Equity funds were hit with £98m in outflows in June as geopolitical tensions in Iran unsettled the market, according to Calastone’s latest Fund Flow Index, although the conflict did not lead to panic among investors.

In June, Israel launched a series of coordinated airstrikes on over 100 Iranian military and nuclear sites, including key installations at Natanz and Fordow. Iran replied with missile and drone attacks, before the US struck Iranian nuclear enrichment facilities on 22 June.

A phased ceasefire went into effect on June 24–25 following mediation by the US and Qatar. The 12‑day confrontation subsided, immediate geopolitical tensions stabilising and markets calming down.

But June’s equity outflows were not driven by increased selling on the back of investors’ nerves, Calastone’s data suggests. Sell orders fell 2.5% to £11.4bn, but buy orders dropped 7.5% to £11.3bn – their lowest level since September 2023 – indicating a buyers’ strike rather than a rush to exit.

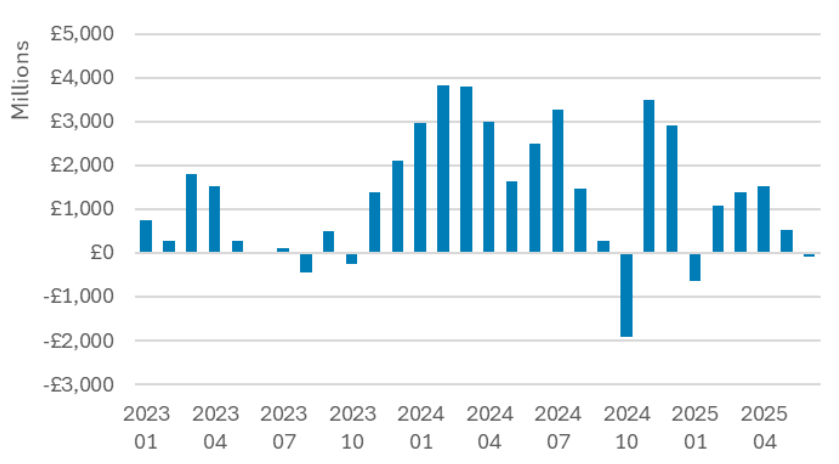

Net flows to equity funds

Source: Calastone Fund Flow Index – Jun 2025

Edward Glyn, head of global markets at Calastone, said: “June was characterised by caution, not fear.

“A net outflow from equity funds as an asset class is relatively rare as we have a structural bias towards adding to our savings – just one month in five over the last 10 years has ever seen investors withdraw capital.”

But he described June’s equity fund outflows as “modest”, saying a £98m withdrawal is “vanishingly small” in the light of £22.7bn of total transactions carried out over the month.

UK equity funds had the largest withdrawals, with £594m in net outflows, continuing a long-standing trend of monthly selling by UK investors. Global equity funds also recorded significant outflows at £365m, the first net selling since September 2022 and only the fifth such month on record.

European equity funds attracted £301m in net inflows, while North American equity funds saw £306m in new capital. Inflows into North American funds increased from May’s £115m but were significantly below the March and April combined total of £3.3bn.

“On the one hand investors were naturally worried by the outbreak of a war with unpredictable consequences and on the other they were reassured by global stock indices being relatively unmoved. They dropped a little at first before ending June ahead, while bond markets rallied throughout the month,” Glyn said.

“Investors weighed the uncertainty, but did not panic.”

Bond fund inflows declined to £195m from £328m in May, while money market funds saw inflows rise to £218m, up from £85m the previous month.