Following a period of interest rate normalisation, investors no longer need to reach down the risk spectrum for yield. It has been readily attainable in government bonds and money market funds.

However, while higher rates are good for these instruments, spread premia can be an additional draw for credit investors. Even when spreads are tight, investors can access attractive yields, especially in high-yield bonds, without having to veer into the lower-quality triple-C segment.

The benefits of a multi-asset approach

For credit investors, a multi-asset credit (MAC) approach can provide the broad diversification of risk while increasing yield and total return potential.

More conservative investors may prefer a portfolio with a greater weighting to investment-grade bonds given their relative safety and security in a variety of market conditions. Investment-grade yields are lower than in high yield, but investment-grade bonds can offer slow and steady income generation via the coupon, potential for low to mid-single digit returns and capital preservation.

Boost the juice

Those with a modestly greater risk appetite may consider a multi-asset credit approach with more high-yield exposure. The circa $2trn global high-yield market offers significant opportunities for investors able to identify credits with strong underlying fundamentals and we believe an attractive yield premium.

A well-structured multi-asset credit strategy can properly deal with the recent increase in bond prices. It can also invest during market dislocations and/or sell-offs. This can provide greater return potential through a longer holding period; the best opportunities tend to be during short periods of indiscriminate selling, not just when markets are going up.

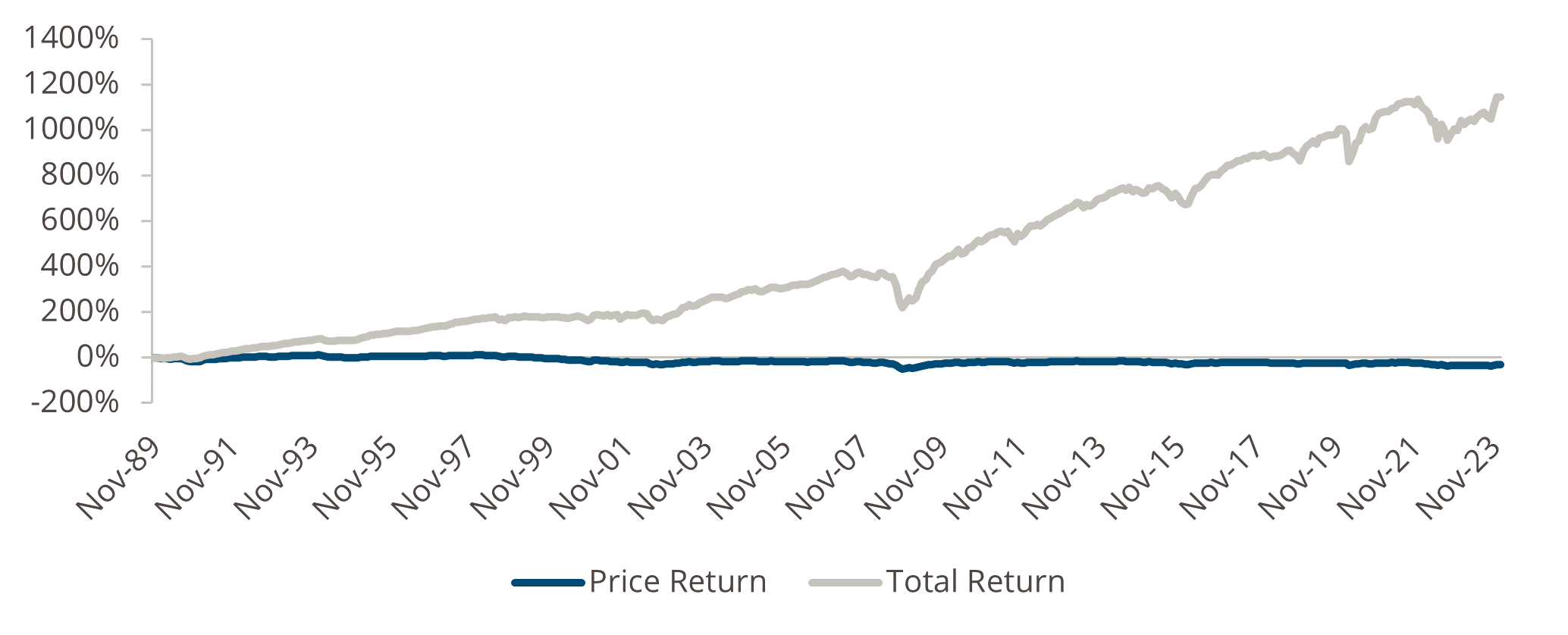

One of the key features of high yield is its regular coupon income. Compounding this income and incorporating it into the price return provides an attractive total return picture over the longer term, as the chart below illustrates.

Capturing the premium in high yield

Sources: ICE Data Platform, ICE BofA US Cash Pay High Yield Index (J0A0) as of Dec 31, 2023

Risk on

High-yield bonds may be more volatile than investment grade, but investors should be able to tolerate higher volatility in exchange for additional yield, which is where credit selection comes in. A long-term approach to high yield means that, over time, yields can mitigate volatility.

