Asset managers and hedge funds continue to take big bets against UK stocks, data from the Financial Conduct Authority (FCA) has found.

Despite the FTSE 100 breaking an all-time high last month, data from IG showed a 34% increase in shorts against the FTSE 100 in July.

Indeed, the amount of stock on loan for companies such as Whitbread (parent company of Premier Inn), real estate investment trust (REIT) Primary Health Properties and bakery chain Greggs, has shot up in the past few months, according to AJ Bell.

Dan Coatsworth, investment analyst at AJ Bell, said that the increased amount of stock on loan indicates that certain companies have either become more popular with short sellers or that existing sellers have become even more confident.

He added: “Forget pomp and glory, certain investors are hoping for ‘slump and glory.”

Despite the “recent euphoria”, the rise of short selling in UK stocks should be a reminder that investors need to think about downside as well as the upside potential of businesses, Coatsworth said.

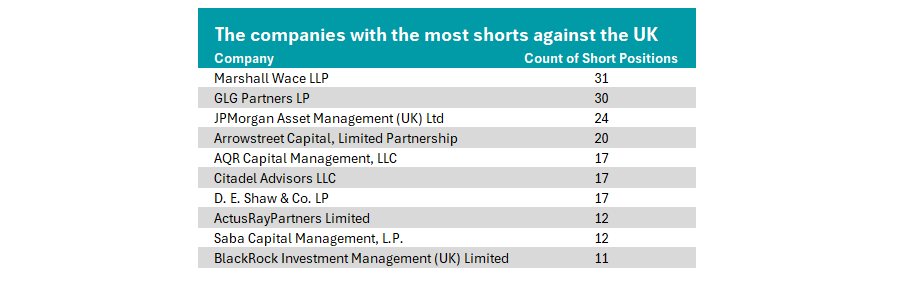

Below, Trustnet looks at the 10 companies taking the most bets against the FTSE 100 and some of their prominent shorts.

Source: Financial Conduct Authority. Data as of 7 August.

At the top of the chart is the hedge fund Marshall Wace LLP, with 31 short positions. Established nearly 25 years ago, the business specialises in long and short global equity strategies, using a quantitative and systematic approach to investing.

Marshall Wace’s largest short position is Hochschild, while its second-largest disclosed short position is Whitbread, a popular option among short sellers recently, with the amount of shares out on loan rising from .2% at the start of June to 5.3% by the end of July.

Coatsworth said despite “ongoing weakness” in the first quarter, Whitbread is trading near its highest multiple since February 2024 after a strong second quarter.

“Short sellers might have concluded the shares have now gone too far, given the news flow doesn’t warrant a premium rating,” he added.

The firm with second largest number of short positions against UK companies is GLG Partners/Man Group. It is the world's largest publicly traded hedge fund, with more than $193bn in assets under management (AUM).

GLG Partners currently hold 30 short positions against UK stocks, including Primary Health Properties (PHP).

AJ Bell’s research found that this was one of the stocks that experienced the biggest rise in short interest in recent months, with the amount of stock on loan rising from 1.8% to 8.3%.

The REIT has been involved in a battle with private equity group KKR to buy medical centre property owner Assura this year, one of many high-profile UK takeover bids.

Assura has recommended shareholders approve the bid from Primary Health Properties, but the slide in PHP’s share price is “telling”, Coatsworth said.

“Short sellers will have been watching this situation closely as Assura’s board seems to be happy to back whoever offers the most amount of money. If PHP loses the bid, its share price could potentially fall back further and that would net the short sellers a profit,” Coatsworth said.

JP Morgan Asset Management (JPMAM) is in third place with 24 short positions. As one of the world's largest asset managers, JPMAM runs more than $3.4trn in assets, with a team of 1,300 investment professionals examining approximately 3,800 companies.

Notably, it holds a 0.6% short against French (but London-listed) film and television company Canal+. It has taken this position despite the parent bank, JP Morgan Chase, among the primary backers for the French firm’s flotation on the UK stock market last year.

Further down the chart is Saba Capital Management. The hedge fund led by Boaz Weinstein may be familiar for its extensive battle with investment trust boards that started at the end of 2024.

It runs roughly $5.9bn in AUM with an emphasis on credit relative value and capital structure strategies. As of 7 August, it is shorting 12 UK stocks.

At the very bottom of the chart, BlackRock Investment Management UK is shorting 11 UK stocks. BlackRock is the largest investment management company in the world and UK branch was established in 1998.

Its largest short position is fellow asset manager Aberdeen plc, but it is also shorting Greggs.

The UK bakery chain has experienced a poor first half of 2025, with the share price down almost 42%. Poor trading updates have been attributed to weather conditions decreasing demand, but investors are “growing tired of the excuses”, Coatsworth said.

The investment case was based on the firm's rapid expansion but changing tastes have led to “growing concerns that Greggs' recent slowdown may not be a one-off”.

Short sellers might be banking on further deterioration in investors' sentiment and in the retailer's share price, Coatsworth concluded.