Credit spreads (the gap between the yields of government bonds and corporate bonds) are at their tightest levels since the global financial crisis, but could tighten even further, according to Stephen Snowden, head of fixed income at Artemis.

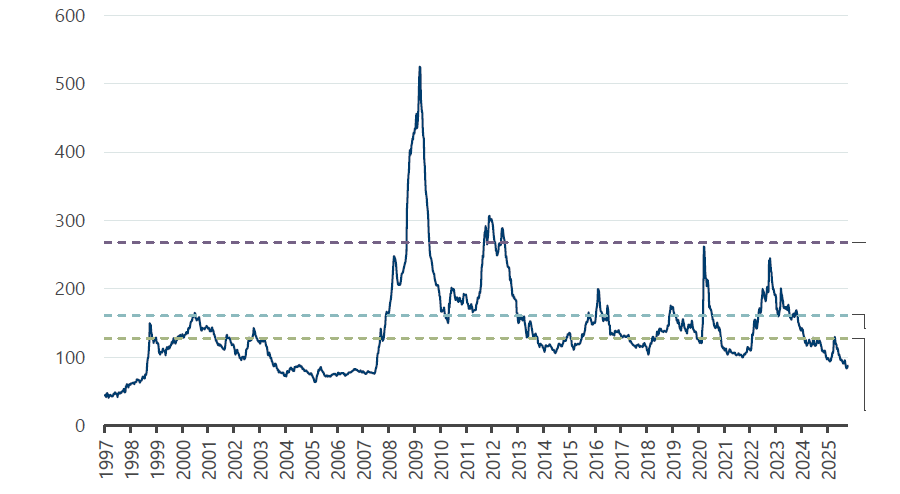

The yield gap is currently below 100 basis points (bps), a relatively low level over the past 17 years. However, in the early 2000s this would have been considered normal, as spreads could be much lower, as demonstrated by the chart below.

ICE BofA Sterling Corporate & Collateralized index spread to worst

Source: Artemis

The “consensus view” has been to avoid corporate bonds this year and wait for spreads to widen, but this is a mistake, Snowden said, as “spreads will get tighter again from here”.

This is due to changing dynamics in the fixed-income market between corporate and government bonds.

Corporate bonds, which are meant to be riskier, now seem “increasingly safe”.

Household debt ratios are sliding across the UK, US, and Europe, meaning the average Western consumer is now far more creditworthy than they used to be, and corporate balance sheets appear similarly well-positioned, with the average corporate balance sheet improving internationally.

By contrast, government bonds, which are meant to be risk-free assets, seem increasingly volatile.

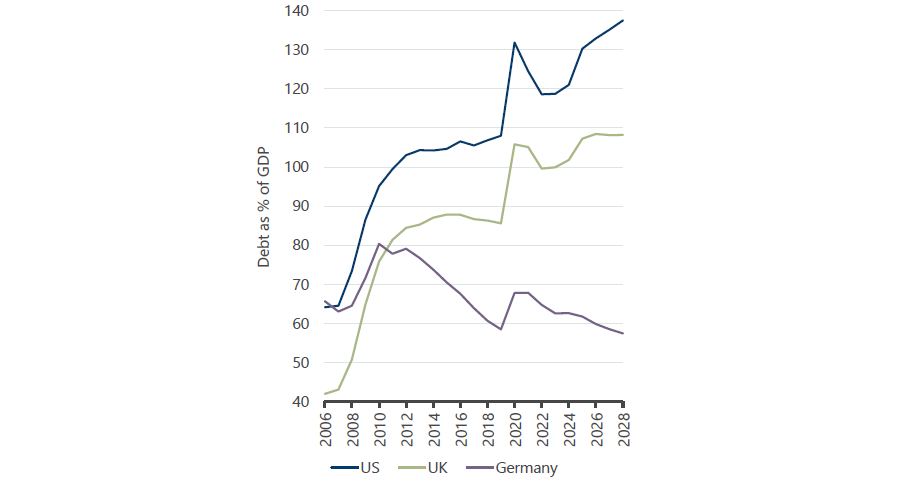

Countries are operating on increasingly high debt-to-GDP ratios and have made very little progress in getting their balance sheets in order. Even Germany, which has lower debt than the US and UK, will have to deal with increasing debt as it funds its government stimulus package, the Artemis manager said.

Government debt to GDP levels

Source: Artemis. Bloomberg, IMF, OBR.