Knowledge of rising and falling credit trends is also an important requirement. High yield comprises different industries operating within their own business cycles (cyclicals, financials, non-cyclicals, etc.). A multi-sector credit strategy that can identify emerging and maturing industry trends is therefore beneficial.

Stronger for longer

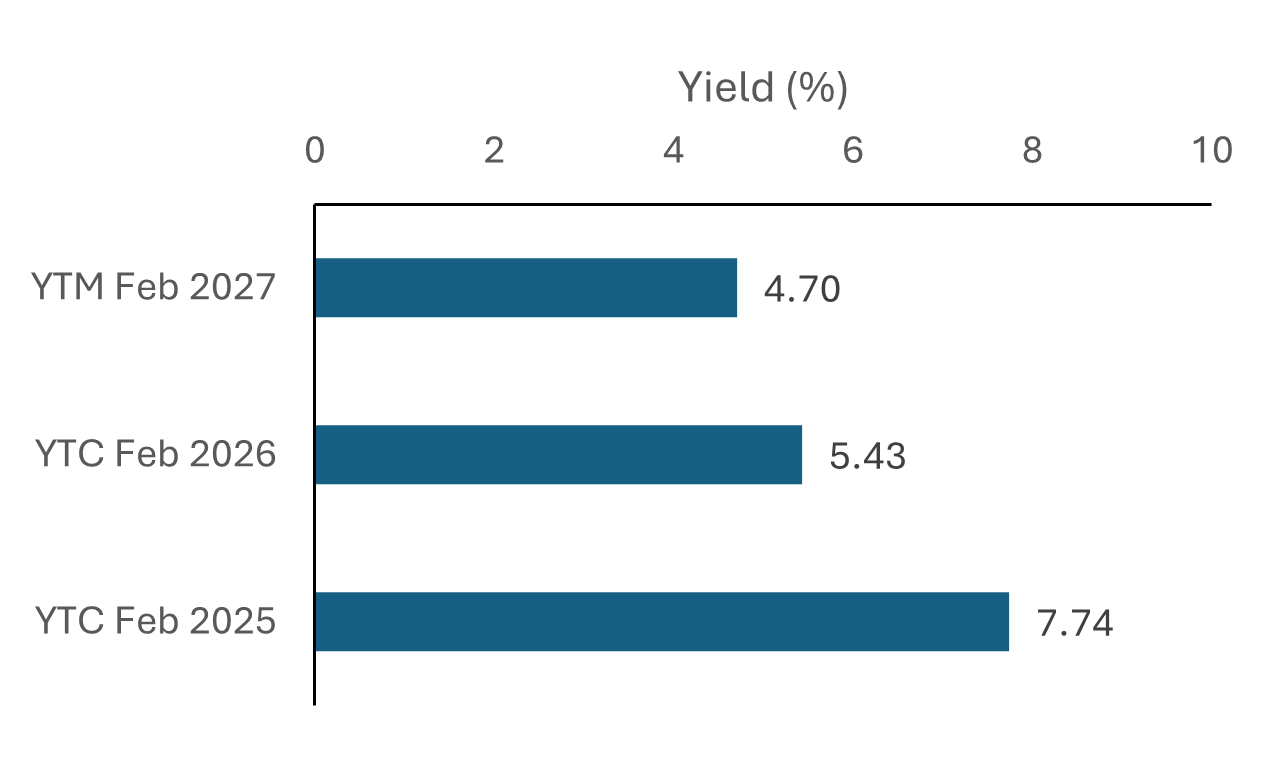

The inverse relationship between yields and price means that with higher yields come lower average prices. With prices at circa 93 in the US and 94 in Europe for example, an investor will receive an additional seven or six points when the price reverts to 100 at maturity.

Given the tendency of issuers to refinance before maturity, the discount is recouped over a shorter timeframe, resulting in a significant increase in yield and spread. While not a common phenomenon, it is present in today’s market conditions. The more commonly referenced yield-to-worst calculation may underestimate the potential realised return for bond investors reflected in the yield-to-call calculation.

Example services issuer 3.25% 2027 bonds

Sources: Muzinich, Bloomberg, data as of 8 Mar 2024

Abating recessionary fears and a higher-for-longer rates environment give high yield the green light. The asset class offers a compelling level of yield, while spreads compensate for default risk.

Credit quality is improving: only 10% of the global high-yield universe is CCC-rated. The investible universe – certainly in Europe – is shrinking, with a lack of supply underpinning prices.

While defaults are rising, they are likely to be limited given the underlying fundamental strength of high-yield corporates, especially in the higher-quality B and BB parts of the market. High-yield bonds also tend to have shorter durations, making them less sensitive to changes in interest rates.

For multi-asset credit investors, diversification is already part of the package. Yet those who want more risk and are willing to accept the volatility could consider strategies with a higher weighting to high yield, complemented by a smaller, but still beneficial, allocation to investment grade.

However, this shouldn’t be a short-term, tactical allocation. It should be a more strategic, long-term investment that seeks to benefit from deep credit analysis, as well as a strong understanding of market dislocations and the broader macroeconomic environment.

Mike McEachern is co-head of public markets at Muzinich & Co. The views expressed above should not be taken as investment advice.