European stocks have been the runaway winner of 2025 and there is every reason to believe they can top the charts once again next year, according to Rob Burnett, manager of the WS Lightman European fund.

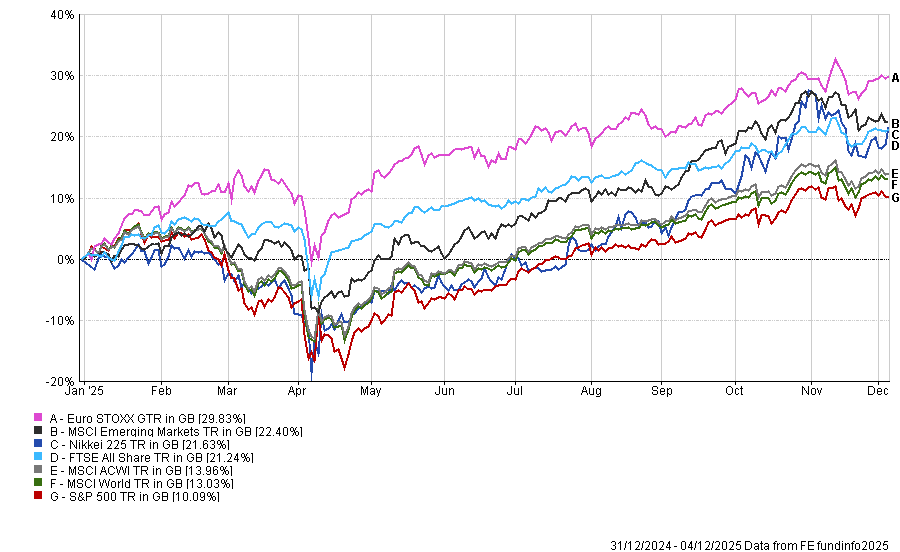

So far this year, the Euro Stoxx index has gained 29.8%, some 7 percentage points ahead of the next best index, MSCI Emerging Markets.

Looking at returns in sterling terms, the S&P 500 has been the worst place investors could have put their money in 2025, with the premier US index up just 10.1%.

Performance of indices YTD

Source: FE Analytics

“European equities are experiencing their seventh-best year versus US equities since 1969. Despite the AI euphoria, US underperformance has been significant in 2025,” said Burnett.

Below, he outlines 10 reasons why he expects this divergence in returns between Europe and the US to continue heading into 2026.

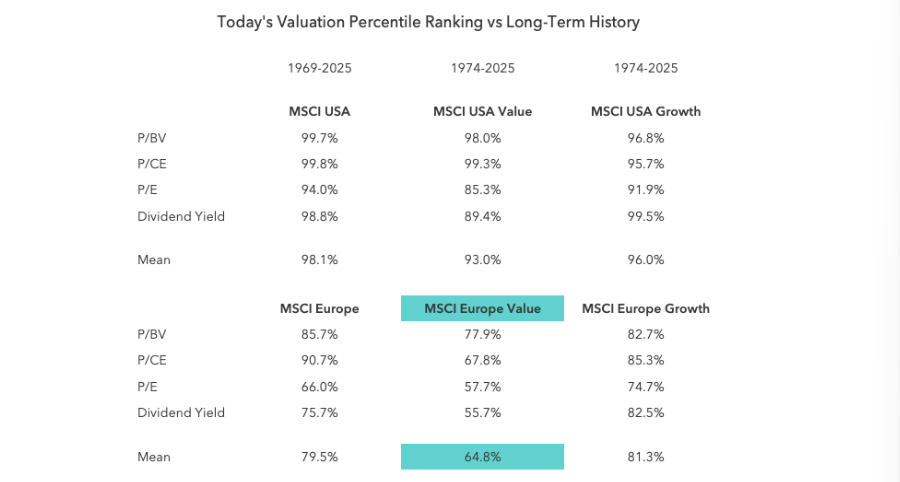

Valuations

Relative to history, European stocks are less expensive than their US counterparts. Using a percentile ranking to show where indices sit today relative to their long-term history (using data between 1969 and 2025), the MSCI USA index is at the 94th percentile for the price-to-earnings (P/E) ratio.

By comparison, the MSCI Europe index stands at just the 66th percentile – still expensive, but “only modestly”, the fund manager noted.

