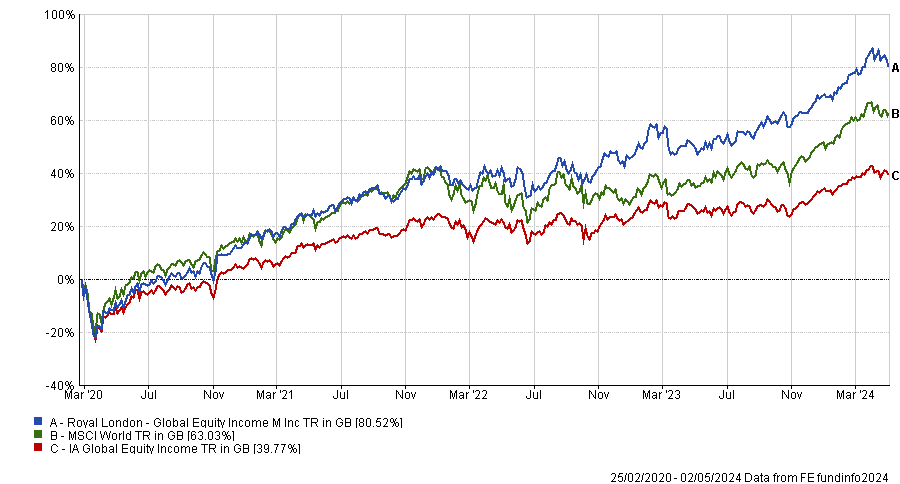

Performance of fund vs sector and benchmark since inception

Source: FE Analytics

Watch and wait

Yearsley is not an advocate of following the outgoing managers to their new venture on day one because “we know so little about it”. This includes the types of funds they will run, how available they will be and when they will launch.

The main question for Turner and Ryan is how much of the investment process can be brought to Pinnacle given that RLAM owns the intellectual property rights.

It is impossible to predict whether the investment process will perfectly translate and whether the fund managers will have all the programmes they need, the right financial support, and whether the risk committee at their new firm will act in the same way as RLAM’s, Ryan said.

Hollands also thinks investors should wait and see how the portfolio managers get on in their new set-up. “They have great track records but how they will fair in a new and perhaps very different environment needs to be considered. We would want to understand the new set-up, resources and whether the approaches will be the same or differ,” he said.

“For example, the Royal London Global Equity Select fund has a quantitative element to the process and those proprietary tools – and the person who built them – remain with RLAM.”