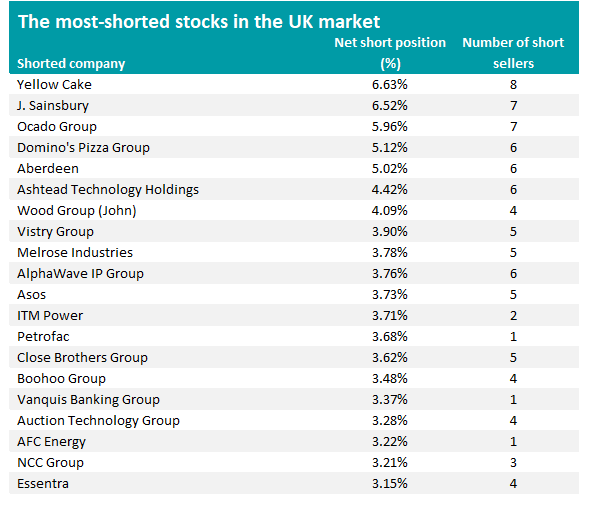

A uranium investment firm is currently the most shorted company in the UK, data from the Financial Conduct Authority (FCA) shows, although a more common theme among short sellers is betting against the UK economy.

Yellow Cake, which invests in physical uranium, has the most disclosed shorts against it under the FCA’s short selling regulations, with 6.6% of the firm’s share issuance being shorted.

Arrowstreet Capital has the largest short position (1.3%) but another seven companies are running shorts including Jupiter Asset Management, Qube Research & Technologies and AHL Partners.

Source: FCA, as at 1 Jun 2025

Yellow Cake offers investors direct exposure to the uranium commodity without the risks associated with mining operations. The company purchases uranium oxide and stores it at licensed facilities.

It was established to capitalise on anticipated long-term increases in uranium demand driven by global nuclear energy growth. Yellow Cake operates under a long-term supply agreement with Kazatomprom, the world's largest uranium producer, enabling it to acquire uranium at market-competitive prices.

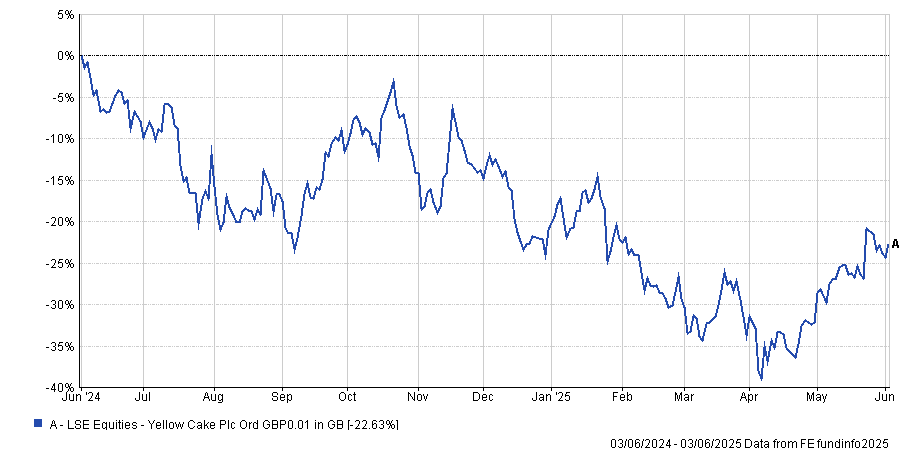

Since peaking at almost $110 per pound in early 2024, the uranium price has fallen some 30% to sit at around $72 today. It did fall as low as $63 a pound but has started to recover since. Over the past year, Yellow Cake’s shares are down 22% although, like the price of uranium, it has rallied in recent weeks.

Jacob White, ETF product manager at Sprott Asset Management, said the uranium market is now showing some positive signs: “After a period of volatility and hesitation, recent developments, from policy clarity around US tariffs to an inevitable resumption in utility contracting, have started to clear the path forward. While short-term investor sentiment has been shaped by geopolitical noise and macro uncertainty, the long-term drivers of the uranium bull market remain solidly intact.

