The UK market does not need global investors to return to be an attractive investment opportunity as it has many unrecognised strengths already, according to Alessandro Dicorrado, manager of the Ninety One UK Special Situations fund.

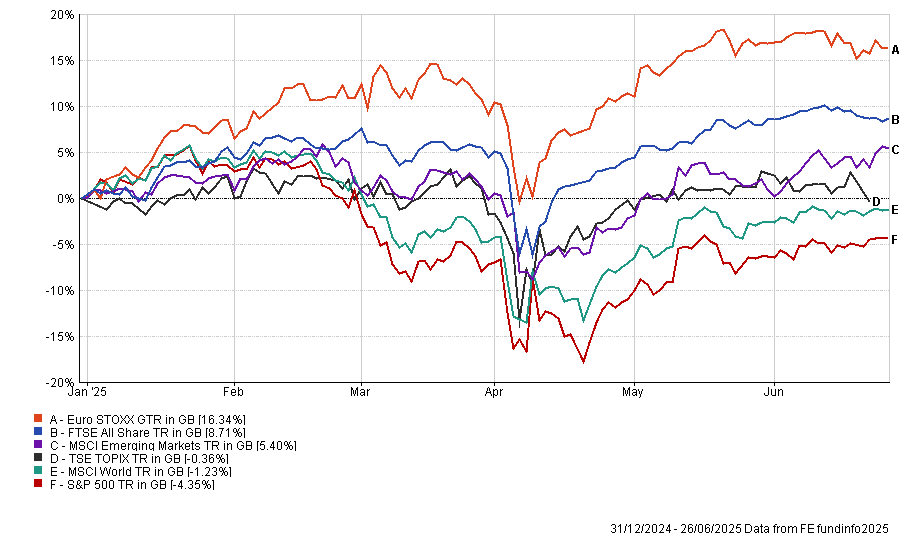

The UK market is rallying this year, with the FTSE 100 hitting record highs and the FTSE All Share outpacing the US and many other developed markets, as seen in the chart below.

Dan Coatsworth, investment analyst at AJ Bell, said this is “exactly what’s needed to raise the UK market's profile among international investors”.

Performance of developed equity markets in 2025

Source: FE Analytics. Total return in pounds sterling

But for Dicorrado, hoping that international investors will come back is missing the point. “Do I want a revival in the UK? Not really. I don’t think you need anyone to come back”, he said.

Domestic investors have been turning away from the UK for some time. UK equity funds have shed £8bn in net outflows over the past year, according to data from the Investment Association, continuing a trend that has been in play since 2016.

Over the past five years, the FTSE All Share is up 39.4% in price performance terms, underperforming the S&P 500’s 83% rise. However, these indices track the capital value of the stock markets, not the total return they generate, which makes the UK look worse than it is.

When dividends are included, things become a lot different, he said. FE Analytics shows the total return of the FTSE All Share was 66.9%, which is much closer to the S&P 500’s 93%.

“One thing I think people don’t quite appreciate is how big of a component dividends are in your total returns,” Dicorrado said.

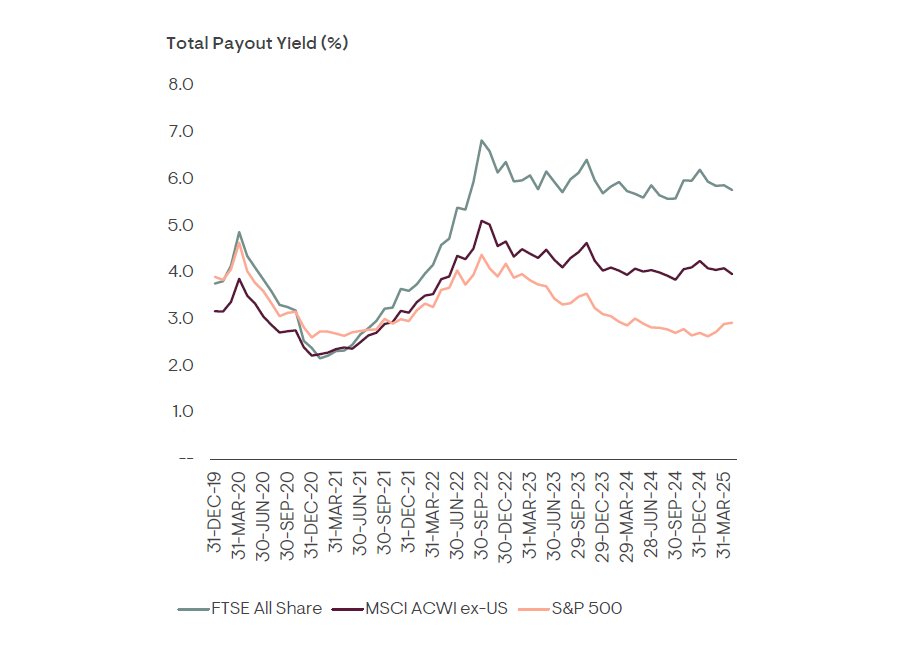

Since 2020, the average payout yield on the FTSE All Share has risen to around 6%, outpacing the S&P 500, as demonstrated by the chart below.

