European funds have produced the best returns of any regional equity sector this year, apart from Latin America.

Even amid Donald Trump’s tariff onslaught, the continent has prospered as some of the headwinds it faced last year dissipated and tailwinds emerged, according to James Piper, fund analyst at FE Investments. German commitments to increase spending on infrastructure and defence have provided a boost to the economy, inflation is more stable and interest rates are coming down, he said.

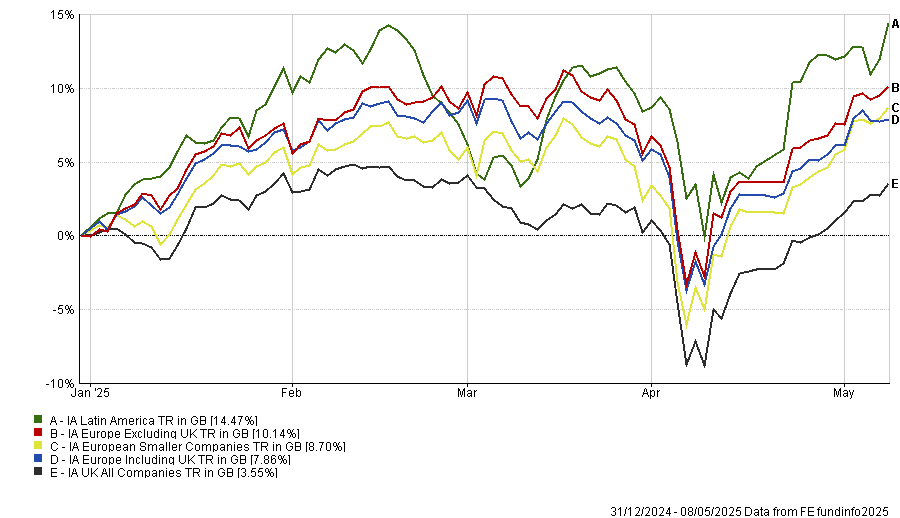

Performance of top five IA sectors YTD

Source: FE Analytics

Within the competitive European equity space, three strategies stood out to fund selectors: Lightman European, Liontrust European Dynamic and BlackRock Continental European Income.

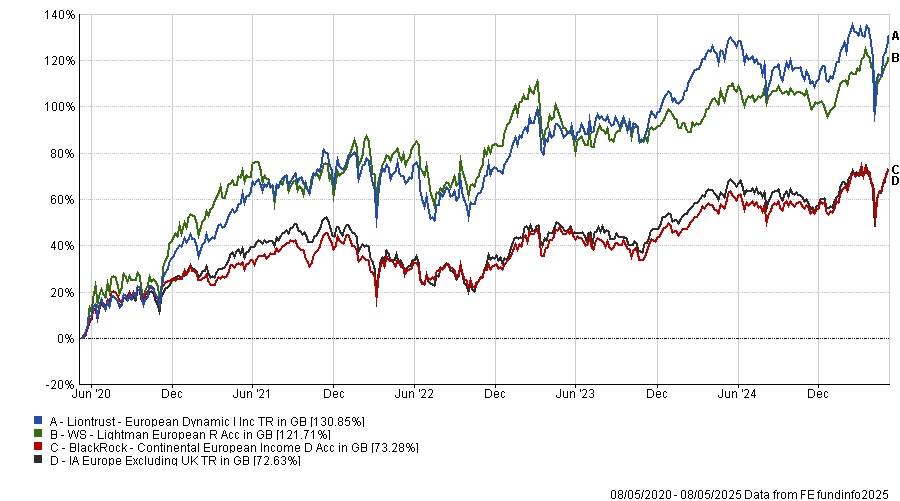

Performance of funds vs sector over 5yrs

Source: FE Analytics

Liontrust European Dynamic

FE Investments added Liontrust European Dynamic to its portfolios a year ago. The £1.9bn fund’s flexible, adaptable process enables it to consistently navigate difficult periods, Piper said.

Managers James Inglis-Jones and Samantha Cleave look at ‘market regime indicators’, including valuations, investor anxiety, corporate aggression and market momentum, to ascertain which style of investing will be rewarded. Then they adjust their exposure between contrarian value, value, growth and momentum bets.

