Knowing when to cut your losses and when to hold out for a recovery is a question investors frequently grapple with – especially during last month’s market turmoil, when many portfolio holdings were deep in the red.

The temptation to sell grows stronger when an investment has been underperforming for what feels like too long. But exiting too early can lock in losses, and investors often end up chasing strategies that are simply in vogue at the time.

David Lewis, co-manager of the Jupiter Merlin fund-of-funds range, continues to hold at least three long-underperforming positions in the Jupiter Merlin Balanced fund, choosing patience over reaction as he allows them time to play out.

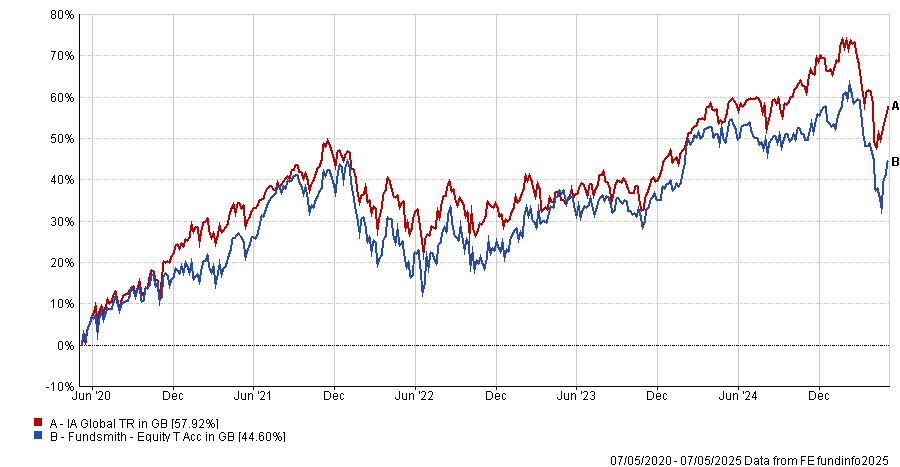

One holding that has truly tested investors’ patience is Fundsmith Equity. It last ranked in the top performance quartile within the IA Global sector in 2019, slipped to the second quartile in 2020 and fell further to the third quartile in 2022, where it remained. Over the past 12 months, it has declined by 3.5%, placing it in the bottom quartile compared to its peers.

Money has flowed out of the fund of late, suggesting investors have started to lose faith in the portfolio, but experts are sticking with it – including Lewis, who argued that underperformance is sometimes just a relative concept.

Performance of fund against index and sector over 5yrs

Source: FE Analytics

“It all depends on what a fund is underperforming against, and whether that is a relevant comparison to how you think a fund should or shouldn't have done,” he said. “Particularly for something like Fundsmith, how relevant is the comparison with the IA Global sector?”

Any market is a blend of growth and value, and each fund should be judged against its own kind, as returns are often polarised in one of the two styles.

“If your manager is very specifically looking at only one cohort of companies and the markets have been driven by the other, should you be penalising them?” he asked.

“Would you hold it against your manager if they hadn’t invested in oil and gas and mining companies or any outperforming asset class that you knew from the start they would never hold?”

Many funds similar to Fundsmith have delivered comparable performance in recent times. For example, Lewis pointed to the Evenlode Global Equity fund, which he holds in other Merlin strategies, as taking a similar quality-growth and free cashflow yield approach to Fundsmith. Looking at that peer group, Smith’s performance looks “much more reasonable”.

“All managers who haven’t been focusing on stocks such as the Magnificent Seven have had far less strong performances than the sector average, but this comparison would be unfair to them,” he said.

Another key question investors should ask themselves is whether the manager can turn that underperformance around.

For Fundsmith, Lewis has a clear answer: “Smith himself is as sharp as he ever has been and he has got a really good portfolio of companies which, for the moment, have been out of favour, but as winds change, things could come back his way,” he said.

“We still believe that investing in quality compound-type companies is an efficacious way to do things.”