European value stocks are even cheaper, although growth companies are more expensive, as the below table shows.

Source: Lightman

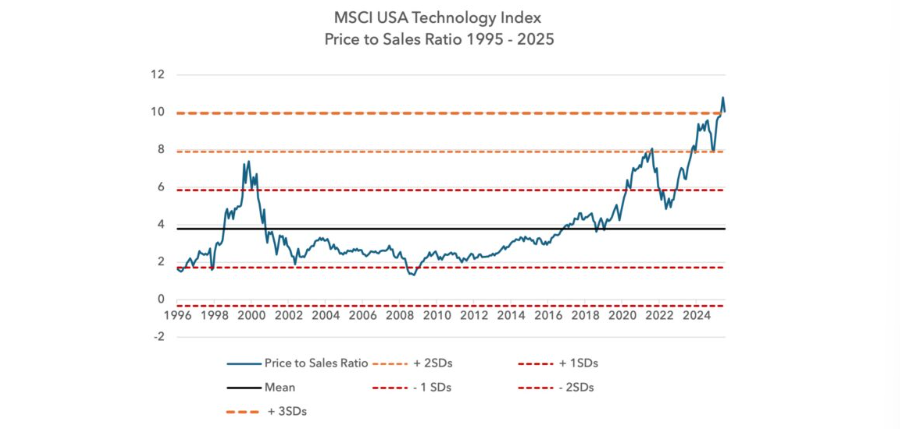

The price of artificial intelligence (AI) stocks

The second reason European stocks are expected to make greater returns than their US peers next year is that the American market has been dominated by tech stocks, which are now at valuations that “far surpass the peak of the dot-com bubble on many metrics”, Burnett said.

“In price-to-sales terms, the recent highs in valuation were 50% above the 2000 peak, at greater than 10x sales.”

Source: Lightman

While bubbles typically have other factors aside from price, “from a valuation point of view, we would say the bubble case for the US and especially US technology is strong”.

US household portfolio weightings

The third reason is fund flows. There has been a flood of cash into the US in recent years as AI has dominated investors’ attention, but with so much already invested, it is hard for even more capital to flow into these companies.

“The higher the reading for equity allocations, the shorter the runway for future flows and vice versa,” he said.

US household data shows Americans have “have huge allocations to equities compared to most other countries” with record highs in stocks versus other assets.

“This suggests limited room to increase flows into equities going forward,” said Burnett.

Current and capital accounts

A current account deficit means a country is buying more from the rest of the world than it is selling. To do this, it needs to attract investment from foreigners to pay for it (capital inflows) or borrow money.

The US runs a deficit and the capital inflows needed to finance it have been bullish for the equity market. Europe and China are notable areas running surpluses, and have then used the excess cash from selling more goods to reinvest in the US market, which has performed strongly.

However, both are committed to shrinking their surpluses, Burnett said, such as through Germany’s fiscal expansion or China’s declaration to reduce the surplus to 2% instead of the current 6%.

Meanwhile, president Donald Trump’s tariff announcement, reshoring plans and weak dollar policy are all designed to shrink the American current account deficit.

This is a "problem" for the US because as these surpluses shrink, there will be less new capital flowing into American assets. The continuous stream of foreign investment that has supported US equity prices will weaken, even though foreign investors still own more than $30trn in American assets.

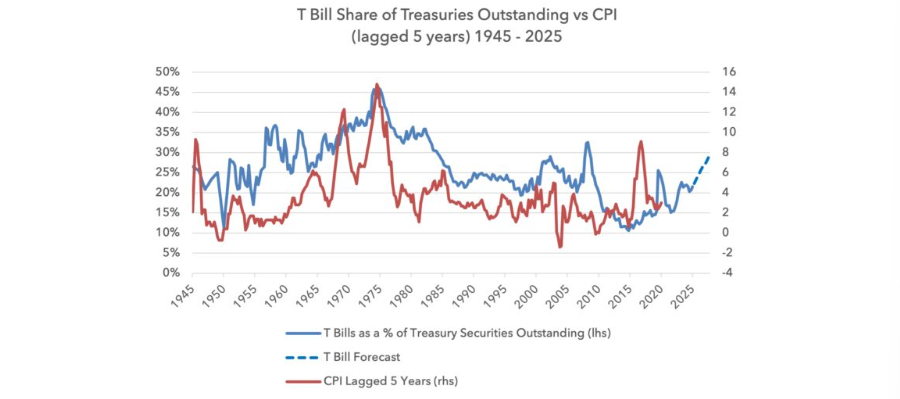

Treasury bills

The US Treasury plans to increase T-bills (short-term government bonds) issuance and reduce the volume of longer-dated debt. While this is viewed as a positive, Burnett said rising issuance tends to be inflationary, which would be bad for the US economy.