As such, this fund might suit investors who want balanced exposure to European equities, said Martin Ward, senior investment research analyst at Square Mile Investment Consulting & Research, because “it should not be overly beholden to style shifts within markets”.

“We like the managers’ strict adherence to their process, but this can mean that there will be periods where the market does not reward their stocks,” he pointed out.

Bestinvest introduced Liontrust European Dynamic to its Best Funds list last year. Managing director Jason Hollands said the strategy has a well-established team and delivered outperformance in both value and growth-led markets.

“At the heart of the investment process is a focus on free cashflow analysis, which the team believes is a key building block of long-term growth that is often underappreciated by investors who instead often put too much store on profit forecasts. The managers believe that cashflow is a far more reliable guide to future profitability,” Hollands explained.

Richard Philbin, chief investment officer (investment solutions) at Hawksmoor Investment Management, said the fund has about 35 holdings but its top 10 comprise less than 40%, which “suggests a relatively flat portfolio”. The fund has about two-thirds in large-cap stocks and the remaining third in small- and mid-caps.

“It doesn’t really take massive positions away from the index,” he continued. “Its largest overweight at sector level is consumer discretionary (22% versus 10% for the index) and the largest country allocation is an underweight to Germany (9% versus 19.5%).”

Liontrust European Dynamic is the second-best performing fund in its sector over 10 years to 8 May 2025 and the third-best over five years.

Lightman European

Lightman European is a value fund but, like Liontrust, its managers adapt along with the market cycle. Manager Rob Burnett dials the value factor up and down depending on his bullishness and this macro-awareness has enabled him to ride out periods when value investing has not been in favour, Piper said.

Burnett and George Boyd-Bowman focus on the bottom 20% of their investable universe by valuation and look for catalysts that will spark a turnaround, he added.

Philbin said Lightman European has a concentrated portfolio of 40 to 50 holdings, with about 40% in the top 10. “The managers are not afraid to take large positions against the benchmark from both a country and sector perspective,” he noted.

The strategy has a bias towards higher yielding stocks. “The fund has a yield of around 4.5% for this year and is forecasting almost 5% for next year. This is also done with a portfolio price-to-earnings ratio less than the market,” Philbin explained.

The £934m fund is the fourth-best performing fund in its sector over five years but slipped to bottom quartile over three years.

BlackRock Continental European Income

AJ Bell uses BlackRock Continental European Income in its income portfolios and as a core holding for portfolios with a smaller allocation to Europe, where only one fund is needed.

Head of investment research Paul Angell said: “The managers of this fund prioritise downside resilience within their companies, as they look for quality businesses paying healthy dividends. Holdings are categorised across high yielders, compounders and high quality franchises.”

Tom Bigley, fund analyst at interactive investor, said the fund’s quality bias and style-agnostic approach means its returns differ from most equity income peers, which tend to have a value bias. The fund invests in quality businesses with strong corporate governance, a robust competitive position, earnings stability and sustainable and growing dividends, he said.

“The portfolio is constructed with a degree of pragmatism, tilting towards either stocks featuring above-average dividends or stocks growing their dividends, depending on the opportunity set and expected risk/reward,” Bigley explained.

“The managers' approach leads to a steadier return profile and to outperformance during periods of market weakness, with strong risk-adjusted returns when compared to both peers and the benchmark. The fund is currently yielding just over 3.4% and has historically beaten the yield of the benchmark by 50%.”

BlackRock Continental European is the six-best performing fund in sector over 10 years to 8 May and it is also top-quartile over 12 months. Its three- and five-year total returns are below the sector average, however.

The team changed last year with Stuart Brown joining from Aberdeen to replace Andreas Zoellinger, who is retiring. Co-manager Brian Hall remains in situ.

Angell said the change has been well managed with an extended handover period. The fund also benefits from BlackRock’s deep pool of European analysts, he noted.

Piper thinks Brown will be able to improve the fund. Since joining, he has made changes that have introduced a different element of diversification and he has deep knowledge of all the stocks within the portfolio, the FE Investments analyst said.