This means that the risky part of the market has become comparatively safe for investors, while government debt has become increasingly unreliable. “All things being equal, credit spreads should be at their tightest level in history. But they’re not,” Snowden said.

On top of this, investors tend to overestimate how long the market spends at a genuinely wide level, he said.

Since 1997, the median spread is about 128bps, which is “quite low” and not that far off current levels. By contrast, the yield gap has rarely been very high; spreads were above 268bps just 5% of the time over the past 28 years and have only peaked above 161 bps in 25% of the period, he said.

“The amount of time credit spreads spend at these elevated levels is fleeting and short,” Snowden said. As a result, it is more likely that spreads will tighten from here rather than widen significantly.

Instead of waiting for spreads to widen, investors should recognise that the corporate bond market still offers good opportunities, the manager said.

For example, UK corporate bonds currently yield around 5%, which is above the average 3% dividend yield from the FTSE All Share, as seen in the chart below.

UK corporate bond vs UK dividend yield

Source: Artemis. Bloomberg

This is a strong starting point for investors' long-term return, he said. While valuations do not “look particularly attractive”, compounding interest on yields of this level should result in much better returns over the long term, making up for this starting point.

Investors should be taking advantage of these high yields while they have the chance, Snowden said.

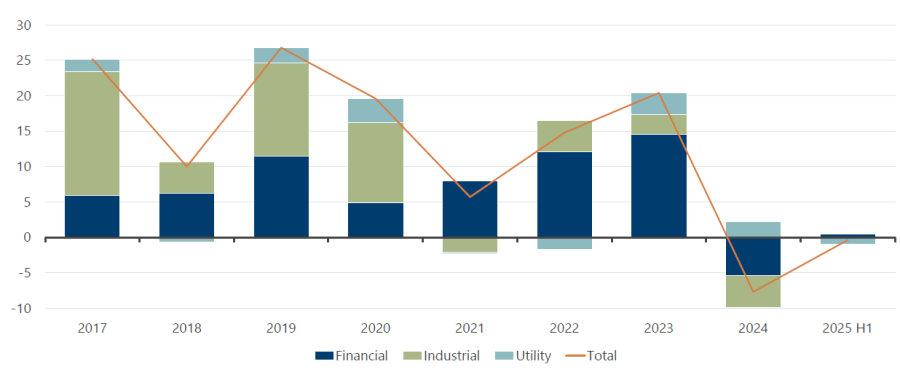

“Companies will always do share buybacks and issue dividends and build new factories. They are not always likely to issue you a 6% bond.” Indeed, issuance in the UK corporate bond market “declined last year and is predicted to fall again next year”, as seen in the chart below, meaning investors will not always have access to these attractive yields.

Net issuance of UK corporate bonds

Source: Artemis, Bloomberg, data as of 30 June 2025. Net issuance in £bn.

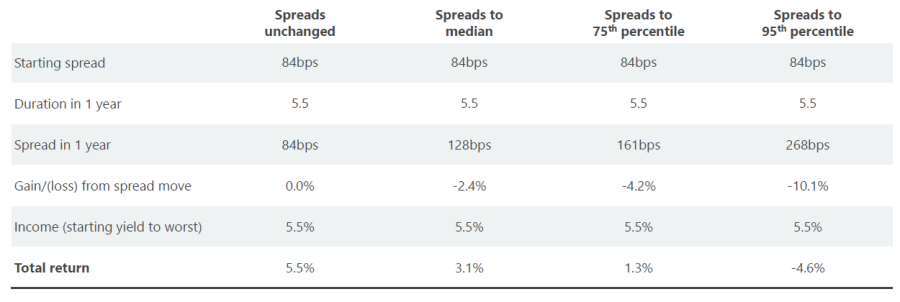

The high starting yield means that investors have exaggerated their potential for losses in this asset class.

If spreads widened to more than 268bps over the next year, investors would lose 10.1% from the move; however, a starting yield of 5.5% would reduce this to a loss of just 4.6%. By contrast, global equities have historically slid by around 30% in the same scenario, Snowden said.

Meanwhile, if spreads widened to median or 75th percentile levels (161bps), the coupon means that investors would still have a positive total return, as demonstrated by the chart below.

Source: Artemis, ICE BofA indices, Bloomberg. Data as of 30 September 2025.

“If you’ve avoided or sold corporate bonds this year because they’re too expensive and you’re worried they’re too risky, you’ve probably wasted your time,” he concluded.