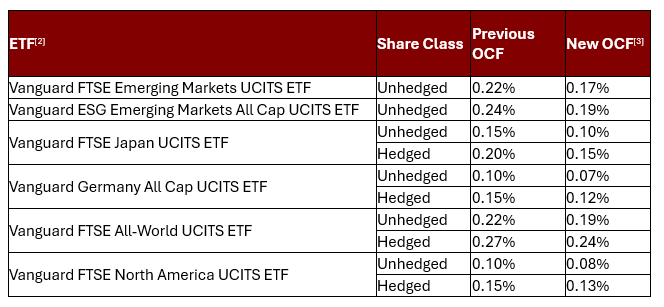

Vanguard has announced fee reductions on five of its regional exchange-traded funds (ETFs), as well as the flagship FTSE All World UCITS ETF. From 7 October, the ongoing charging figure (OCF) of the six vehicles will reduce by between 2 and 5 percentage points.

The $48bn FTSE All World tracker will charge 0.19% for the unhedged share class and 0.24% for the hedged share class – a three basis-point reduction which will save investors a yearly 30p per £1,000 invested.

The same principle applies to the Vanguard Germany All Cap UCITS ETF, where the fee was cut by 3 basis points, while the Vanguard FTSE North America UCITS ETF is now 2 basis points cheaper.

The biggest cuts (5 basis points) were reserved for the Vanguard FTSE Emerging Markets and ESG Emerging Markets trackers, as well as the Vanguard FTSE Japan UCITS ETF, as the table below shows.

Vanguard’s new fees

Source: FE Analytics

This follows Vanguard’s decision to cut fees across its fixed income ETF range earlier this summer.

Jon Cleborne, head of Vanguard Europe, said this latest round of equity fund fee cuts will “help investors keep more of their returns”.

“It’s part of our ongoing mission to lower the cost and complexity of investing – helping to make money for investors, not from them,” he said.

Cleborne estimated the reduction in the FTSE All-World UCITS ETF alone will save investors $13.7m per year, with total annual savings from today’s changes expected to reach approximately $18.5m.