Owning SpaceX offers investors exposure to one of the world’s most transformative companies according to Scottish Mortgage FE fundinfo Alpha Manager Tom Slater, but the best part is that you can get it effectively “for free”.

Explaining why requires some maths and forecasts, starting with SpaceX’s latest valuation point of about $400bn in market capitalisation.

“The way to think about its valuation is through Starlink, which exited [ended] last year with 4.5 million subscribers. [Owner] Elon Musk recently said they now have 7 million, so by simple extrapolation we can probably say they’ll exit this year with about 9 million – growing at 100% annually,” Slater said.

These assumptions also include a market share expansion. The broadband market is worth around $1tn, said Slater, with Starlink owning less than a 0.5% share. But its technology is getting better and cheaper, with the required antennae having fallen “substantially” in price.

“If you assume $75 a month for the service over 12 months, that’s about $8bn in revenue, growing at 100%. Everyone can make their own assumptions about where that $8bn of revenue that they're going to exit this year with is going to go to. But if you add in a couple more reasonable margin assumptions and Starlink’s growth pays for the whole of SpaceX,” the Alpha Manager said.

Then there’s the launch business. SpaceX “has a monopoly” on rocket launches that is set to “transform what’s done in space and how attractive it becomes”.

This allowed Slater to declare: “To my mind, you’re getting that business for free at this point.”

SpaceX is Scottish Mortgage’s top holding. With a 7.8% weighting in a £12bn portfolio, the position is approximately worth £1bn.

But while Slater is investing with Elon Musk in SpaceX, he is not doing the same with Tesla, a name which he “very substantially” reduced at the end of 2024.

He did keep a small position, however, because “it’s usually a bad idea to bet against Elon Musk”.

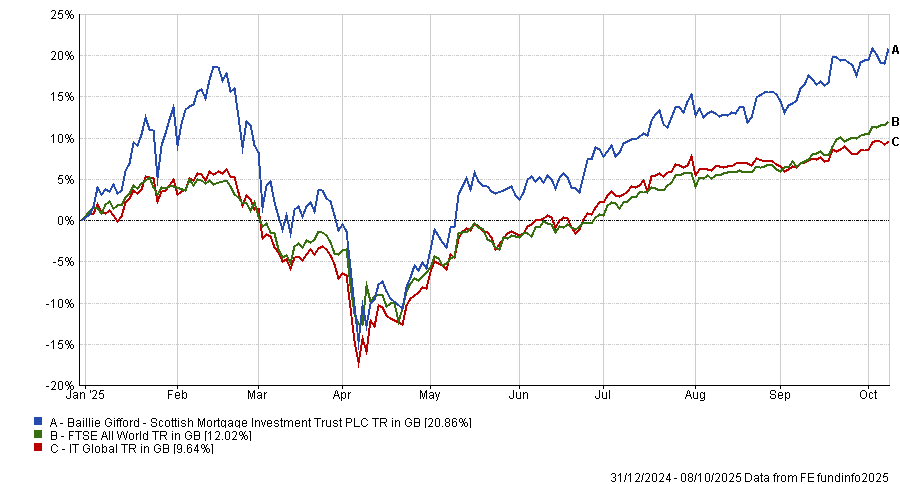

Performance of fund against index and sector over 1yr

Source: FE Analytics

The decision to cut Tesla was prompted by a change in its strategic focus. The company no longer plans to release many new passenger cars, Slater explained, as management has decided the future is autonomous and electric. “They’re all in on that bet,” he said.

The case for holding Tesla therefore now depends on believing in its autonomous driving and robotics ambitions.

“To own Tesla today, you have to believe autonomy – particularly RoboTaxi – will succeed, and that its technology will also enable humanoid robots,” the Alpha Manager said.

“If you believe those two things, you can still make a lot of money in Tesla. Our judgment was that you were paying too much upfront for that opportunity with too many proof points still to come.”

Slater is not against autonomous vehicles and was impressed when he tested self-driving technology in person across different markets.

“I rode in autonomous vehicles from three different companies in Shanghai and Beijing. I’ve also driven in Google’s Waymo cars and in Wayve vehicles [a UK start-up within the Scottish Mortgage portfolio] here in London. These cars are very safe,” he said.

People have been excited about autonomous cars for years and, although it has taken time for these cars to meet exacting standards, Slater noted “we’re now getting there”.

“It’s hard for humans to judge the difference between something that’s accurate 99.99% of the time and something accurate to six or seven decimal places of nines. Travelling along that safety curve has delayed deployment,” he said.

“Waymo is doing hundreds of thousands of rides a month in San Francisco and expanding rapidly. Aurora Innovation, which we own, has launched commercial autonomous trucking in Texas. These vehicles are now safer than human drivers and ready for prime time.”

Whether all the progress is going to come from developed markets, however, remains to be seen.

“One thing that this story illustrates is that this is going to be a much more competitive market in China,” he said.

“There's a relatively small number of players across everywhere else in the world, whereas in China there's a handful of really credible players that are going to really drive this trend forward quickly.”