Fund managers around the world have become increasingly downbeat in their outlook for the economy following the market crash in early October, a closely watched sentiment survey has found.

The latest edition of the Bank of America Global Fund Manager Survey, which polled 189 asset allocators running a total of $508bn, was carried out between 2 and 8 August – so was running when global stocks tanked on Monday 5 August.

As has been discussed widely, several factors combined to spark the sell-off including worries that the US economy could fall into recession, the unwinding of the Japanese carry trade and fears that US tech stocks were overvalued.

Below, we look at seven charts from the Bank of America Global Fund Manager Survey to see how investors were affected by the August stock market drop.

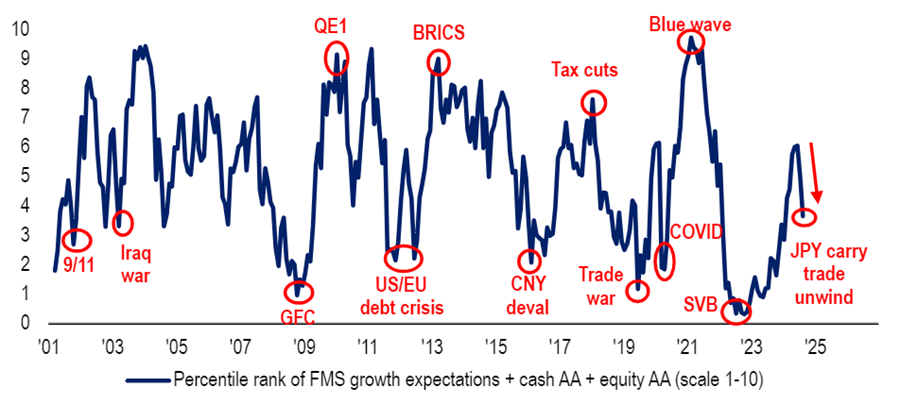

Bank of America Global Fund Manager sentiment indicator

Source: Bank of America Global Fund Manager Survey, Aug 2024

Bank of America’s broadest measure of fund manager sentiment revolves around the percentile ranking of respondent’s growth expectations, cash levels and equity allocations. This fell to 3.7 in August, down from 5 in July.

Part of this was down to fund managers’ increasing their cash levels for the second month in a row, from 4.1% to 4.3%, as the market sold off in the opening week of the month.

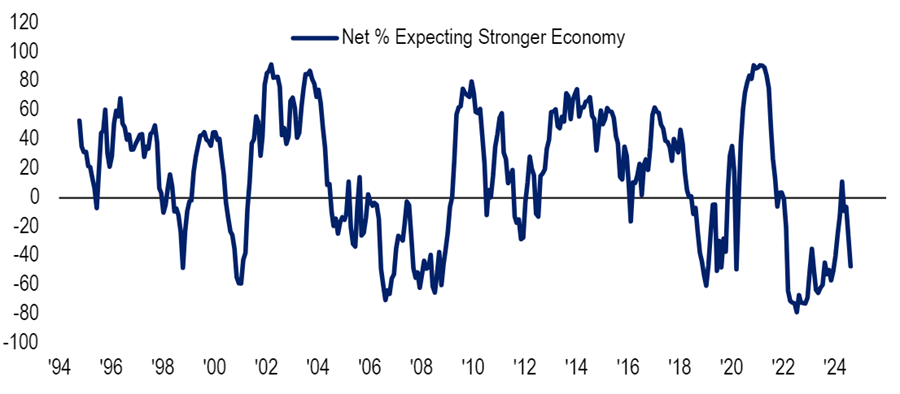

Net % of fund manager expecting a stronger global economy in next 12 months

Source: Bank of America Global Fund Manager Survey, Aug 2024

But a major source of the fall in sentiment can be seen in the chart above – confidence in the economy has collapsed to an eight-month low. The August survey found a net 47% of investors expect a weaker economy in the next 12 months, down 20 percentage points from the previous survey.

Some 52% of managers think the most likely scenario for the global economy is ‘below-trend growth and above-trend inflation’ (down from 65% last month). One-third expect ‘below-trend growth and below-trend inflation’, which is the most since November 2020.