“Below we show the T-Bill share of Treasury debt with inflation lagged by five years, during the postwar period. The chart is streaky but you can see the relationship between the two,” he said.

“We add a forecast in the coming years. All things being equal, this T-Bill strategy ought to lift inflation over time. It may also help to weaken the dollar, which often supports equity outperformance by the rest of the world over the US.”

Source: Lightman

The Federal Reserve

The Fed could also inadvertently help European assets, as it moves its holdings closer to the maturity split of outstanding government debt. It is therefore going to allow its longer-duration bonds to mature and re-invest in T-bills, increasing supply but adding duration back to the market.

“All things being equal [this] should lead to higher longer-term interest rates,” said Burnett, which amounts to “a tightening of financial conditions”.

“Many investors are positioned for a more generous liquidity environment, but this Fed balance sheet policy path suggests we may see the opposite.”

The AI revolution

Although the WS Lightman European fund manager noted that the AI revolution “can be real”, it does not mean that now is the time to be “necessarily bullish”.

He drew comparisons between large language models (LLM) such as ChatGPT and telecoms.

“In telecoms, it took just four players in a given market to provide sufficient competition to damage returns. There are 21 significant LLM developers in the world, all seeking to maximise user engagement,” he said.

Additionally, investors are beginning to scrutinise capex spending on AI, which is expected to hit around $500bn next year. Although currently affordable from free cashflow, Burnett estimated this will turn not be the case by 2027.

“Investors believe that huge revenues will materialise soon from AI and so free cashflow will surge and easily fund this spending. But recent debt issuance suggests the companies themselves may not share this confidence,” he said.

Threats to Nvidia and OpenAI

Google’s Gemini 3 has “wowed many AI specialists”, he said. The key here is the company used its own Tensor Processing Unit chips, making it a de facto competitor to Nvidia.

“Meta was so impressed with Google’s TPU performance that it has already announced plans to buy them,” said Burnett.

Google and all other cloud providers still need Nvidia GPUs for their cloud services. But Google is showing other hyperscalers that there is an alternative to Nvidia and “a credible path for them to build their own chips, particularly in the highest margin AI training category”.

Meanwhile, investors should be prepared for the possibility that OpenAI fails, he warned, as the company generated losses of $12bn and was “burning cash at a frightening rate”, the manager said.

“European equities would be significantly more cushioned from any disruption to Nvidia, OpenAI or the AI value chain, compared to US equities,” he added.

Private equity

Private equity firms face growing investor redemption requests but are struggling to find buyers for their assets, Burnett said, with one potential option to list businesses on the market via an initial public offering (IPO), although “we are not there yet”.

“If and when that moment comes, it could be significant for public markets, as the flood of supply may be hard to absorb,” he said. “We believe investors should at least be prepared for a crisis that engulfs the private asset industry.

“Whilst a private asset crisis would be a global phenomenon, it is most acutely a headwind for US-owned businesses, given this is where the concentration of ownership is highest. We therefore view a private asset crisis as most damaging for US public equities, versus European equities or emerging markets.”

The end of the Russia-Ukraine war

Burnett said there is “logic” that the war could end in the coming year as Ukraine has been “applying pressure” inside Russia by taking oil refineries offline and attacking the energy grid.

“This is relevant because [Russian president Vladimir] Putin’s bargain with the Russian people has always been that foreign policy excursions are tolerated as long as they do not impact life at home. This is no longer the case,” he said.

“A lasting peace between Russia and Ukraine is bullish for European equities. There are high precautionary savings in neighbouring countries, in particular in Germany and Poland. These savings ought to decline if the war ends. A Ukrainian reconstruction would also be highly resource-intensive and lift growth in surrounding countries.”