Total payout yield of major equity markets since 2020.

Source: Ninety One

Starting with 6% dividend yield gives UK investors a head start over many other equity markets, he explained. While the FTSE All Share may have grown less impressively than the S&P 500, the high starting yield means UK companies have “far less work to do” to achieve comparable total returns.

“You have to think about buying a stock over the long term. Some of your returns will be from growth, but in the UK, most of it will come from the dividend,” he added.

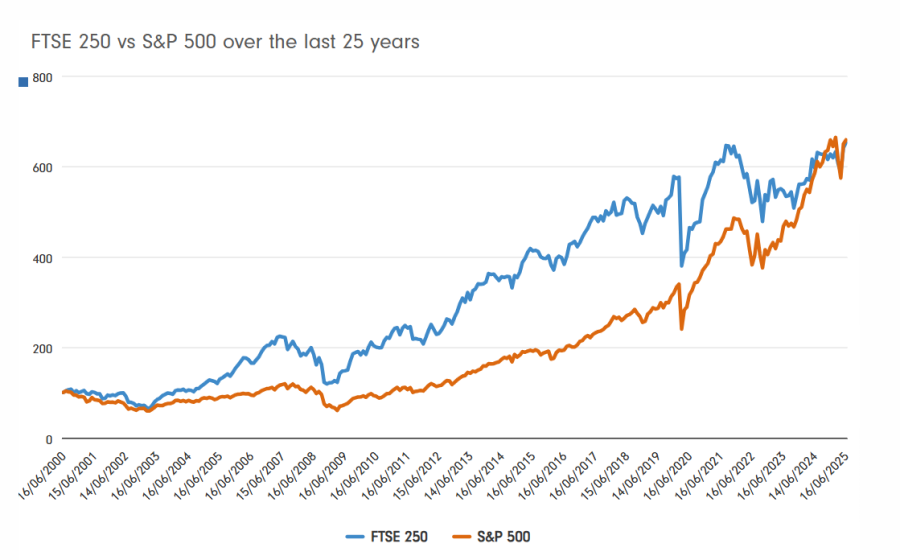

He is not the only investor to draw attention to this. Recent research from Fidelity International indicated that an investor who put a lump sum of £100 in the FTSE 250 25 years ago would have outperformed someone doing the same in the S&P 500, due to the influence of dividends.

Source: Fidelity International

Dicorrado said: “If the strong, good companies on the market continue to do even just okay, you’ll see it in earnings growth, you'll see it in payouts and you’ll see it in your return.”

This is part of the reason why the UK did not need a revival: the returns are already attractive and, by waiting for international interest, investors are missing out, he argued.

Additionally, interest from global investors would narrow the valuation gap between the UK and its competitors, creating a new set of challenges.

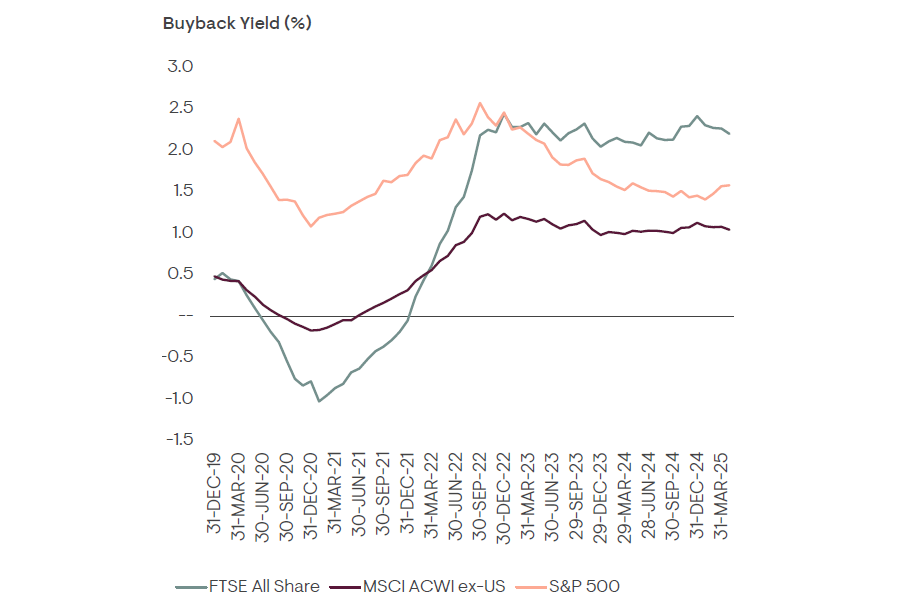

This is because cheap stocks encourage share buybacks, he said. While the UK has always been a high dividend-paying market, historically it was not big on share buybacks and UK businesses used to “waste a lot of money” before the pandemic.