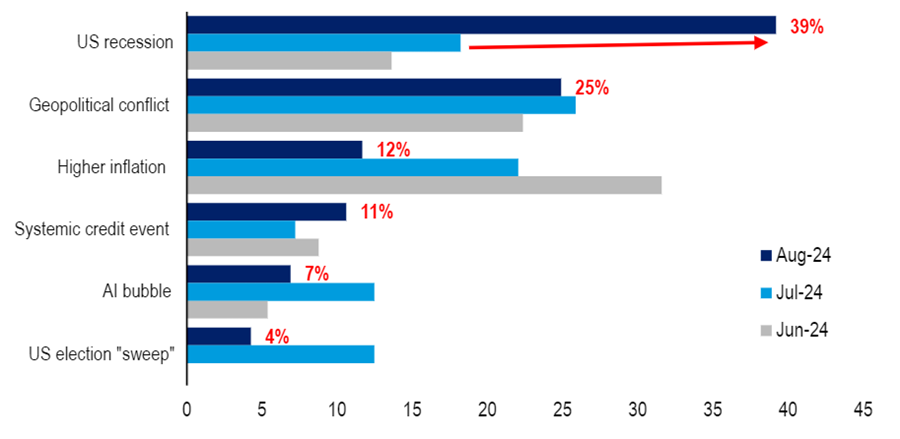

What fund managers consider to be the biggest ‘tail risk’

Source: Bank of America Global Fund Manager Survey, Aug 2024

Because of this, a potential recession in the US has become the biggest ‘tail risk’ for global asset allocators. In July, just 18% of investors cited this as the main risk; in the latest survey, 39% said they worry about this the most.

The number of managers worried about geopolitical conflict, higher inflation, an artificial intelligence (AI) bubble or a US election ‘sweep’ (where one party takes the presidency and a senate majority) has fallen as macro concerns mounted.

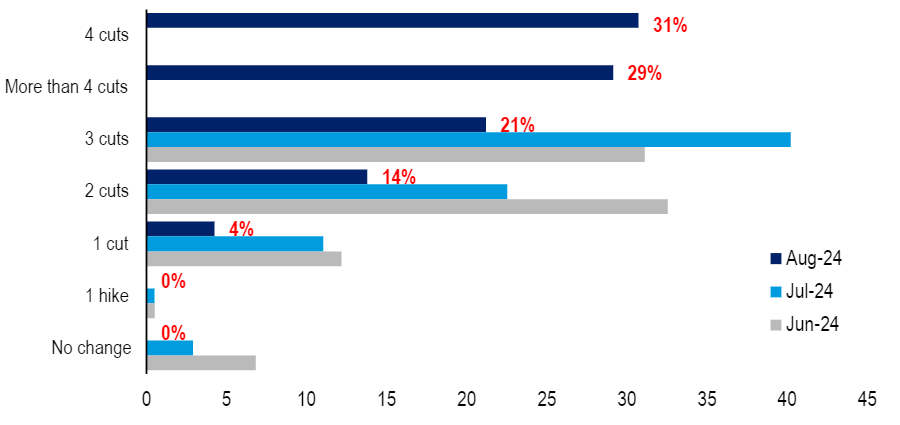

What is the most likely move for the Fed in the next 12 months?

Source: Bank of America Global Fund Manager Survey, Aug 2024

However, the core assumption among fund managers is that the global economy will encounter a ‘soft landing’ (a slowdown rather than recession) in the next 12 months, with 76% expecting this outcome.

That said, investors now expect a greater degree of policy easing from the Federal Reserve will be required to achieve this. Around 60% of managers anticipate four or more rate cuts in the US over the next 12 months, with 94% expecting the first at the Fed’s September meeting.

That said, just 8% of managers expect ‘no landing’, down from 18% last month. Some 13% think a ‘hard landing’, or recession, is on the cards in the coming 12 months, up from 11%.

