The extreme concentration of the S&P 500, the self-reinforcing role of index flows and the widening gap between US mega-caps and the rest of the market are central risks for investors, especially fans of index trackers.

The question for investors then is how to approach the index sensibly at a time when leadership has become so narrow and valuations so stretched.

Retreating from equities is not the solution, according to Simon Evan-Cook, multi-manager at Downing, who said the real task is to reconsider where risk is being taken.

Investors continue to crowd into the most expensive areas of the market despite the presence of far more attractive opportunities elsewhere.

“Everyone is doing exactly the opposite [of what they should] currently, and they are charging towards that.”

How investors can respond

Several practical options exist that don’t involve piling in (or cashing out). The first is to underweight the US – though investors must be willing to tolerate the risk that the current market regime persists for some time. Alternatively, active management may better suit investors who want deeper scrutiny of underlying holdings while maintaining diversified exposure.

Rupert Silver, director at Credo, said the Credo Dynamic Fund aims to combine growth-oriented US technology exposure with value-based holdings across a wide geographical base.

Bringing small- and mid-caps into the mix can also result in a “more balanced and blended strategy where different parts of the portfolio can contribute at different times and in different scenarios”.

The limits of equally-weighted and capped indices

Some investors have turned to capped or equally-weighted versions of the S&P 500, where single positions can’t exceed certain limits, but Andrius Makin, associate portfolio director at Killik, argued that these strategies can introduce new problems.

While appearing to solve concentration, this approach is “flawed because it increases exposure to lower quality companies, not to mention the increased transaction costs of frequent rebalancing.”

Silver, however, noted that the case for equal-weighting has historically held up.

“The bifurcation of performance has been significant in recent years, reversing historical norms where the equally weighted index more often outperformed”.

Evan-Cook agreed that equally-weighted indices contain structural quirks of their own, for example, they have higher exposures to sectors where there happens to be a large volume of companies. This, however, didn’t worry him too much as he stressed that he would not invest in the market-cap weighted version of the index.

Time horizon: The hidden risk behind concentration

Another key consideration is time horizon. Makin said: “After each and every drawdown the S&P 500 has always recovered because it is diversified across many companies and sectors.”

Capital naturally reallocates to firms expected to grow their earnings, which then gain a higher weight at each rebalancing. This mechanism means the index “is far from uninvestable, assuming your time horizon is long enough to hold through any drawdowns and let rebalancing work its magic”.

Evan-Cook also picked up on this, noting investors should not underestimate how long it can take to recover from valuation extremes.

“If you had bought the US equity tracker in September 2000 as a Briton, you had to wait 11 and a half years to break even,” he said.

For those approaching retirement or with shorter investment windows, this is a material issue. Investors with at least a decade to spare may be able to look through this risk, but many cannot.

“Frankly, I just don’t see that you need to be taking that type of risk, currently”.

Where opportunity still exists

Rather than viewing equity allocations as a binary decision (to invest or not), the more meaningful distinction is between expensive and attractively valued parts of the global market.

Evan-Cook pointed to the early 2000s as a reminder that the most unloved sectors can lead the way once extreme valuations unwind.

“When you look at what did well in the noughties, that was stuff that everyone hated back then, which was UK small-cap value,” he said. “Small-cap value did well everywhere”.

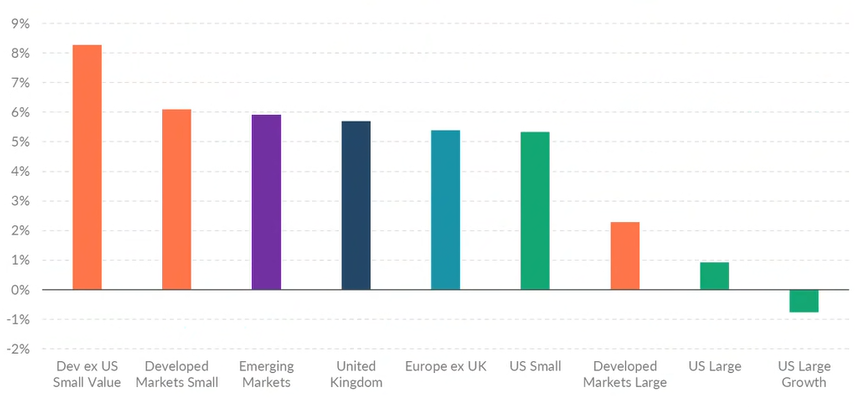

Today, he sees a similar pattern developing, as the chart below shows.

Expected 10-year real returns

Source: Downing, Research Affiliates as at August 2025.

While retail flows remain heavily tilted towards the most expensive US mega-caps, professional managers with personal stakes in their funds have been “tiptoeing away” from the US, Evan-Cook noted.

In the Downing Fox range, this has resulted in a reduced US exposure from around 35% to roughly 30% over the past couple of years.

Instead, he is more in favour of a modest home bias, particularly when the domestic market is “one of the cheapest on the planet” and with the quality of its corporate governance.

UK and European small-caps, along with parts of Japan, also look “really quite attractive, more attractive than they looked in a generation,” he concluded.