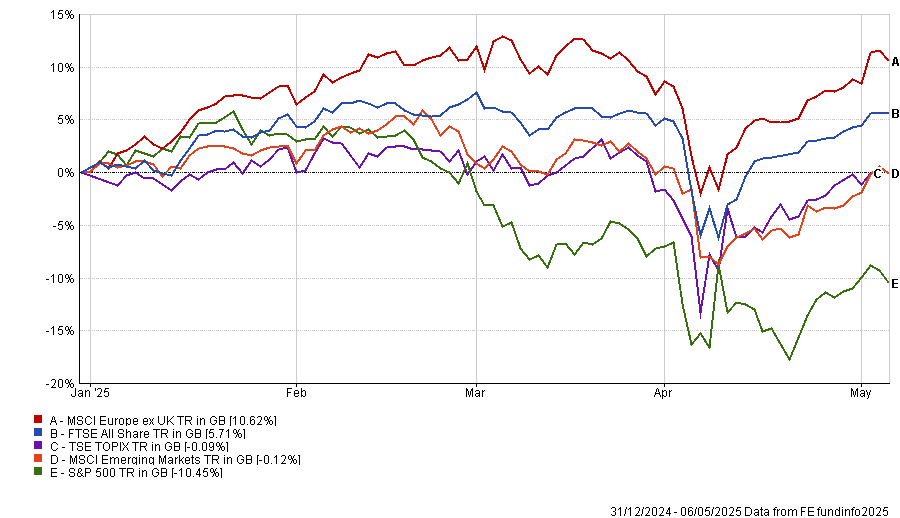

European equities have captured investors’ attention this year by storming ahead of other regions.

Not only is continental Europe the best-performing major equity market year-to-date in sterling terms, but it has achieved almost double the return of the next-best region – the UK – and has recovered all of its post-Liberation Day losses.

Europe is enjoying the fruits of lower interest rates, stable inflation, more political stability following the German election and higher defence spending commitments. Yet with the threat of tariffs looming and heightened geopolitical uncertainty globally, there is an argument for investing with experienced managers who are supported by large teams of analysts and extensive resources.

Performance of European equities vs other regions YTD

Source: FE Analytics

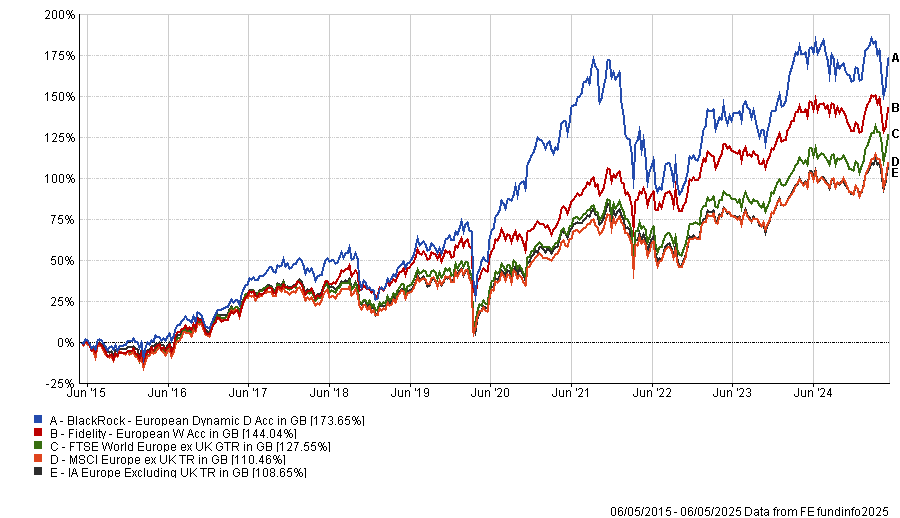

Two popular strategies fitting that bill are BlackRock European Dynamic and Fidelity European, the largest actively managed funds in the IA Europe Excluding UK sector with £4.5bn and £4.2bn respectively.

They are both led by FE fundinfo Alpha Managers (BlackRock's Giles Rothbarth and Fidelity's Sam Morse) and feature on several platforms’ buy lists. They each achieved top-quartile returns over 10 years to 6 May 2025, although they have struggled more recently.