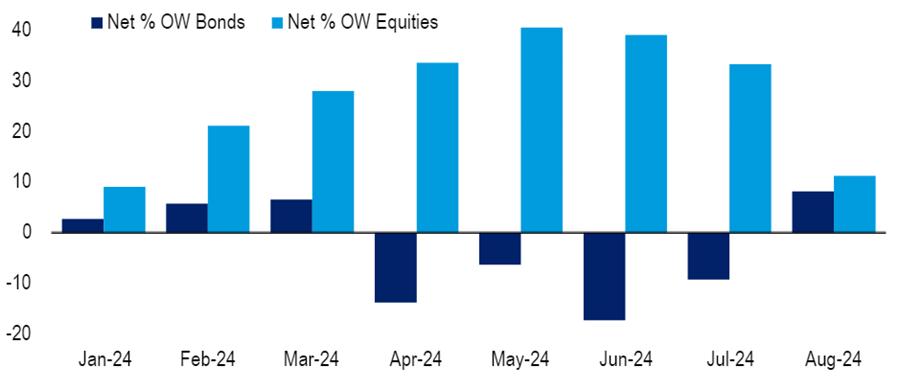

Net % overweight equities and bonds in 2024

Source: Bank of America Global Fund Manager Survey, Aug 2024

During August, the net overweight to stocks has fallen to 11%, down from 33% last month. This is managers’ lowest allocation to equities since January 2024 and the largest month-on-month drop since September 2022.

The allocation to bonds shifted from a net 9% underweight in July to a net 8% overweight this month as investors rotated into safer havens.

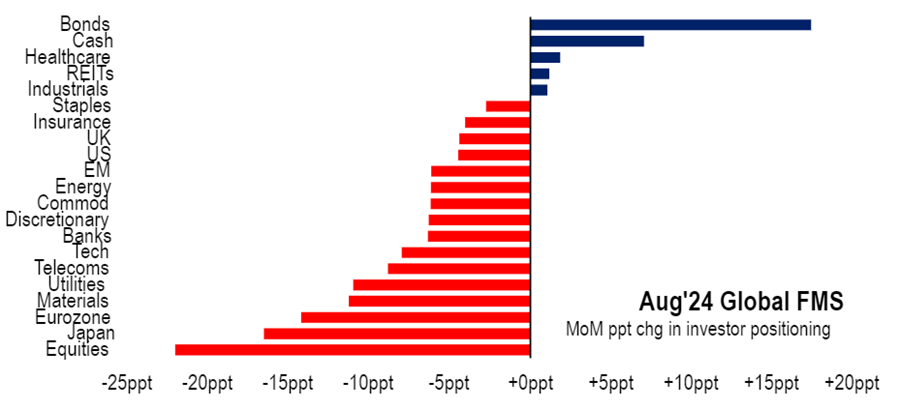

Month-on-month change in manager positioning

Source: Bank of America Global Fund Manager Survey, Aug 2024

The above chart shows this rotation in more detail, with investors increasing their allocation to defensive areas of the market (bond, cash and healthcare) while moving away from riskier assets (stocks, Japan, tech, banks and commodities).

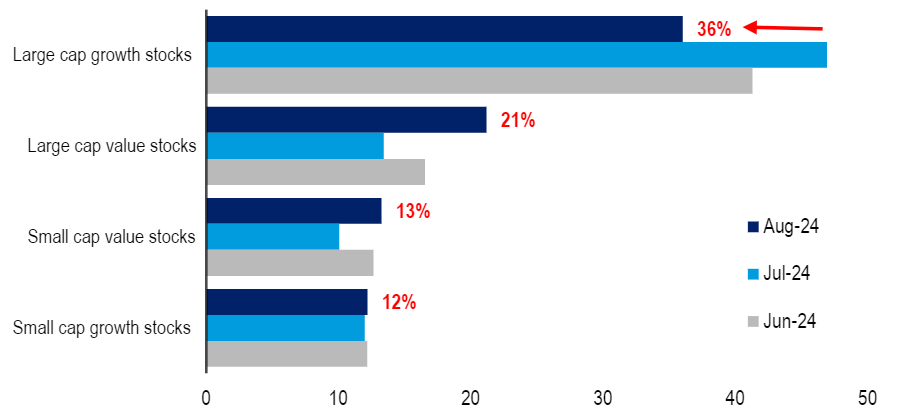

What managers believe will lead the new US equity bull market

Source: Bank of America Global Fund Manager Survey, Aug 2024

Looking forwards, fund managers continue to believe that large-cap growth stocks will lead the next US bull market, much like they have over recent years. However, confidence in this view has been shaken: 36% of investors backed large-cap growth stocks in August, down from 47% last month.

In contrast, there’s a growing number of asset allocators looking to large-cap value stocks as the likely leaders of the next bull market, with 21% backing them – up from just 13% in July.