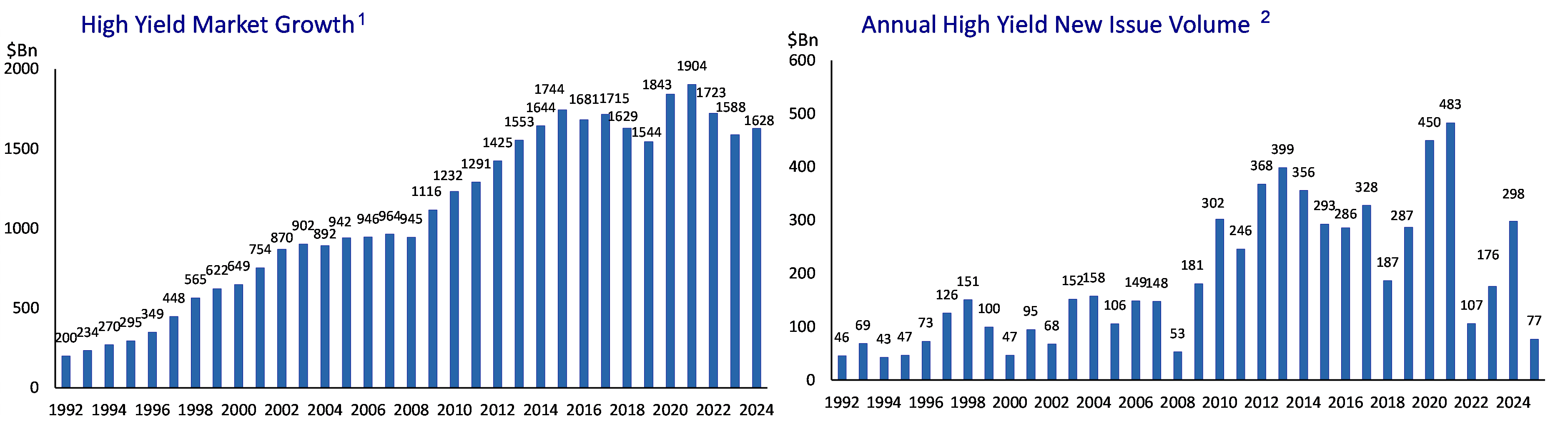

Since the global financial crisis, the US high yield market has undergone a structural evolution driven by low interest rates and regulatory changes.

New issue volumes increased dramatically after 2008 as financing costs for high yield companies declined, attracting more diverse and sophisticated companies. Amongst the largest issuers today are recognised brands and global leaders including Charter Communications, Hilton Hotels and Carnival Cruise Lines.

Meanwhile, regulatory changes have been successful in encouraging more sophisticated borrowers into the market, attracted not only by cheaper rates but also the additional flexibility that high yield bonds give companies around their financing needs.

This new supply has been met by increased investor demand given attractive yields relative to other parts of the fixed income spectrum, with traditional buyers of US high yield such as mutual funds, pension funds and insurance companies all increasing their exposure in the post- global financial crisis decade.

Source: JP Morgan Research: 1) Credit Strategy Weekly as of 31 December 2024; 2) high yield Bond and Leveraged Loan Market Monitor as, of 30 April 2025.

Improved ratings mix

Coinciding with this growth has been a shift in the credit quality of the US high yield market, with the amount of BBs (at the highest end of the high yield rating spectrum) growing from 38% pre- global financial crisis to 53% today, at the expense of the CCC and below rated issuers (the lower end of the spectrum), which today account for just 11% of the market.

This trend has accelerated since 2020 and reflects the scale of credit improvements made by high yield issuers – using the initial fall in interest rates to push out maturities and refinance at low levels. This allowed many high yield companies to use the extra cash to reduce leverage and improve interest coverage.

Consequently, the market has witnessed record amounts of rising stars moving from high yield to investment grade, with $282bn of rising stars elevated between 2022 and 2024 compared with $37bn of fallen angels moving the other way.

Declining defaults

This trend is also significant in accounting for the declining US high yield default rate over this period. Since the pandemic-induced peak of 6% (excluding distressed exchanges), the par-weighted 12-month trailing high yield bond default rate has declined to just 0.3% as of April 2025 (or 1.3% including distressed exchanges).

Historically, the CCC portion of the high yield market has accounted for the vast majority of defaults – so the better ratings mix today provides a healthy starting point when thinking about where the default rate goes from here.

Furthermore, there has been growth in the proportion of high yield new issuance that is secured (first or second lien), which has priority over unsecured debt in the capital structure due to being backed by underlying assets.

This offers higher recovery rates to creditors, which acts as compensation for lower coupon rates. The surge in secured issuance, which makes up nearly one-third of today’s US high yield market, is one of the ways in which issuers have adapted to the higher interest rate environment since 2022, allowing them to minimise interest expense.

A new normal for spreads?

During April’s tariff-related volatility, US high yield spreads widened by 103 basis points (bp) in two days – one of the largest two-day moves outside of the 2008/2009 crisis. Suddenly, investors were faced with that age-old quandary: buying opportunity or worse still to come? After a strong two-year rally, many had been waiting on the sidelines for such an entry point. Yet spreads rallied back strongly.

What comes next? Did the entry point come and go in the blink of an eye? April’s peak came close to the post-crisis average of 465bp but was still comfortably within the non-recessionary historical average spread of 496bp.

However, given the structural changes in US high yield market composition, comparing spread levels today with longer-term historical averages may be inherently flawed, even if recent ranges have been expensive relative to any yardstick. Putting a number on what the ‘new normal’ average high yield spread might be over the next 15 years is anyone’s guess, but there is a fair argument to suggest that it will be lower again than the previous 15 years.

This is not only due to factors above, but also due to improvements in liquidity made possible by electronic trading and portfolio trades, which have partly facilitated a decline in high yield bid-ask spreads. Meanwhile, due to shifting dynamics across the leveraged finance landscape, stressed issuers across both the high yield bond and BSL (broadly syndicated loans) markets that may have gone on to default in the past now have the backstop of accessing capital flowing in from private credit. This has contributed towards a lower default rate, but it could also drive coupons down in the future.

With fundamental and technical factors still proving supportive, on current reading we do not see the high yield default rate picking up to levels higher than long-term averages – even with heighted uncertainty on the macro front. In this scenario, spreads should continue to find support from buyers on any widening, as happened towards the end of April and into May.

Today’s US high yield market can be characterised by improved overall credit quality, better liquidity, lower duration and a higher proportion of secured bonds than 15 years ago. We feel that, together, these factors have rendered the old stigma associated with the high yield market obsolete. Maybe, just maybe, it can shake off the junk bond reputation for good over the coming decade.

Jack Stephenson is a US fixed income investment specialist at AXA Investment Managers. The views expressed above should not be taken as investment advice.