Worries about a recession in the US and the likelihood of further market volatility have led BlackRock to shift its positioning away from US tech companies towards a broader set of opportunities.

The asset management giant has been investing in the artificial intelligence (AI) theme for some time, making it a key focus of its equity strategy. However, the latest update from the BlackRock Investment Institute explained how this has been tweaked.

Natalie Gill, portfolio strategist at BlackRock Investment Institute, said: “US recession fears and other factors have jolted markets. We could see more volatility flare-ups ahead of the US presidential election.

“We move from a US tech focus within our equity overweight, leaning further into a wider set of winners from the artificial intelligence buildout.”

The AI theme has dominated markets since the first large-language models (LLMs) such as ChatGPT were launched at the end of 2022, leading to stellar returns for companies involved in the emerging technology.

However, investors have become increasingly cautious on the theme in recent months amid worries that companies investing big into AI might have to wait some time to see the fruits of this.

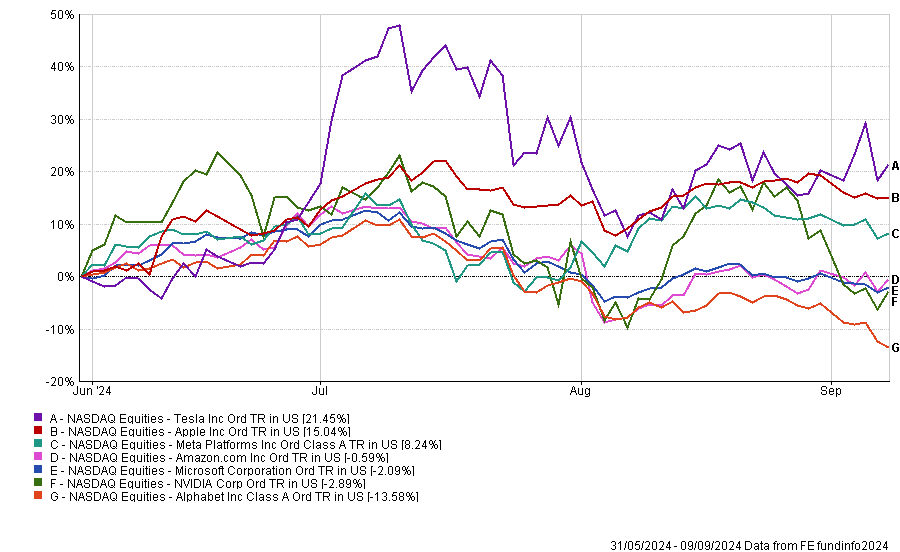

As a result, some of the ‘Magnificent Seven’ (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla) – stocks that soared thanks to their involvement with AI – struggled over the summer.

Performance of Magnificent Seven since the start of H1 2024

Source: FE Analytics. Total return in US dollars

Last week’s note from the BlackRock Investment Institute expressed confidence in the AI theme but reminded investors that patience will be needed to identify the long-term winners of this tech revolution.

It also outlined a three-phase roadmap to track the impact of AI.

In the first phase – which we are currently in – a buildout takes place as large tech companies race to invest in data centres. Early winners here include the big spenders and chip producers as well as firms supplying key inputs such as energy, utilities and real estate.

During the second phase, AI adoption expands to sectors beyond tech such as healthcare and financials. This may then lead to the third phase of broad productivity gains, although the size and impact of this are still uncertain.

Furthermore, the asset management house gave three ‘signposts’ it is using to assess the robustness of the AI investment theme: signs of stalling revenue growth at top AI companies; changes in still-low AI adoption beyond the tech sector; and any US growth downturn that could cause big tech companies to curb spending.

In the BlackRock Investment Institute’s latest update, Gill said: “We still favour the AI theme yet fine-tune our exposure. In the first phase of AI now underway, investors are questioning the magnitude of AI capital spending by major tech companies and whether AI adoption can pick up.

“While we eye signposts to change our view, we think patience is needed as the AI buildout still has far to go. Yet we believe the sentiment shift against these companies could weigh on valuations. So we turn to first-phase beneficiaries in energy and utilities providing key AI inputs – and real estate and resource companies tied to the buildout.”

WisdomTree is another asset management firm advocating for a broadening out from the immediate AI winners, although it is pointing investors to a wider range of opportunities than just other companies linked to the theme.

Aneeka Gupta, macroeconomic research director at WisdomTree, said leadership within stock markets remains “quite narrow”, attributing this to the “AI frenzy” and earnings concentration.

However, she expects the ongoing bull market to be maintained by policy easing from the Federal Reserve and growing earnings, although volatility could be pushed higher by the US election.

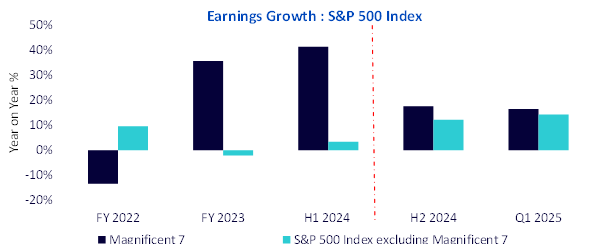

“The Magnificent Seven has been the most crowded trade amongst investors for 16 straight months. US equities have been more concentrated than at any point since the mid-1970s,” she added.

“A risk of returns being so concentrated within such a small segment of the market is that, when those companies fail to meet expectations, their performance suffers. [But] forward earnings growth looks set to expand beyond the current leaders.”

Comparison of earnings growth

Source: Factset, S&P, WisdomTree. Data as of 30 Jun 2024

Looking at areas that might benefit from broadening earnings, WisdomTree noted that the Russell 2000 index of small-cap stocks has lagged in its large-cap peers over the past decade.

While many investors have crowded into US mega-caps in recent years, Gupta suggested a barbell approach combining large-cap exposure with small-caps as a way to maintain a more balanced US equity allocation.

The strategist also pointed to value investing, especially in emerging markets, as an opportunity given that growth stocks have enjoyed more than a decade of outperformance in the developed world. European and Japanese equities are also highlighted for offering value.

Finally, she highlighted equity income investing as attractive and said ordinary dividends (excluding special payments) in Europe are expected to reach 4% this year, hitting a new high of €463bn.

Gupta finished: “Continued global earnings growth should lend a positive tailwind for a continuation of the rally.

“Yet global equity markets are not only concentrated by name but also by sector and factor, opening up a plethora of opportunities. The most attractive risk/reward prospects appear to be offered by overlooked areas of the market – small caps, dividend and value stocks.”