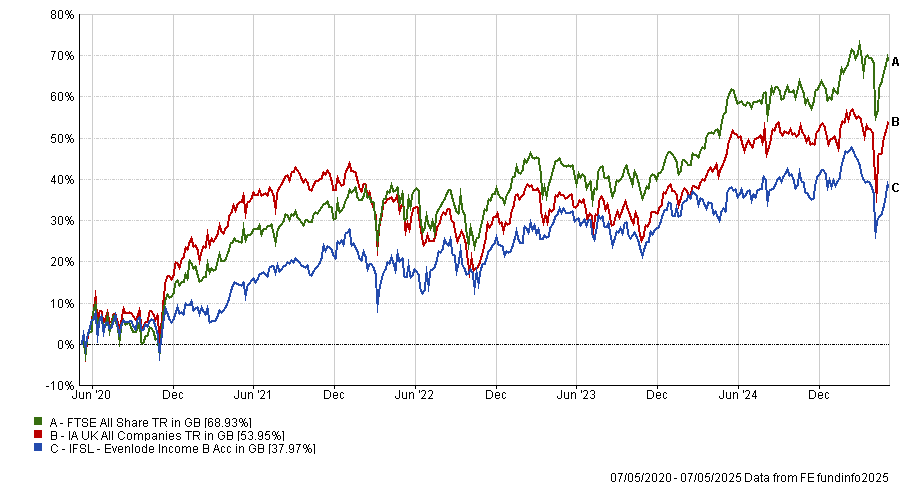

The growth-versus-value debate has been a key factor in the UK as well, where Lewis has three holdings – Man Income, Jupiter UK Income and Evenlode Income.

The first two have been among his best calls of the past year, as he recently told Trustnet, while the Evenlode fund was among the worst, with below-average performance over one, three and five years, as well as shorter timeframes.

Performance of fund against sector over 5yrs

Source: FE Analytics

In this case, the manager is holding on to all three for the added benefit of diversification.

“I suppose we've got something of a barbell in the UK, with Man Income and Jupiter Income on one side and Evenlode Income on the other, which is very much on more quality-growth end of the spectrum,” he said.

“The more growth-orientated managers within the UK have certainly done less well lately, but there's nothing wrong with having a blend of different managers, you don't want all your eggs in one basket.”

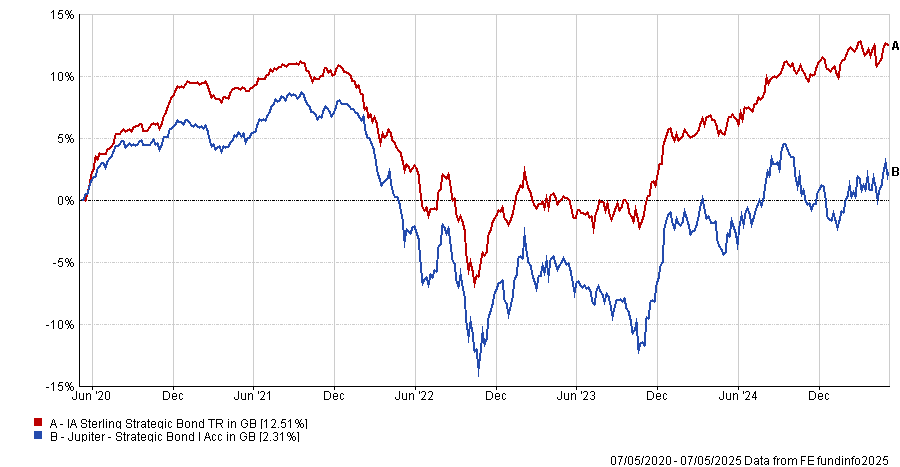

As for the Jupiter Strategic Bond fund, the past couple of years have been very challenging for flexible bond managers to navigate, with few historical precedents.

Performance of fund against sector over 5yrs

Source: FE Analytics

Lewis remains comfortable holding managers who “retain an eye on the risks and the downside”. He has “certainly been encouraged” that underperforming strategies like Jupiter Strategic Bond have fared better in 2025 to date, as volatility has risen in this environment of heightened economic and geopolitical risk.