Nowadays, UK businesses are much more careful with capital than they used to be. Instead of sitting on excess capital or buying other companies, more UK businesses are considering buying back their stocks and investing internally, with the buyback yield on the average FTSE All Share company rising to around 2.5% over the past five years.

Share buyback yield of developed markets since 2020

Source: Ninety One

This process of share buybacks is primarily a “function of valuation”, he explained.

“If you buy back stock at a cheap valuation, you're compounding the per-share earnings of whatever investor remains. It’s like the end investor buying more of the stock, except the business is doing it for them.”

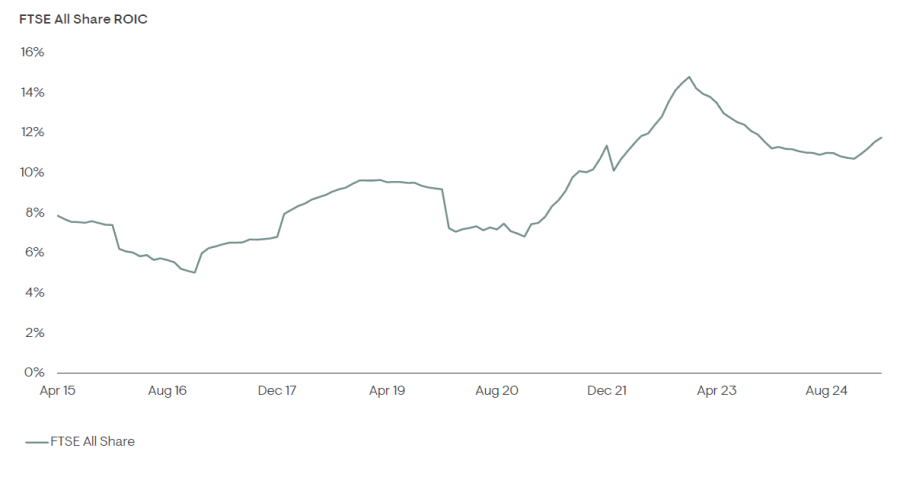

Internal investment has also made UK businesses much stronger and tightly run, with the return on investor capital (ROIC) of the FTSE All Share doubling in the past decade.

FTSE All Share ROIC since 2015.

Source: Ninety One.

“We got consumer staples in the UK that are cheaper than consumer staples in the US and we’ve got industrials and capital goods that are cheaper than in Europe.”

If international investors do come back, he explained, these stocks will likely rerate upwards, which would boost returns, but it would also make share buybacks far less compelling.

“We don’t want the market to die, of course, but we want it to remain cheap,” Dicorrado said. “So I don’t think you need that [international interest] to make the call to invest in the UK.”

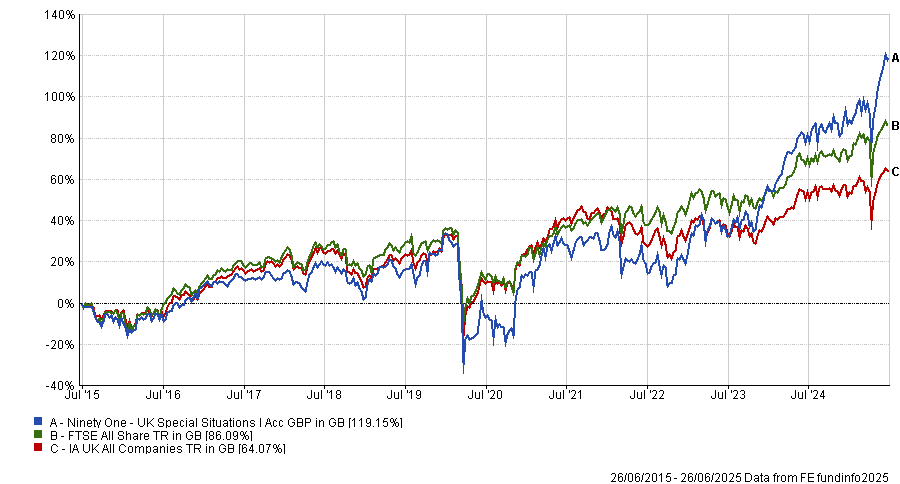

Performance of fund vs sector and benchmark over past 10yrs

Source: FE Analytics. Total return in pounds sterling

Ninety One UK Special Situations has delivered top-quartile returns in the IA UK All Companies sector over the past one, three, five and 10 years, while outperforming the FTSE All Share over all these periods.