Performance of funds vs benchmarks & sector over 10yrs

Source: FE Analytics

The funds’ investment styles are complementary so they could work well as a pairing, said Richard Philbin, chief investment officer (investment solutions) at Hawksmoor Investment Management. “They tend to trade off each other quite well,” he noted.

BlackRock European Dynamic is growth-oriented and has a beta of about 1.1, whereas Fidelity European focuses more on valuations and has a beta of approximately 0.8, Philbin said. Both portfolios are fairly concentrated, with BlackRock holding about 50 stocks while Fidelity has 45.

Rothbarth takes large bets away from his benchmark, whereas Morse is more benchmark-aware. Nonetheless, both funds have a sizeable off-benchmark position in the UK, worth 5.4% for BlackRock and 4.4% for Fidelity.

Those in favour of Fidelity European

FE Investments uses Fidelity European as a core holding, said fund analyst James Piper.

Morse and co-manager Marcel Stotzel believe dividend growth drives returns so they look for high-quality companies with low debt, strong balance sheets and earnings growth that can keep raising their dividends. These factors have given the fund a defensive tilt and a growth bias, Piper explained. The portfolio’s average price-to-earnings (P/E) ratio, return on invested capital and earnings growth usually exceed its benchmark.

The fund doesn’t take big sector or country bets which, combined with its defensiveness, is why it works well as a core holding, he said. This also means alpha is driven by stock selection.

Piper praised Morse’s consistent investment process and his “diligent, unemotional way of approaching investment – really thinking about the bottom up and ignoring the noise”.

The fund has underperformed over the past year due to its considerable exposure to large international companies, especially those in the consumer discretionary sector such as L’Oreal and LVMH, which have been vulnerable to weaker Chinese demand and tariff concerns, he acknowledged.

Tom Bigley, fund analyst at interactive investor, is also a fan of Fidelity European, describing it as “a strong option for investors seeking quality-growth exposure to European markets”.

“Given the proximity with which the fund is managed to its benchmark, returns are unlikely to differ enormously from the market over the short term and therefore are unlikely to astound in a rising market. However, the strategy has shown great resilience on the downside, aided by the emphasis on looking for quality attributes on companies' balance sheets,” he said.

Square Mile has awarded an AA rating to Fidelity European because of its high conviction in Morse and Stotzel, said Martin Ward, senior investment research analyst. “Morse has a history of acting as a safe pair of hands,” he explained.

Ward also emphasised the strategy’s defensive credentials and said it may underperform during bull markets. “However, we feel the strategy should typically provide a more robust performance profile in weaker, more volatile market environments, which should improve its risk-reward characteristics over time,” he said.

“Since January 2010, the strategy has outperformed in 70% of down months and the portfolio tends to operate with a beta of less than one to the market, with a relatively low tracking error.”

Backers of BlackRock European Dynamic

BlackRock European Dynamic features on AJ Bell’s favourite funds list as its growth pick within Europe. Head of investment research Paul Angell described it as a “highly credible fund, managed out of BlackRock's enviably large team of European portfolio managers and analysts”.

Rothbarth has spent his whole career in this team, working closely with the fund’s previous manager, Alister Hibbert. He started out as a financials analyst before becoming a named manager on the fund in 2021.

The investment strategy focuses on “businesses with the best cashflow and earnings stories, typically giving the portfolio a growth bias”, Angell continued. “The fund can be dynamic with regards to this style exposure however, for example rotating into more cyclical names in the second half of 2020.”

For Ward, the unconstrained nature of the strategy is one of its key attractions. “It is one of the most flexible funds in the team’s product range. The portfolio manager can alter the fund’s stylistic, investment sector and market capitalisation positioning to take advantage of any opportunities that may arise,” he said.

However, this also means that performance can deviate materially from the benchmark. The fund outperformed significantly in 2020 but underperformed materially in 2022, he said. It is fourth quartile within its sector over the past 12 months.

“The strategy may suit investors that are willing to accept a little more volatility from their exposure and this fund should be seen as a long-term holding,” he noted.

Ward also praised the team, describing it as “one of the best-resourced teams operating in the region”. Furthermore, Rothbarth draws on BlackRock's wider resources to manage risk, using the firm's risk and quantitative analysis team as well as its extensive portfolio monitoring tools, he added.