“Supply remains constrained, with major producers exercising discipline and new projects facing delays or deferrals. The re-emergence of the carry trade highlights improving functionality in uranium markets and demand from AI-driven energy growth and national nuclear strategies continues to build quietly in the background.”

Performance of Yellow Cake over 1yr

Source: FE Analytics

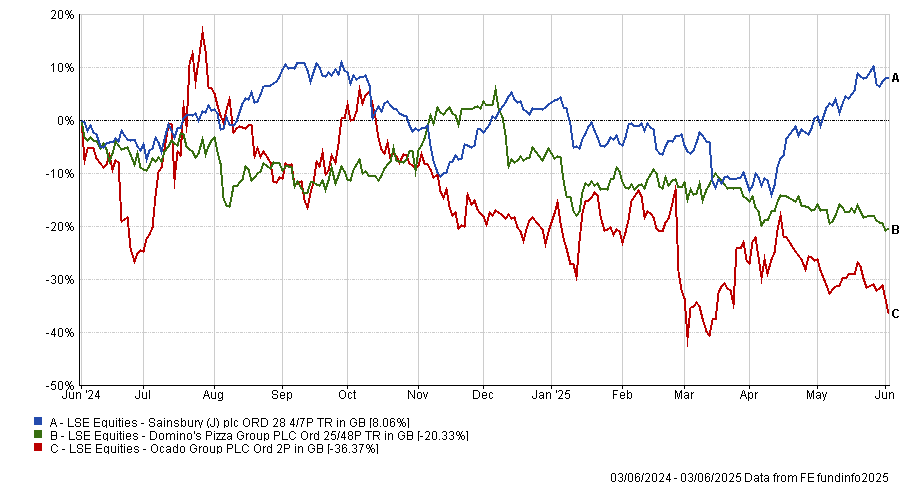

Next are a group of shorts that seem to be based on a worsening UK economy: Sainsbury’s, is the second-most shorted company on the FCA’s register, followed by Ocado and Domino's Pizza.

Some 6.5% of Sainsbury’s shares have shorts disclosed against them, with short sellers including AKO Capital, Ilex Capital Partners, BlackRock and GLG Partners.

Arrowstreet Capital, AQR Capital Management and Wellington Management International are among those shorting 6% of Ocado’s stock.

Meanwhile, Domino's Pizza has 5.1% of its stock in disclosed shorts, with GLG Partners, Fosse Capital Partners and JPMorgan Asset Management holding some of them.

Over the past year, Ocado has fallen 36.4% while Domino's Pizza is down 20.3%. Sainsbury’s has made a positive return of 8.1% after a rally in recent months.

The fortunes of all three companies are linked to the health of the domestic economy, which has a lacklustre outlook. Economists at groups such Barclays Capital, Capital Economics, Citigroup, Beacon Economic Forecasting and the British Chambers of Commerce expect the UK economy to grow by around 1% in 2025.

Performance of Sainsbury’s, Ocado and Domino's Pizza over 1yr

Source: FE Analytics

Similar reasoning might be behind the shorts on online fashion names Asos and Boohoo Group.

Asset management group Aberdeen is in fifth place, with shorts disclosed by six companies including BlackRock, GLG Partners and Canada Pension Plan Investment Board.

Aberdeen has struggled to maintain its market position since merging with Standard Life in 2017. The business faced integration challenges and continued client outflows as several key funds underperformed and investors shifted towards passive strategies.

Market volatility, rising interest rates and poor performance in emerging markets have further weighed on the firm. Although it acquired Interactive Investor to broaden its reach, the company remains under pressure to stabilise revenues and define a clear strategic path.

But its shares are actually up over the past 12 months, gaining close to 26%. That bucks a longer-term trend, which has seen the shares decline for much of the past decade.